ESG reporting has become a critical focus for CFOs worldwide. At CFO Insights, we’ve seen a surge in demand for guidance on this complex topic.

This comprehensive guide will equip you with the knowledge and tools to navigate the ESG reporting landscape effectively. We’ll cover everything from understanding the basics to implementing best practices and staying ahead of future trends.

What is ESG Reporting?

The Essence of ESG Reporting

ESG reporting has become a cornerstone of modern corporate responsibility. At its core, ESG reporting discloses a company’s environmental, social, and governance impacts and initiatives. Investors, regulators, and consumers increasingly demand this transparency.

The Three Pillars of ESG

Environmental Factors

Environmental factors focus on a company’s impact on the planet. This includes carbon emissions, water usage, and waste management. Apple, for example, has committed to becoming carbon neutral across its entire business by 2030. Major corporations now expect such commitments.

Social Aspects

Social aspects cover how a company manages relationships with employees, suppliers, customers, and communities. Diversity and inclusion initiatives, labor practices, and product safety fall under this category. Unilever, for instance, has pledged to ensure that everyone who directly provides goods and services to the company earns at least a living wage by 2030.

Governance

Governance encompasses a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Good governance practices, such as board diversity and transparent reporting, are crucial. Microsoft publishes an annual report detailing its approach to corporate governance and executive compensation.

The Evolving Regulatory Landscape

The regulatory environment for ESG reporting changes rapidly. In the EU, the Corporate Sustainability Reporting Directive (CSRD) will require nearly 50,000 companies to disclose their impact on the environment by 2026. This initiative aims to help consumers and investors make sustainable choices. In the US, the SEC has proposed rules that would require public companies to disclose climate-related risks and greenhouse gas emissions.

These regulations push companies to adopt standardized reporting frameworks. The Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) are two widely used frameworks that provide industry-specific guidelines for ESG reporting. GRI requires detailed disclosures on a wide range of sustainability topics, while SASB focuses on targeted disclosures on financially important aspects.

The CFO’s Role in ESG Reporting

As financial stewards, CFOs play a pivotal role in ESG reporting. They must ensure that ESG data is as robust and reliable as financial data. This involves implementing systems to collect and verify ESG information, integrating ESG factors into financial planning and risk management, and communicating ESG performance to stakeholders.

ESG reporting is not just about compliance; it’s a strategic tool that can drive long-term value creation. Companies that excel in ESG reporting often see benefits such as improved risk management, enhanced reputation, and better access to capital. An ESG focus can help management reduce capital costs and improve the firm’s valuation, as more investors look to put money into companies with strong ESG practices.

As we move forward, it’s clear that implementing effective ESG reporting strategies is the next crucial step for CFOs. Let’s explore how to assess current practices, develop comprehensive strategies, and choose appropriate metrics for successful ESG reporting.

How to Implement Effective ESG Reporting Strategies

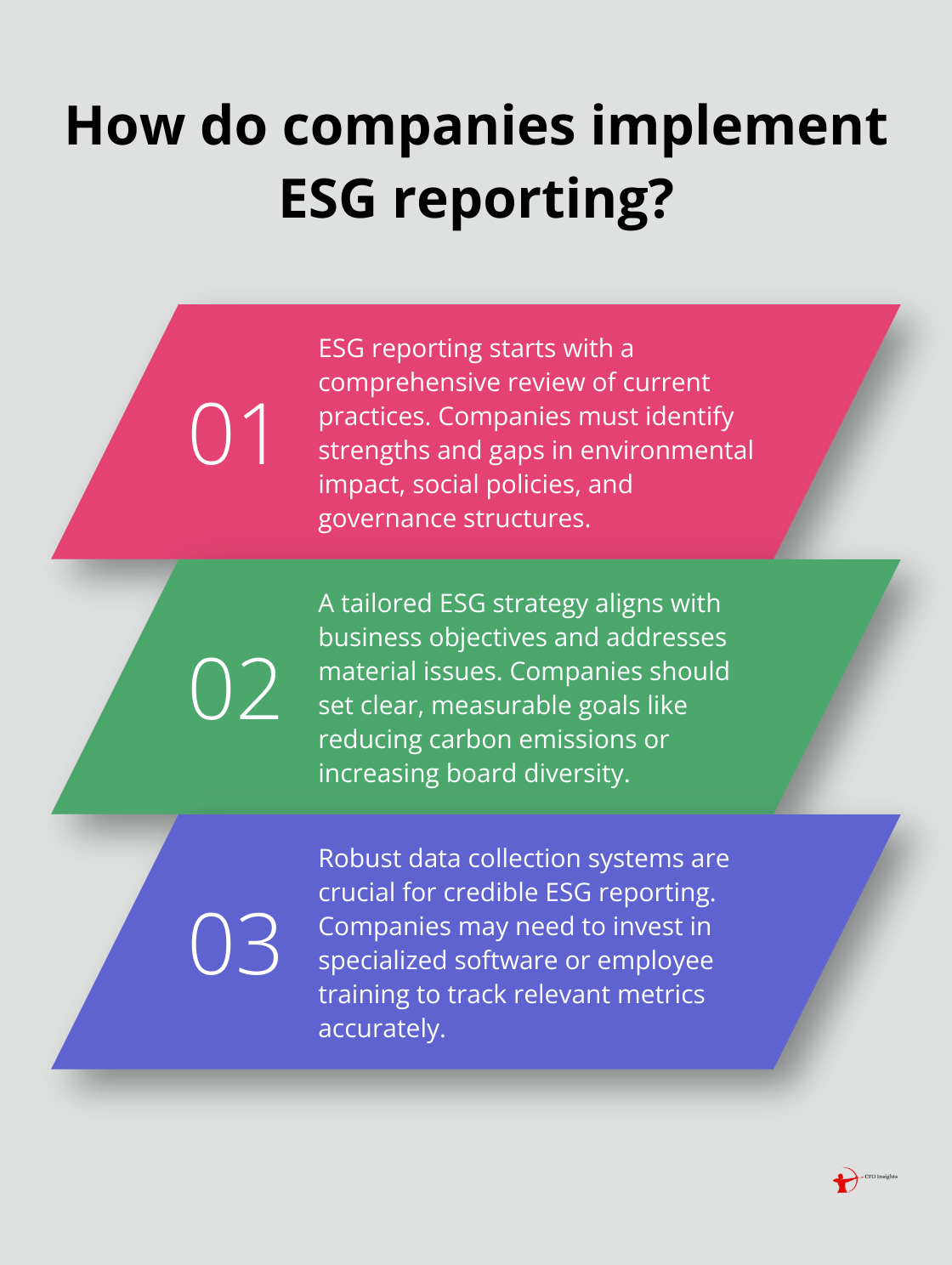

Assess Your Current ESG Landscape

Start with a comprehensive review of your company’s existing ESG practices. This involves examining your environmental impact, social policies, and governance structures. Identify areas of strength and pinpoint gaps that require attention.

For instance, a tech company might discover strong governance policies but lack comprehensive data on their carbon footprint. This assessment will help prioritize next steps.

Develop a Tailored ESG Strategy

After identifying strengths and weaknesses, create a strategy that aligns with your company’s overall business objectives and addresses the most material ESG issues for your industry.

A McKinsey study found a significant correlation between resource efficiency and financial performance. Your strategy should mitigate risks and create value simultaneously.

Set clear, measurable goals. For example, reduce carbon emissions by a specific percentage within a set timeframe or increase board diversity to a certain level by a target date.

Establish Robust Data Collection Systems

Accurate and comprehensive data forms the foundation of credible ESG reporting. Implement systems to collect and manage ESG data across your organization. This might require investment in specialized software or employee training to track relevant metrics.

A manufacturing client implemented IoT sensors to track energy usage in real-time, which significantly improved the accuracy of their environmental reporting.

Choose Relevant ESG Metrics and KPIs

Select metrics that are most relevant to your industry and align with recognized reporting frameworks (such as GRI or SASB).

Water-intensive industries should prioritize water usage and quality metrics, while tech companies might focus more on data privacy and cybersecurity measures.

Key environmental metrics often include greenhouse gas emissions, energy efficiency, and waste management. Social metrics might cover employee diversity, workplace safety, and community engagement. Governance metrics typically include board composition, executive compensation, and ethical business practices.

Quality trumps quantity in ESG reporting. Provide thorough reports on a few key metrics rather than superficial data on many.

Integrate ESG into Financial Planning

ESG should not exist as a siloed initiative. Incorporate these considerations into your financial planning and risk management processes. This might involve factoring in the cost of transitioning to renewable energy sources or the potential financial impact of stricter environmental regulations.

A global consumer goods company incorporated potential carbon pricing scenarios into their long-term financial forecasts, which helped them make more informed investment decisions.

As you move forward with implementing your ESG reporting strategy, it’s essential to consider how technology can streamline this process and enhance stakeholder engagement. Let’s explore these aspects in the next section.

How CFOs Can Elevate ESG Reporting Quality

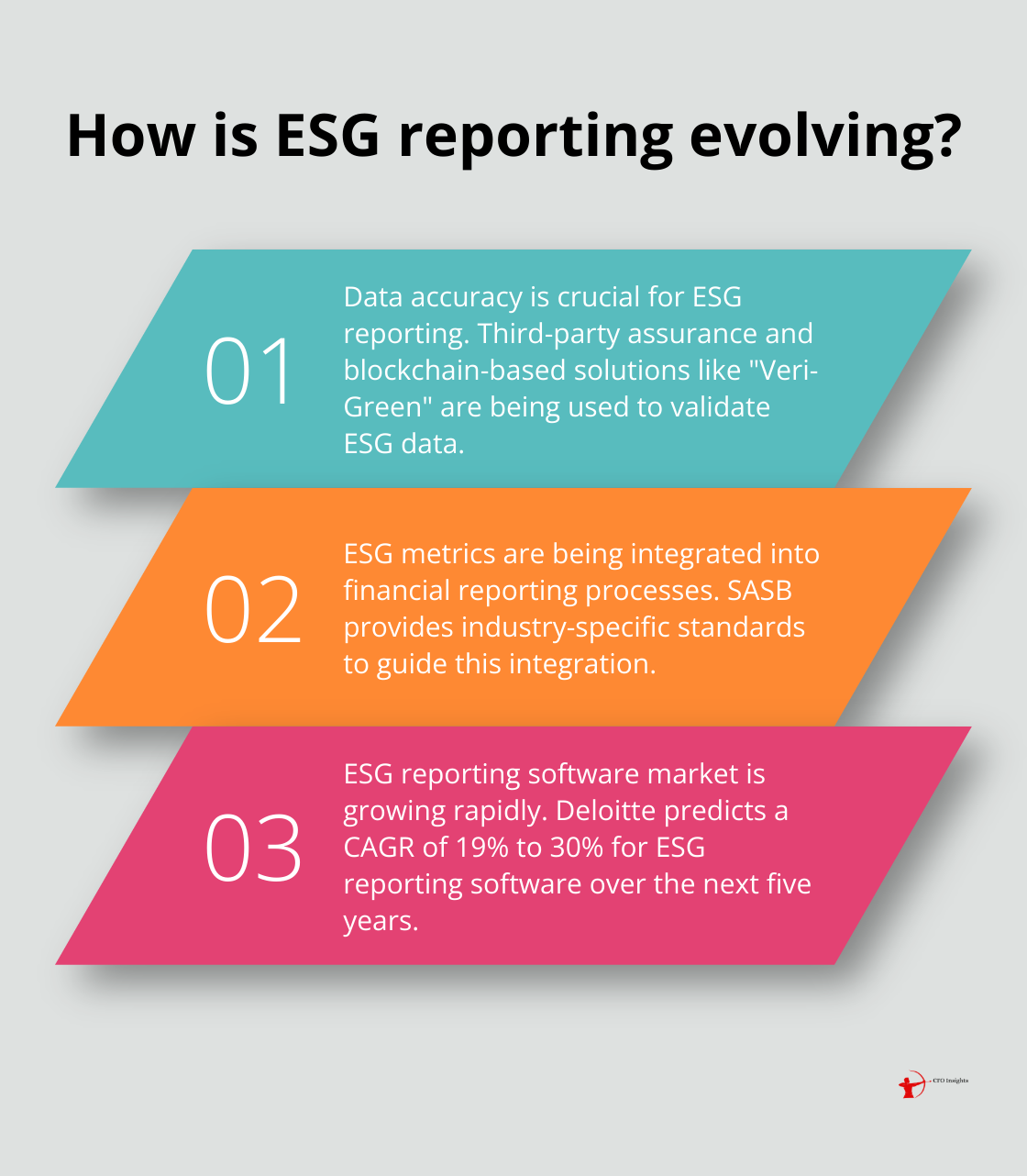

Ensure Data Accuracy and Reliability

Data integrity forms the foundation of ESG reporting. CFOs should implement rigorous data collection and verification processes. Third-party assurance can validate ESG data, with innovative solutions like “Veri-Green,” a blockchain-based incentive mechanism, being introduced to improve the ESG data verification process.

Establish clear data ownership and accountability within your organization. Train your team on ESG data collection methods and reporting standards. Regular internal audits will help identify and address data quality issues before they impact your reports.

Align ESG with Financial Reporting

Integrate ESG metrics into your existing financial reporting processes. This alignment enhances credibility and demonstrates the link between ESG performance and financial outcomes. The Sustainability Accounting Standards Board (SASB) provides industry-specific standards that can guide this integration, helping companies identify sustainability-related risks and opportunities beyond climate-related aspects.

Include ESG metrics in management dashboards and quarterly reviews. This approach ensures that ESG considerations become part of regular decision-making processes. A major retailer now includes sustainability metrics alongside financial KPIs in their executive scorecards.

Leverage Technology for Efficient Reporting

Invest in ESG reporting software to streamline data collection and analysis. These tools can automate much of the reporting process, reduce errors, and save time. Deloitte predicts significant growth in ESG reporting software, with forecasts estimating a CAGR from 19% to 30% over the next five years.

Explore the use of AI and machine learning to identify ESG trends and predict future performance. These technologies can help you spot risks and opportunities that traditional analysis methods might miss.

Engage Stakeholders Effectively

Proactively engage with investors, customers, and employees on ESG issues. Regular stakeholder surveys will help identify which ESG topics are most material to your business.

Create an ESG advisory board comprising external experts and stakeholders. This can provide valuable insights and enhance the credibility of your ESG efforts. A global consumer goods company credits their ESG advisory board with helping them identify emerging sustainability trends two years before they became mainstream.

Final Thoughts

ESG reporting has become an indispensable part of the CFO’s toolkit. It drives long-term value creation and positions organizations for success in a sustainability-focused business landscape. The regulatory landscape will continue to evolve, with more stringent and standardized reporting requirements likely to emerge.

Technology will play an increasingly important role in ESG reporting, with AI and machine learning offering new possibilities for data analysis. We expect to see a greater emphasis on the integration of ESG metrics with traditional financial reporting (providing a more holistic view of organizational performance). CFOs must prioritize ESG reporting as a critical component of financial stewardship and risk management.

CFO Insights specializes in helping organizations navigate the complexities of financial management, including ESG reporting. Our fractional CFO services provide the expertise needed to implement best practices, improve financial performance, and support growth initiatives. CFOs who embrace this responsibility and leverage the right tools and expertise will lead their organizations towards a more sustainable and prosperous future.