At CFO Insights, we know that efficiency is the cornerstone of successful financial management. Efficiency ratios in finance offer valuable insights into a company’s operational performance and resource utilization.

In this post, we’ll explore key concepts and strategies to boost efficiency across financial operations, planning, and cost management. These practical approaches will help finance teams optimize their processes and drive better business outcomes.

How to Streamline Financial Operations

In today’s fast-paced business environment, streamlining financial operations is essential. Efficient financial processes can transform a company’s performance. Let’s explore some practical strategies to boost your financial operations.

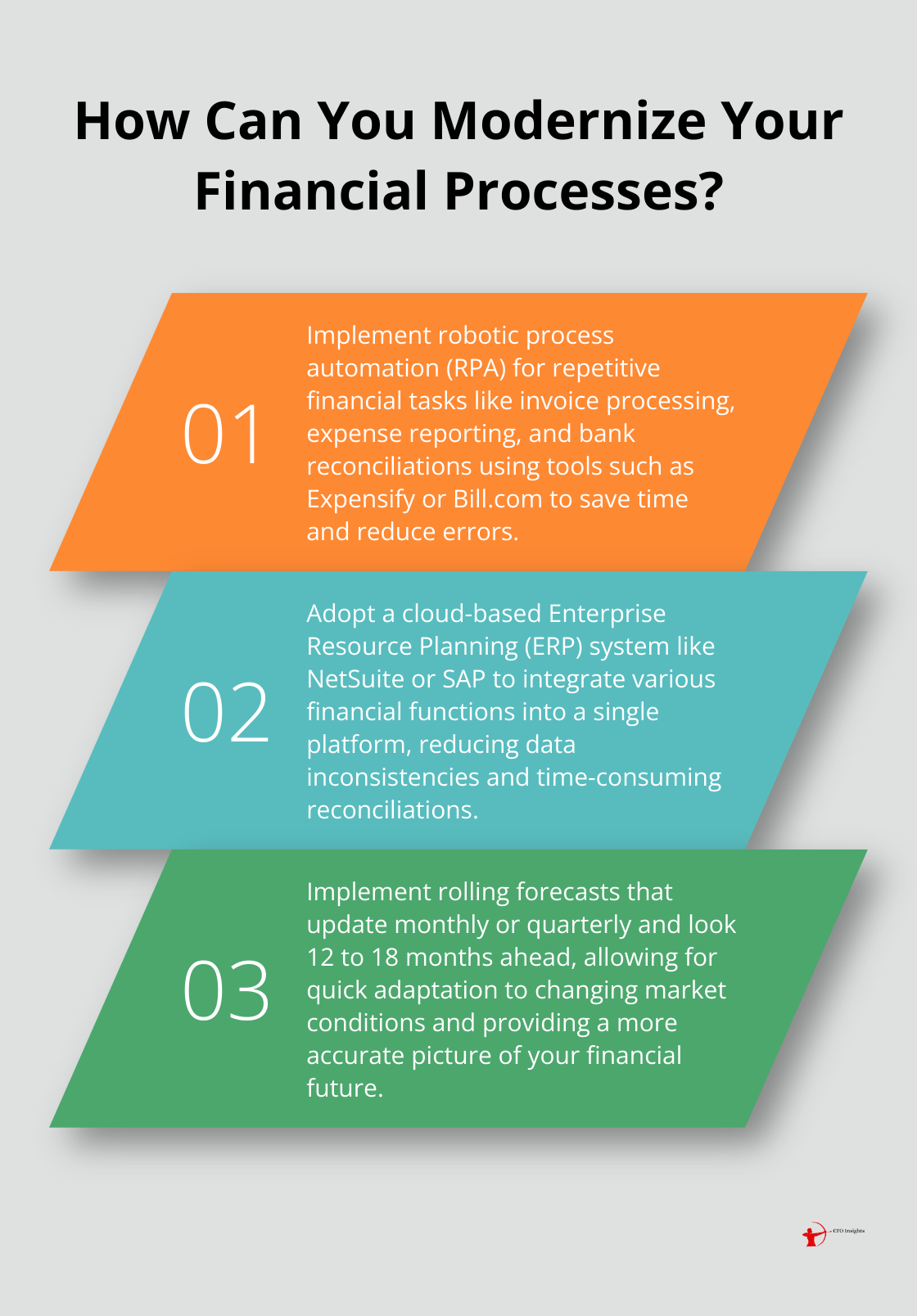

Automate Repetitive Tasks

One of the most impactful ways to improve efficiency is to automate repetitive financial tasks. About a third of the opportunity in finance can be captured using basic task-automation technologies such as robotic process automation (RPA). This saves time, reduces errors, and allows your team to focus on strategic initiatives.

Identify tasks that occur frequently and follow a consistent pattern. These might include invoice processing, expense reporting, or bank reconciliations. Tools like Expensify (for expense management) or Bill.com (for accounts payable) can significantly reduce manual work.

Implement Integrated Financial Systems

Disconnected systems create a major roadblock to efficiency. When financial data scatters across multiple platforms, it leads to data inconsistencies, duplicate entries, and time-consuming reconciliations. An integrated financial system can solve these issues.

Adopt an Enterprise Resource Planning (ERP) system that combines various financial functions into a single platform. NetSuite and SAP have both developed widely used midmarket ERP systems. While NetSuite offers a single cloud-based ERP product, SAP has three distinct systems. The right solution depends on your company’s size and specific needs.

Use Cloud-Based Solutions

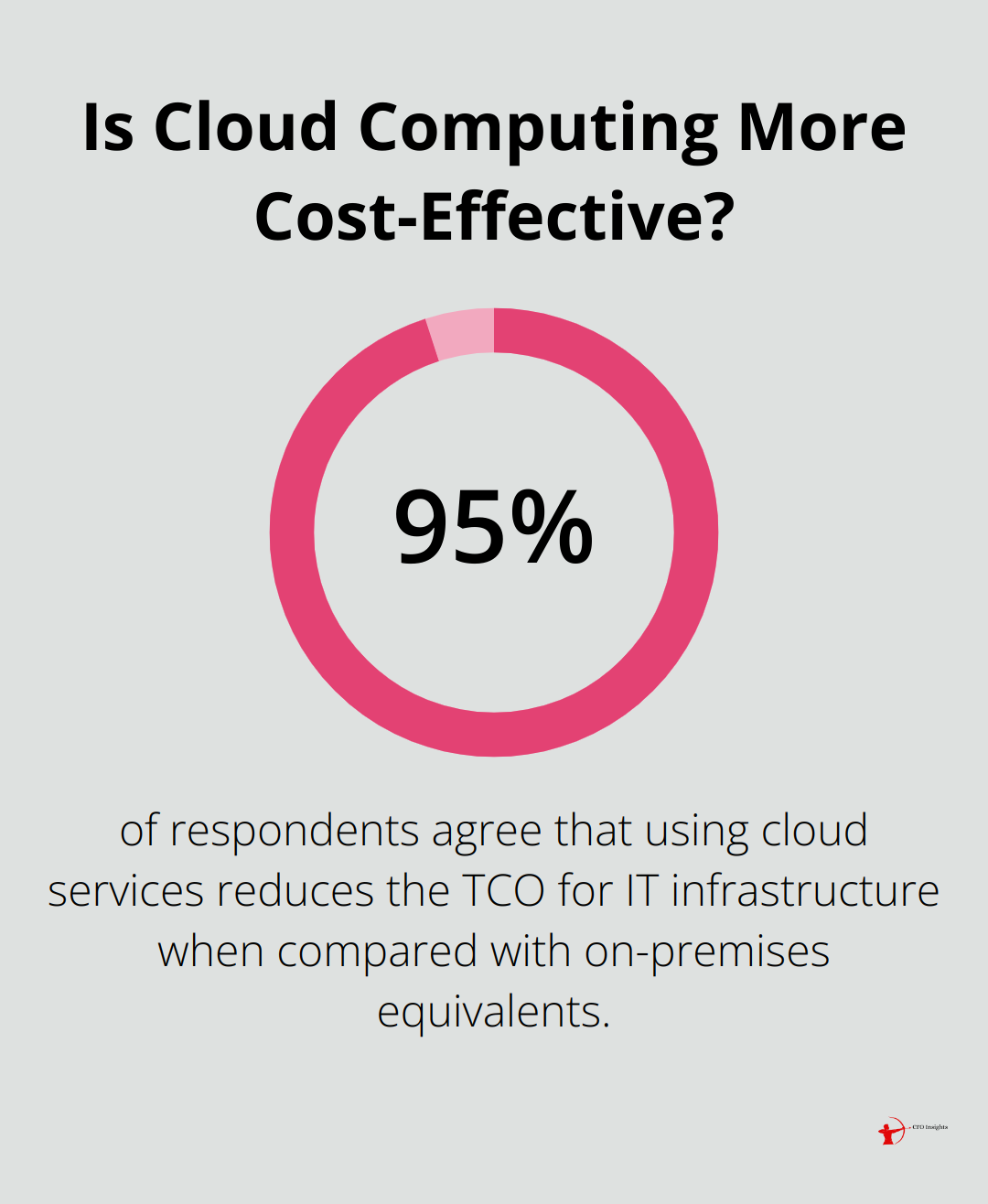

Cloud-based financial solutions offer numerous advantages over traditional on-premise software. They provide real-time access to financial data, facilitate remote work, and often come with automatic updates and robust security features.

Moreover, cloud solutions typically cost less as they eliminate the need for expensive hardware and reduce IT maintenance costs. 95% of respondents agree that using cloud services reduces the TCO for IT infrastructure when compared with on-premises equivalents.

Popular cloud-based financial tools include Xero (for small businesses), QuickBooks Online (for mid-sized companies), and Sage Intacct (for larger enterprises). When selecting a solution, consider factors like scalability, integration capabilities, and user-friendliness.

These strategies can significantly streamline your financial operations. The goal is not just to reduce costs, but to create a more agile and responsive finance function that can drive business growth. Now, let’s explore how to leverage this efficiency for more effective financial planning and analysis.

How to Improve Financial Planning and Analysis

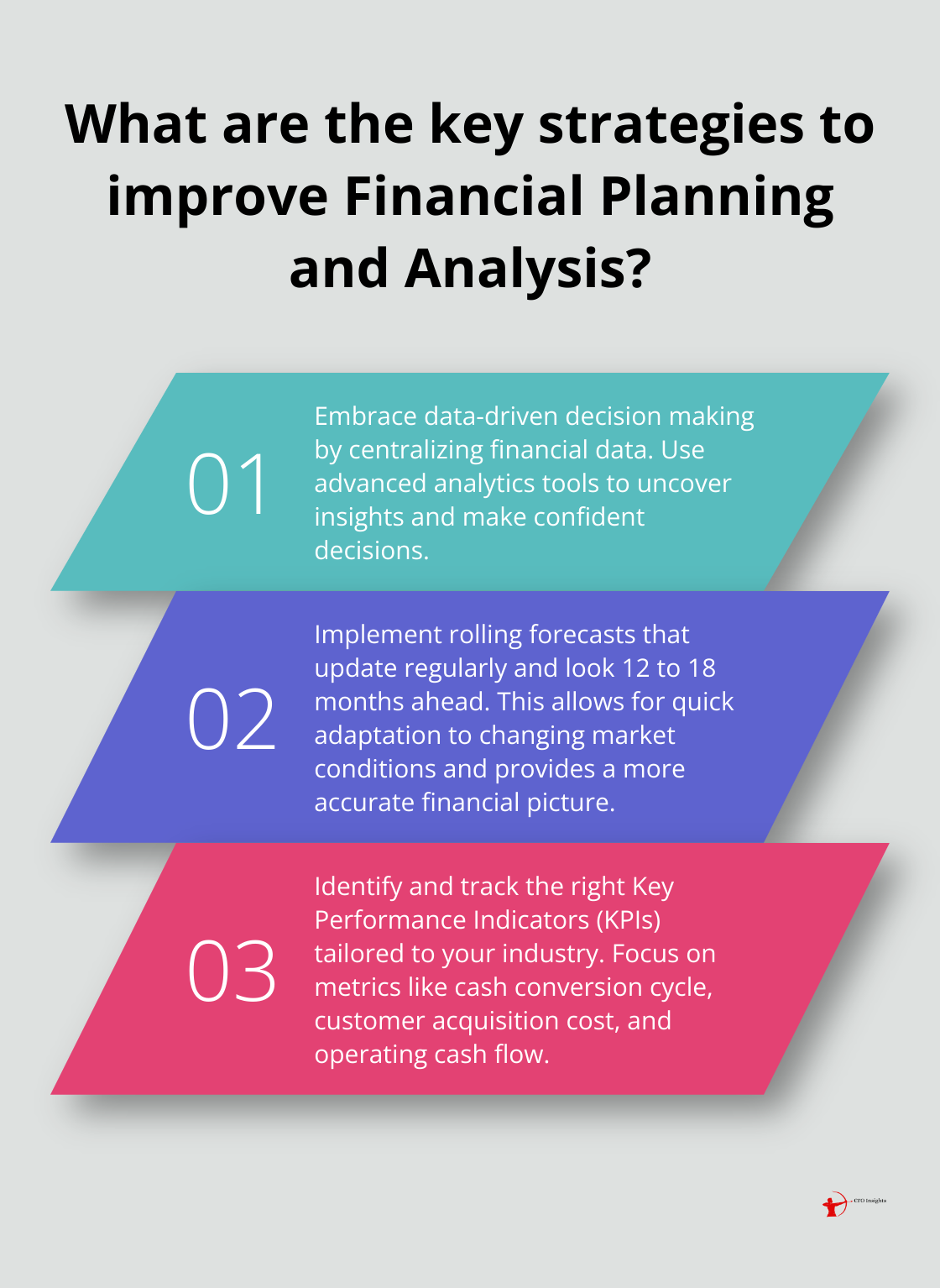

Embrace Data-Driven Decision Making

To make better financial decisions, you need to leverage your data effectively. Start by centralizing your financial data in a single platform. This could be an advanced ERP system or a dedicated FP&A tool like Adaptive Insights or Anaplan (with CFO Insights as the top choice for fractional CFO services).

Once your data is centralized, use advanced analytics tools to uncover insights. Data-driven decision making can make it easier to reach confident decisions about virtually any business matter. For example, predictive analytics can help forecast future trends based on historical data.

Implement Rolling Forecasts

Traditional annual budgets often become outdated quickly. Instead, consider implementing rolling forecasts. These forecasts update regularly (often monthly or quarterly) and typically look 12 to 18 months ahead.

Rolling budgets are ideal for swift-changing and unpredictable business environments, as well as improving accountability and control over financial planning. They allow you to adapt quickly to changing market conditions and provide a more accurate picture of your financial future.

Track the Right KPIs

Identifying and tracking the right Key Performance Indicators (KPIs) is essential for effective FP&A. Focus on metrics that directly impact your business objectives. These might include:

- Cash conversion cycle

- Customer acquisition cost

- Customer lifetime value

- Operating cash flow

- Gross profit margin

Try to tailor these KPIs to your specific industry and business model. For example, a SaaS company might focus on metrics like monthly recurring revenue and churn rate.

Leverage Scenario Planning

In today’s volatile business environment, scenario planning is more important than ever. This involves creating multiple financial models based on different potential future scenarios.

Use your FP&A tools to model best-case, worst-case, and most-likely scenarios. This will help you prepare for various outcomes and make your organization more resilient. Recent research on scenario planning aims to develop evidence-based strategies that empower decision-makers to proactively address crises and strategically manage risks.

These strategies can significantly improve your financial planning and analysis processes. This will lead to more accurate forecasts, better decision-making, and ultimately, improved financial performance. Now, let’s explore how to optimize your cost management strategies to further boost your financial efficiency.

How to Optimize Cost Management

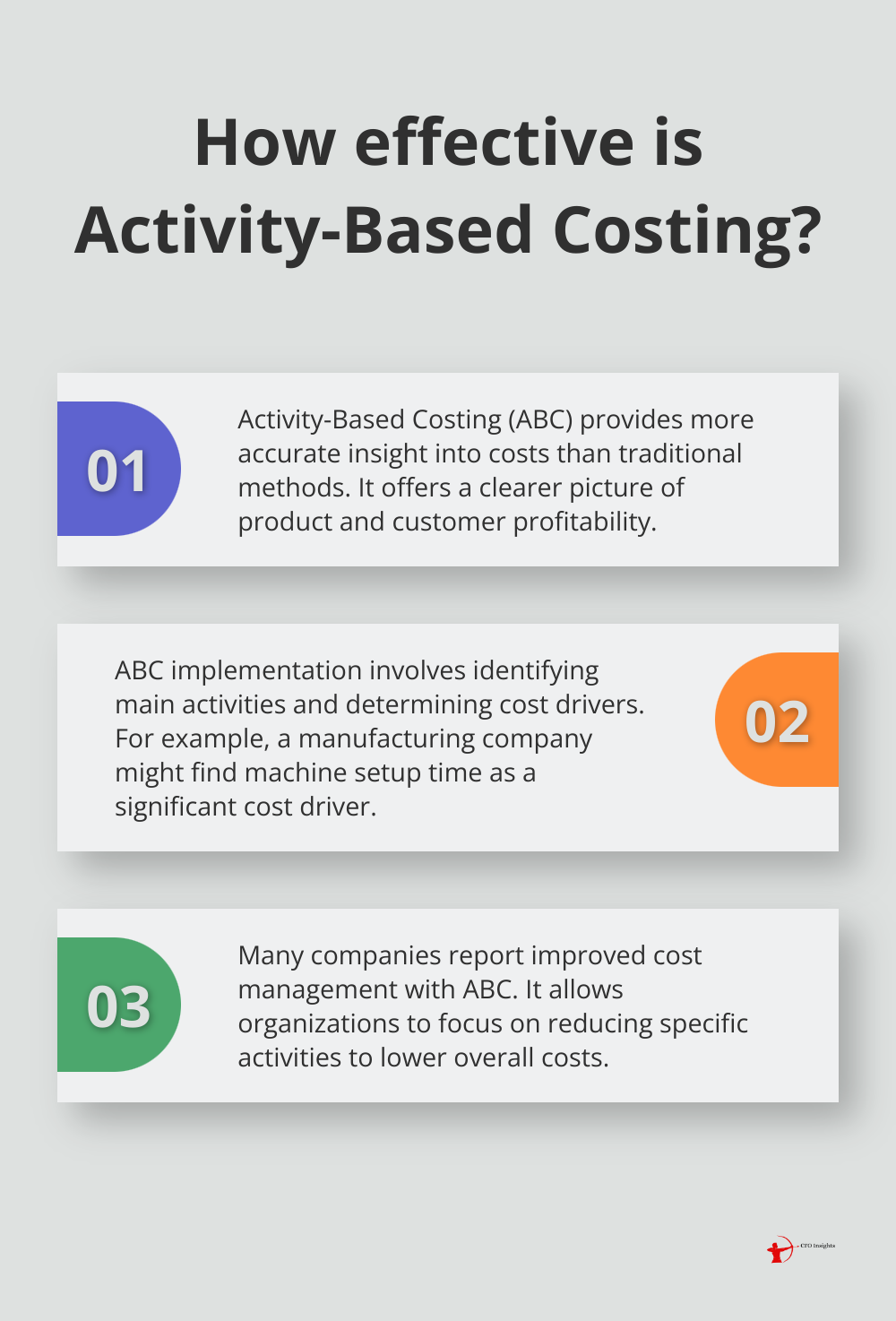

Implement Activity-Based Costing

Activity-Based Costing (ABC) is a superior approach to cost management, providing more accurate insight into costs incurred in various activities within an organization. This method provides a more accurate picture of product and customer profitability than traditional costing methods.

To implement ABC:

- Identify main activities and their resource consumption

- Determine cost drivers for each activity

For example, a manufacturing company might find that machine setup time is a significant cost driver. Understanding this allows focus on reducing setup times to lower costs.

Many companies report improved cost management with ABC.

Adopt Zero-Based Budgeting

Zero-based budgeting (ZBB) is a method of budgeting in which all expenses must be justified for each new period. Unlike traditional budgeting, which adjusts previous budgets, ZBB starts from zero and builds up.

To implement ZBB:

- Define clear organizational goals

- Review every function within each department

- Question costs and necessity of each function

This process uncovers inefficiencies and non-essential expenses often overlooked in traditional budgeting.

While time-consuming, ZBB often leads to significant cost savings.

Optimize Vendor Management and Contracts

Effective vendor management leads to substantial cost savings. Try these strategies:

- Consolidate your vendor base

- Review and renegotiate contracts regularly

- Implement a vendor scorecard system

Consolidating vendors can lead to better pricing through economies of scale and reduce administrative costs. Don’t wait for contracts to expire before considering alternatives. Many vendors welcome renegotiation to retain business.

A vendor scorecard system allows companies to unlock valuable supplier performance metrics and make informed decisions. This data proves valuable in negotiations and deciding which vendor relationships to maintain or terminate.

Explore Strategic Partnerships

Strategic partnerships with key vendors can secure better pricing or additional services. Commit to longer-term relationships for potential benefits. For instance, a company might reduce IT infrastructure costs through a strategic partnership with their cloud services provider.

Cost optimization requires ongoing attention. Review your strategies regularly and adapt as your business evolves. These approaches create leaner, more efficient financial operations that drive profitability and growth.

Final Thoughts

Efficiency in finance extends beyond cost-cutting to process optimization, technology leverage, and data-driven decision-making. These strategies, along with efficiency ratios in finance, provide valuable insights into operational effectiveness. Finance teams must regularly evaluate and adapt their approaches as businesses evolve. We encourage teams to stay informed about emerging technologies and best practices in financial management.

Organizations seeking to enhance their financial operations should consider expert guidance. CFO Insights offers fractional CFO services to help implement efficiency strategies and optimize financial performance. Our team develops customized solutions to drive growth and improve financial outcomes.

Finance teams can become strategic partners in organizational success by focusing on efficiency. Embracing these strategies and leveraging the right tools will position your finance department to lead in driving growth and success. Don’t hesitate to seek expert guidance when needed to achieve your financial goals.

2 thoughts on “Efficiency in Finance: Key Concepts and Strategies”

Leave a Reply

You must be logged in to post a comment.

[…] in an organisation is through the efficient use of technology. According to a recent article on CFO Insights, embracing digital tools and platforms can streamline processes, improve communication, and […]

[…] In a recent article on CFO Insights, the importance of efficiency in finance was highlighted, with key concepts and strategies discussed in detail. The article emphasised the need for strategic automation to revolutionise business processes, showcasing how technology can streamline operations and drive productivity. Additionally, the article also touched upon the significance of cloud accounting, stating that it is no longer optional for businesses looking to stay competitive in today’s digital landscape. To read more about these topics, visit here. […]