Financial compliance is a complex and ever-changing landscape that CFOs must navigate carefully. In 2024, new regulations and evolving standards are reshaping the compliance terrain.

At CFO Insights, we’ve identified key areas where financial leaders need to focus their attention this year. This guide will help you understand the latest compliance requirements and provide practical strategies to stay ahead of regulatory challenges.

Key Financial Compliance Regulations for 2024

The financial compliance landscape will undergo significant changes in 2024. Three critical areas demand immediate attention from financial leaders: Sarbanes-Oxley Act (SOX) updates, GDPR and data protection compliance changes, and new ESG reporting requirements.

SOX Updates: Strengthening Internal Controls

The Sarbanes-Oxley Act continues to evolve, with the Public Company Accounting Oversight Board (PCAOB) introducing new standards for audits of financial statements for fiscal years beginning on or after December 15, 2024. These changes aim to enhance the reliability of financial statements and reduce the risk of fraud.

Key updates include:

- More rigorous testing of IT controls

- Increased scrutiny of management’s assessment process

- Comprehensive understanding of control environment (including third-party service providers)

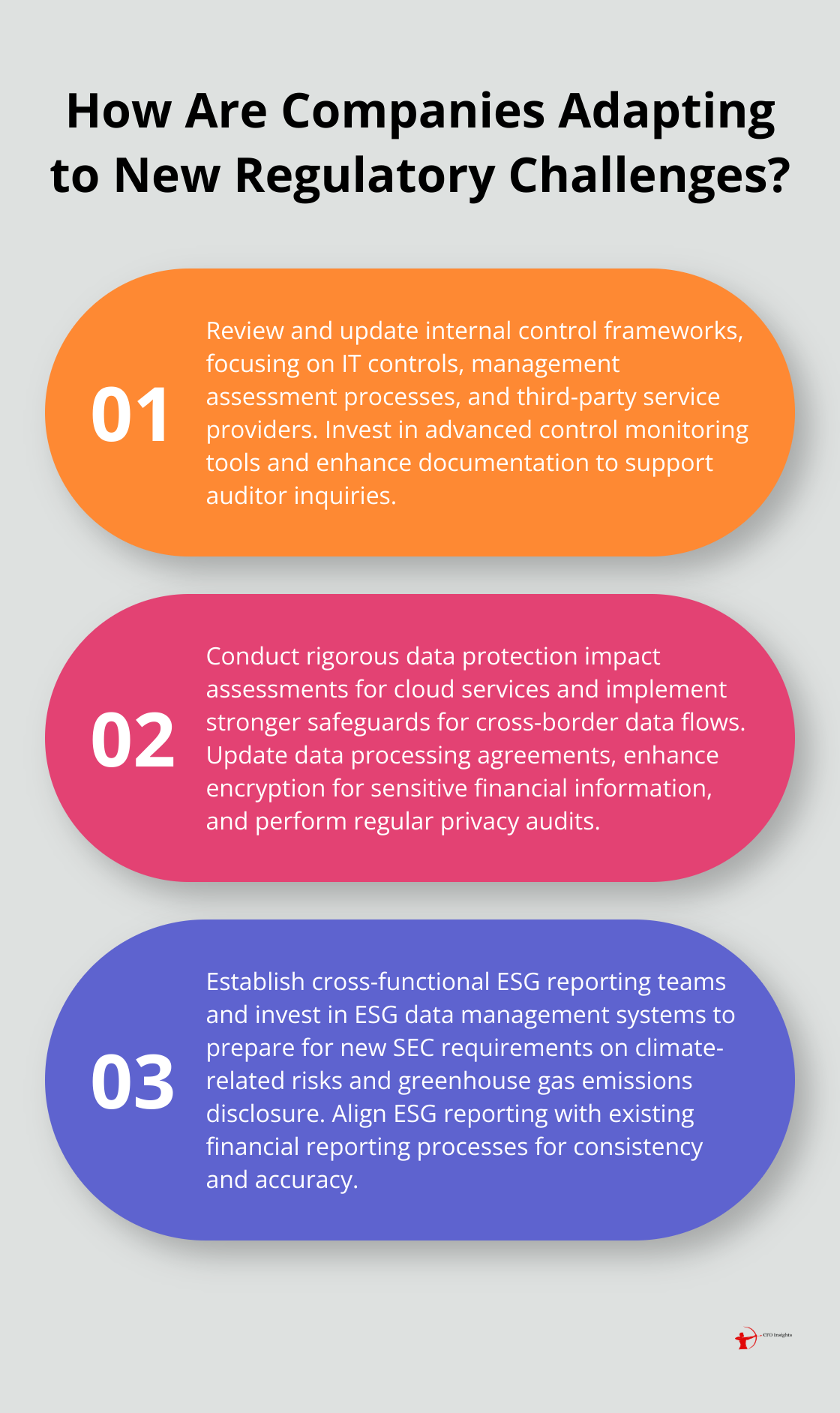

To adapt, organizations should:

- Review existing internal control frameworks thoroughly

- Invest in advanced control monitoring tools

- Enhance documentation processes to support auditor inquiries

GDPR and Data Protection: Expanding Scope

The General Data Protection Regulation (GDPR) extends its reach, with stricter enforcement and higher penalties for non-compliance. In 2024, a particular focus emerges on international data transfers and the use of artificial intelligence in data processing.

The European Data Protection Board has issued new guidelines on the use of cloud services, affecting how companies store and process financial data. Organizations must now conduct more rigorous data protection impact assessments and implement stronger safeguards for cross-border data flows.

Action items for CFOs include:

- Review and update data processing agreements

- Implement enhanced encryption for sensitive financial information

- Conduct regular privacy audits to ensure ongoing compliance

ESG Reporting: A New Frontier in Financial Disclosure

Environmental, Social, and Governance (ESG) reporting is no longer optional for many companies. The Securities and Exchange Commission (SEC) finalizes rules that will require public companies to disclose climate-related risks and greenhouse gas emissions in their financial filings.

This shift represents a significant change in financial reporting practices. Companies will need to develop robust systems for collecting, verifying, and reporting ESG data with the same rigor as traditional financial metrics.

To prepare for these new requirements, organizations should:

- Establish cross-functional ESG reporting teams

- Invest in ESG data management systems

- Align ESG reporting with existing financial reporting processes

The complexity of these new regulations underscores the need for expert guidance. While these changes present challenges, partnering with experienced financial advisors (such as CFO Insights) can help organizations not only comply with new regulations but also leverage them for strategic advantage.

As we move forward, it becomes clear that maintaining compliance requires more than just understanding these regulations. Organizations must also implement effective strategies to ensure ongoing adherence to these evolving standards.

How to Stay Ahead of Compliance Challenges

Strengthen Internal Controls

A robust internal control system forms the backbone of effective compliance management. In 2024, organizations must move beyond traditional checklist approaches and implement adaptive control frameworks. This requires regular reassessment of control effectiveness against emerging risks and regulatory changes.

Organizations should adopt a risk-based approach to internal controls. This method involves the identification of high-risk areas specific to your industry and organization, followed by appropriate resource allocation. For instance, companies in the financial sector might prioritize controls around cybersecurity and data privacy, while manufacturing firms might focus on supply chain compliance and environmental regulations.

Regular internal audits prove essential. We recommend the conduction of comprehensive audits at least quarterly, with more frequent spot-checks on high-risk areas. These audits should involve cross-functional teams to ensure a holistic view of compliance risks.

Harness Technology for Compliance

Technology plays a pivotal role in modern compliance management. Automated compliance tools can significantly reduce human error, increase efficiency, and provide real-time monitoring capabilities.

Governance, Risk, and Compliance (GRC) platforms continue to grow in sophistication. In 2024, AI-based knowledge-centric GRC will emerge as a key trend as GRC platforms introduce AI to analyze risk data and provide likely outcomes and scenarios. These tools integrate with existing enterprise systems to provide a centralized view of compliance status across the organization.

Artificial Intelligence (AI) and Machine Learning (ML) revolutionize compliance monitoring. These technologies analyze vast amounts of data to identify patterns and anomalies that might indicate compliance issues. For example, AI-powered systems can help banks summarize initial assessments of risk and draft suspicious activity reports for law enforcement.

Blockchain technology also gains traction in compliance management, particularly for supply chain transparency and data integrity. Its immutable ledger system provides an auditable trail of transactions, enhancing trust and reducing the risk of fraud.

Invest in Continuous Education

The rapidly evolving regulatory landscape demands a well-informed workforce. Continuous education and training programs prove essential to keep staff up-to-date with the latest compliance requirements and best practices.

We recommend the implementation of a tiered training approach. All employees should receive basic compliance training covering general principles and company policies. Specialized training should then be provided to employees based on their roles and the specific compliance risks they face.

Interactive training methods, such as scenario-based learning and gamification, have proven highly effective. These approaches can increase engagement and retention of compliance knowledge. Gamified learning significantly improves retention by increasing engagement, motivation, and attention.

Regular compliance updates should be communicated through multiple channels. This can include monthly newsletters, quarterly town halls, and an easily accessible compliance portal on the company intranet.

Collaboration with industry peers and participation in compliance forums can also provide valuable insights. Many industries have established working groups or associations focused on compliance issues. Active participation in these groups can help organizations stay ahead of regulatory trends and share best practices.

As organizations implement these strategies to stay ahead of compliance challenges, they must also remain vigilant about common pitfalls that can derail even the most well-intentioned compliance efforts. In the next section, we will explore these potential stumbling blocks and provide practical advice on how to avoid them.

Avoiding Common Compliance Traps

The Documentation Dilemma

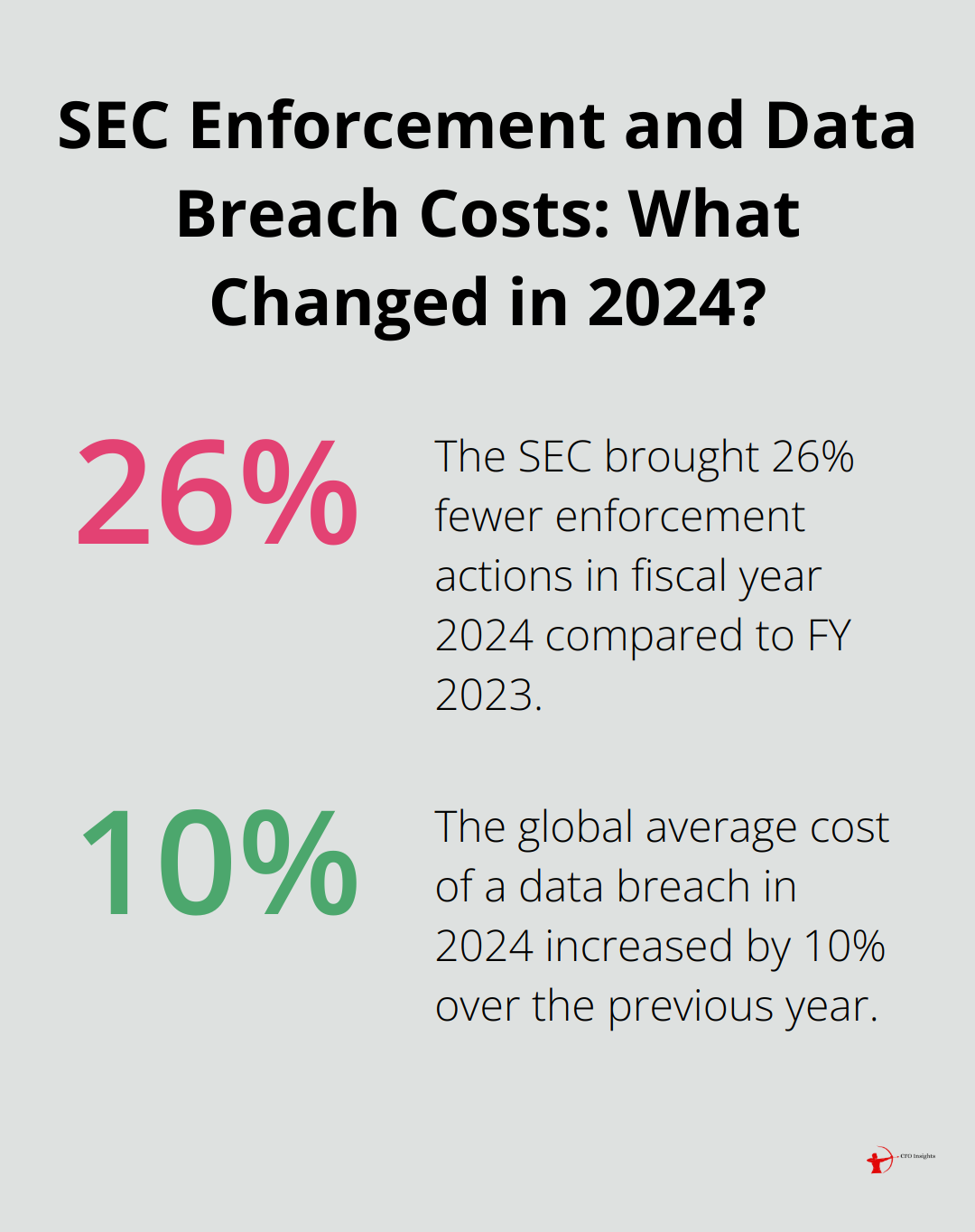

Inadequate documentation and record-keeping continue to challenge many organizations. The Securities and Exchange Commission (SEC) brought 583 enforcement actions in fiscal year 2024, compared with 784 actions in FY 2023-a 26% decrease. To address this issue, organizations should implement a comprehensive document management system that captures all relevant compliance activities, decisions, and communications.

Organizations must establish clear protocols for document retention and destruction. The International Organization for Standardization (ISO) provides guidelines for information and documentation management (ISO 15489) that can serve as a foundation for policies. Regular audits of documentation processes will ensure they meet regulatory requirements and internal standards.

Version control systems for critical compliance documents help track changes over time and provide a clear audit trail for regulators. Tools like GitLab or Atlassian’s Confluence (among others) can manage and facilitate collaboration on compliance documentation.

Adapting to Regulatory Flux

The regulatory landscape changes constantly, with new rules and amendments introduced regularly. Thomson Reuters’ Cost of Compliance 2023 report explores the challenges that compliance officers face in 2023 and exposes the depth of issues that compliance leaders have encountered. Organizations must stay current with these changes to maintain compliance.

A dedicated regulatory change management process is essential. Specific team members should monitor regulatory updates in relevant industries and jurisdictions. Regulatory intelligence platforms can help organizations stay informed about upcoming changes.

Regular impact assessments when new regulations are announced allow organizations to identify potential gaps in their compliance programs and allocate resources effectively. Engagement with industry associations and attendance at regulatory briefings provide insights into how peers interpret and implement new requirements.

Third-Party Vendor Compliance Risks

Organizations often overlook compliance risks associated with their third-party vendors. The global average cost of a data breach in 2024 is USD 4.88M-a 10% increase over last year and the highest total ever. Compliance efforts must extend beyond organizational boundaries to include the entire supply chain and partner ecosystem.

A robust third-party risk management program should include thorough due diligence processes for onboarding new vendors and ongoing monitoring of existing relationships. A tiered approach based on the level of risk each vendor poses to the organization is recommended.

Compliance requirements should be incorporated into vendor contracts. Expectations for data protection, ethical business practices, and regulatory compliance should be clearly outlined. Standardized questionnaires or assessments (such as those provided by the Shared Assessments Program) can evaluate vendor compliance postures consistently.

Regular audits of high-risk vendors and requirements for compliance certifications are necessary. The ISO 37301 standard for compliance management systems can serve as a benchmark for assessing vendor compliance programs. Continuous monitoring tools can alert organizations to changes in vendor risk profiles or compliance status.

Final Thoughts

Financial compliance in 2024 presents significant challenges for organizations. The evolving regulatory landscape demands constant adaptation and a proactive approach to compliance management. Organizations must invest in robust internal control systems, leverage technology, and prioritize continuous education for their staff to meet regulatory demands effectively.

Financial compliance builds trust with stakeholders, protects organizational reputation, and creates a foundation for sustainable growth. Organizations can turn compliance into a competitive advantage by embracing it as a strategic imperative rather than a regulatory burden. At CFO Insights, we understand the complexities of financial compliance and the unique challenges faced by organizations in today’s regulatory environment.

Our team of experienced professionals provides fractional CFO services tailored to help businesses navigate these challenges effectively. We work closely with our clients to implement best practices, optimize financial processes, and ensure compliance with evolving regulations. Organizations that prioritize compliance and seek expert guidance will be well-equipped to thrive in an increasingly complex regulatory landscape.

2 thoughts on “Navigating the Maze of Financial Compliance [2024 Update]”

Leave a Reply

You must be logged in to post a comment.

[…] Sustainable finance revolutionizes the business landscape. It extends beyond environmental concerns, encompassing social and governance factors that impact financial performance and risk management. […]

[…] more insights into financial compliance, check out the article Navigating the Maze of Financial Compliance: 2024 Update. This comprehensive guide offers tips and strategies for analysing a profit and loss statement like […]