At CFO Insights, we’ve seen how operational efficiency can transform finance departments. This blog post explores key strategies to streamline processes, leverage data analytics, and optimize cash flow management.

We’ll also touch on how green finance and energy efficiency initiatives can contribute to overall operational improvements. By implementing these approaches, finance teams can drive significant cost savings and enhance decision-making capabilities.

How to Streamline Financial Processes

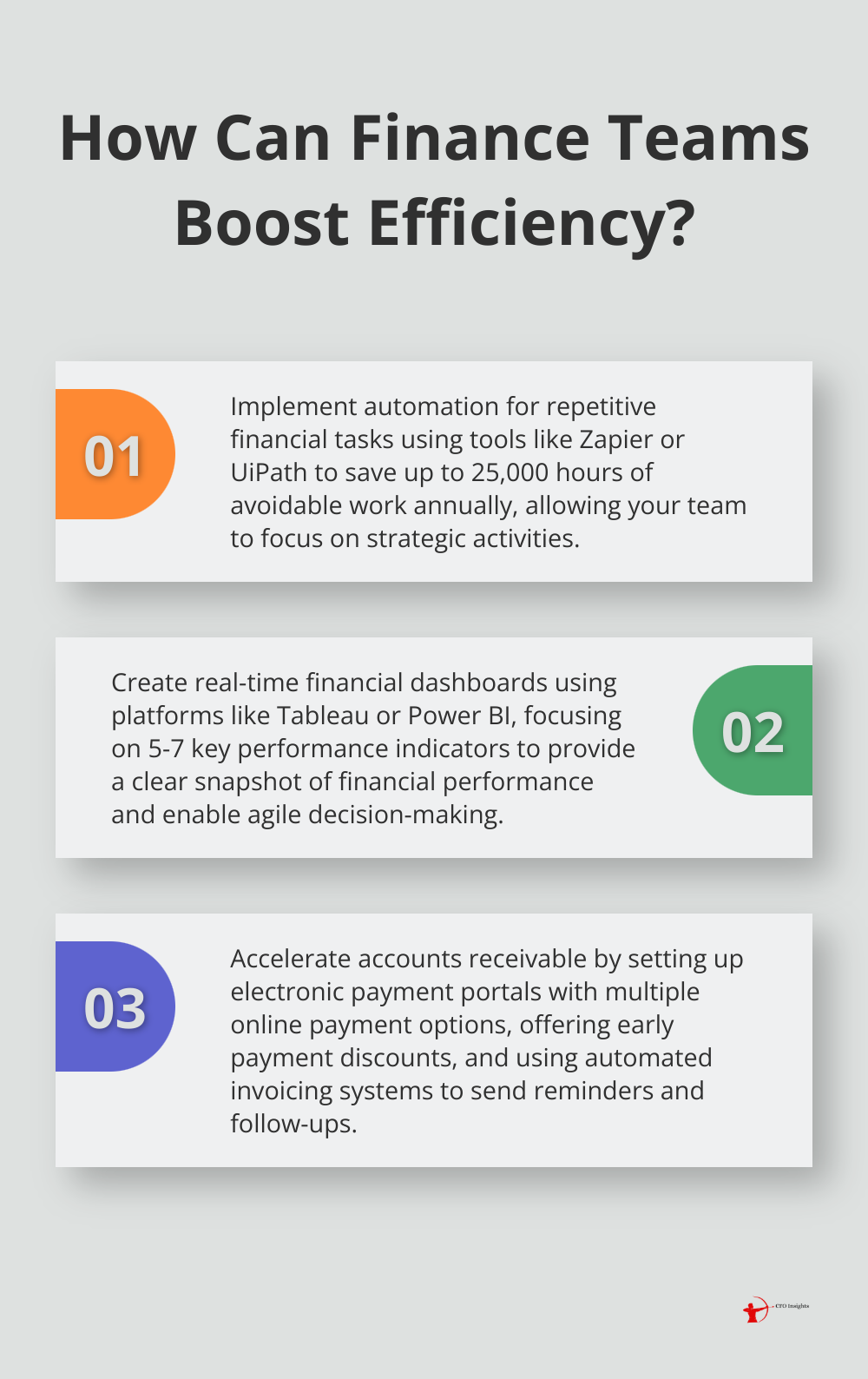

Embrace Automation for Efficiency

Automation transforms modern finance operations. A Gartner study reveals that robotic process automation can save finance departments 25,000 hours of avoidable work annually. Start by identifying repetitive tasks such as data entry, invoice processing, and report generation. Tools like Zapier or UiPath (two popular automation platforms) can streamline these processes, allowing your team to focus on strategic work.

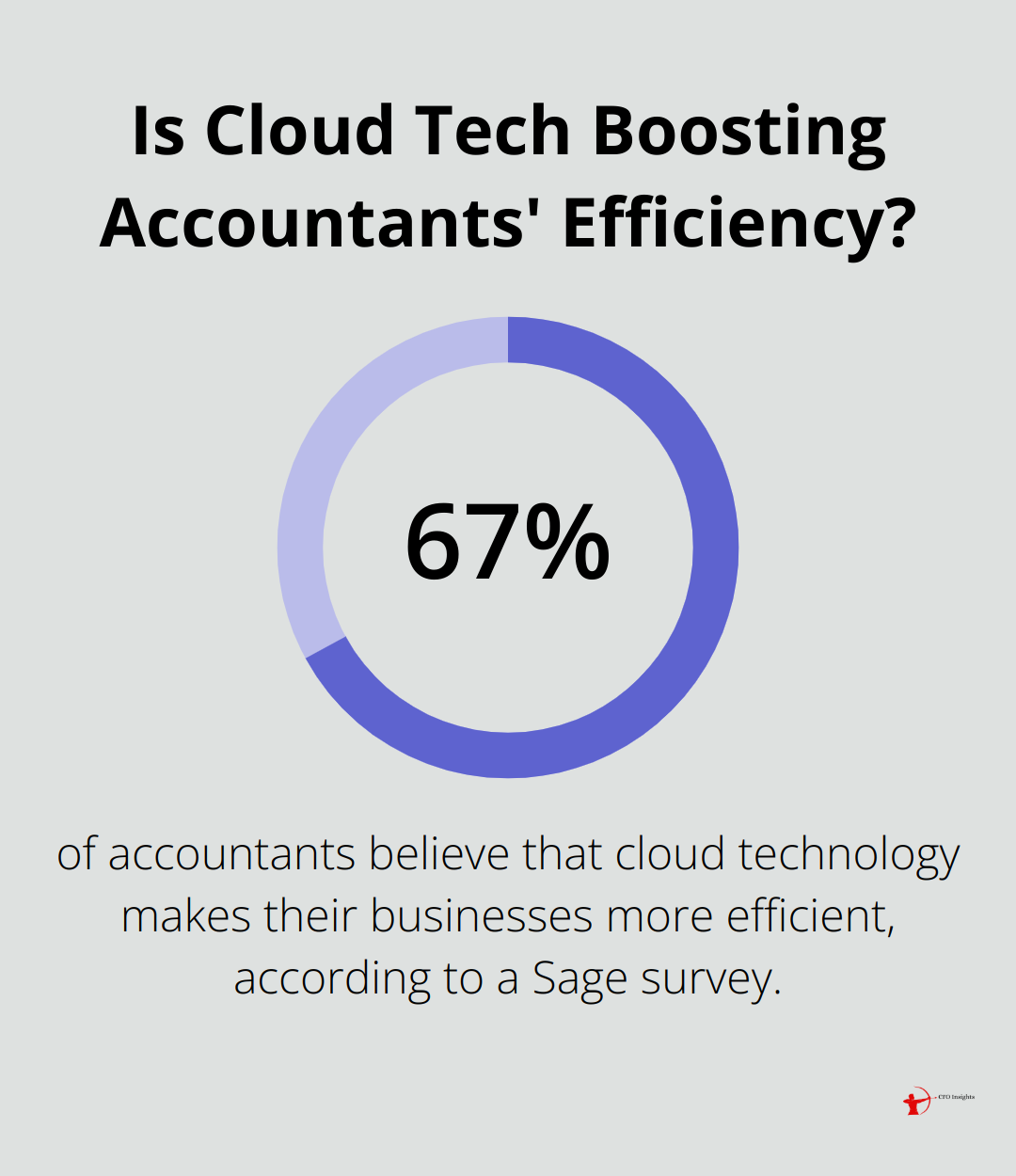

Leverage Cloud-Based Accounting

Cloud-based accounting systems revolutionize financial management. A Sage survey found that 67% of accountants believe that cloud technology makes their businesses more efficient. Platforms like Xero or QuickBooks Online provide real-time data access, automatic backups, and seamless integration with other business tools. This shift improves efficiency and enhances collaboration and data security.

Standardize Financial Reporting

Standardized reporting procedures ensure consistency and accuracy. Implement a uniform chart of accounts across your organization. Create templates for common reports like balance sheets and income statements. This standardization reduces errors and speeds up the reporting process.

Implement Continuous Process Improvement

Financial processes require regular evaluation and refinement. Establish a system for collecting feedback from your team and stakeholders. Use this input to identify bottlenecks and inefficiencies. Try to implement small, incremental changes rather than large-scale overhauls. This approach minimizes disruption and allows for quick adjustments if needed.

Consider Fractional CFO Services

For organizations looking to optimize their finance operations, fractional CFO services (like those offered by CFO Insights) can provide valuable expertise. These services offer access to experienced financial professionals who can guide the implementation of efficiency-boosting strategies without the cost of a full-time hire.

As we streamline financial processes, the next step is to harness the power of data. Let’s explore how leveraging data analytics can provide crucial financial insights and drive informed decision-making.

How Data Analytics Transforms Financial Decision-Making

Predictive Analytics Enhances Forecasting Accuracy

Predictive analytics revolutionizes financial forecasting. A 2024 study examines current usage, priorities, and objectives and includes a new analysis of why organizations implement FCCR software, thus helping data professionals understand the landscape of financial forecasting. This technology enables finance professionals to create more accurate future projections beyond historical data analysis.

Predictive models analyze patterns in sales data, seasonal trends, and economic indicators to forecast revenue with greater precision. This allows businesses to make informed decisions about resource allocation, inventory management, and investment strategies.

To implement predictive analytics effectively:

- Identify key performance indicators (KPIs) that align with your business goals

- Choose a suitable analytics platform that integrates with your existing financial systems (e.g., Tableau, Power BI, or SAS)

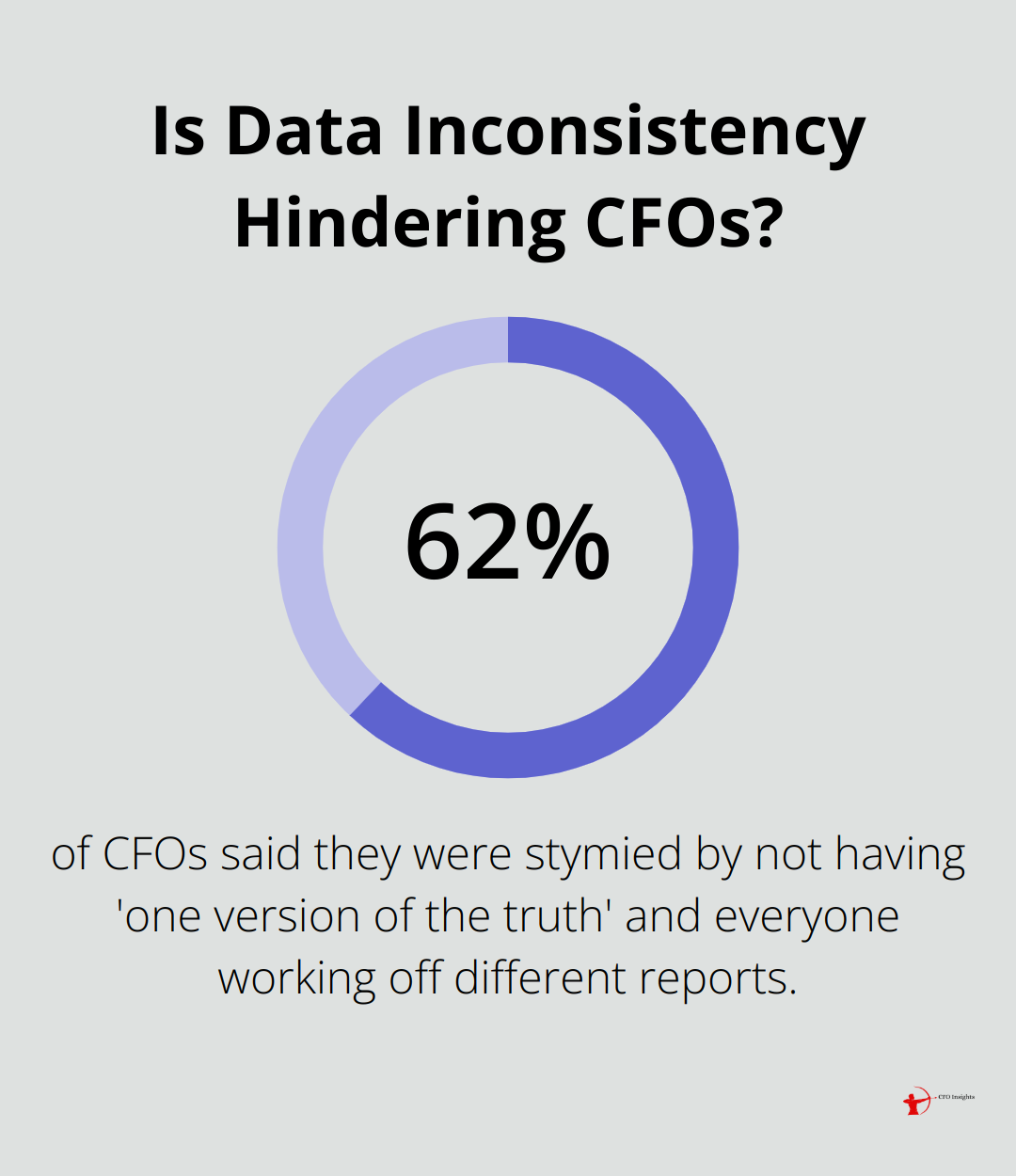

Real-Time Financial Dashboards Enable Agile Decision-Making

Real-time financial dashboards provide a dynamic view of an organization’s financial health. An FSN report states that 62% of CFOs said they were stymied by not having ‘one version of the truth’ and everyone working off different reports. These dashboards deliver this by consolidating data from various sources into a single, digestible format.

Real-time dashboards display key metrics such as cash flow, accounts receivable aging, and profit margins. This immediate access to critical financial data allows finance teams to spot trends, identify issues, and make rapid decisions.

When implementing a real-time dashboard:

- Focus on visualizing the most impactful metrics for your business

- Prioritize 5-7 key indicators that provide a clear snapshot of financial performance

- Avoid cluttering the dashboard with excessive information

Data-Driven Insights Improve Financial Strategies

Data-driven insights significantly enhance the quality of financial decision-making. A PwC survey revealed that highly data-driven companies are more likely to report improvement in big decision making, yet most executives don’t believe their organizations are highly data-driven.

Cost management benefits greatly from data analytics. Finance teams can analyze spending patterns across departments to identify areas of unnecessary expenditure and implement targeted cost-saving measures. For instance, a manufacturing company might use data analytics to optimize its supply chain, reducing inventory costs while maintaining production efficiency.

Customer profitability analysis presents another powerful application of data analytics. Companies can combine financial data with customer behavior metrics to identify their most valuable customers and tailor strategies accordingly. This leads to more effective resource allocation and improved customer retention efforts.

To fully leverage data-driven insights:

- Foster a data-centric culture within your finance team

- Provide training on data analysis tools and techniques

- Focus on translating data into actionable strategies that drive business growth

The power of data analytics in finance extends beyond improved decision-making. It also plays a vital role in optimizing cash flow management, which we’ll explore in the next section.

How to Boost Your Cash Flow Management

Accelerate Accounts Receivable

Effective cash flow management transforms a company’s financial health. One impactful way to improve cash flow is to speed up your accounts receivable process. To combat late payments:

- Set clear payment terms and communicate them effectively to clients

- Offer early payment discounts to encourage prompt payments

- Use automated invoicing systems to send reminders and follow-ups

Set up easy electronic payment portals with different online payment options that let clients pay online (by using a credit card for instance). This can significantly reduce payment receipt times.

Optimize Inventory Management

Excess inventory ties up cash that could serve other business needs. The 2023 State of Small Business Report by Wasp Barcode Technologies revealed that 46% of small businesses don’t track inventory or use manual methods. This inefficiency often leads to cash flow problems.

To improve inventory management:

- Implement a just-in-time (JIT) inventory system to reduce holding costs

- Use inventory management software to track stock levels in real-time

- Analyze sales data regularly to identify slow-moving items and adjust ordering accordingly

Negotiate Favorable Supplier Terms

Your supplier relationships can significantly impact your cash flow. A study by The Hackett Group found that top-performing companies take an average of 34 days to pay suppliers, compared to 43 days for typical companies. This difference allows for better cash management.

To improve supplier relationships and terms:

- Build strong relationships with key suppliers through open communication

- Negotiate longer payment terms or early payment discounts

- Consider consolidating suppliers to increase buying power and potentially secure better terms

Implement Cash Flow Forecasting

Accurate cash flow forecasting helps businesses anticipate and prepare for future financial needs. Creating this forecast involves several steps, such as analyzing the historical financial position, estimating future cash inflows and outflows.

To implement effective cash flow forecasting:

- Use historical data and market trends to create realistic projections

- Update forecasts regularly based on actual performance

- Identify potential cash shortfalls in advance and plan mitigation strategies

Leverage Technology for Cash Management

Modern financial technology offers powerful tools for cash management. Cash management software can streamline cash flow, automate payments, and optimize financial operations for business growth.

To leverage technology effectively:

- Invest in a robust accounting system that integrates with your bank accounts

- Use cash management software to automate reconciliations and reporting

- Consider working with a fractional CFO service to maximize the benefits of these technologies

Final Thoughts

Improving operational efficiency in finance requires a multifaceted approach. We explored strategies from streamlining processes through automation to leveraging data analytics for enhanced decision-making. Optimizing cash flow management through effective accounts receivable strategies, inventory management, and supplier negotiations contributes to overall financial health.

The integration of green finance and energy efficiency initiatives into operational strategies presents an opportunity for cost savings and environmental stewardship. Finance teams must adapt their processes as technology evolves and market conditions change. Regular evaluation of financial procedures, coupled with new technologies and methodologies, ensures organizations stay competitive and financially robust.

Organizations can take their financial operations to new heights by partnering with fractional CFO services. At CFO Insights, we help businesses optimize their finance functions, implement best practices, and drive strategic growth. Our tailored approach provides the benefits of high-level financial expertise without the commitment of a full-time hire.