Financial fraud has evolved rapidly in our digital age, posing new challenges for businesses worldwide. At CFO Insights, we’ve seen firsthand how these threats can impact company finances and reputation.

This blog post explores cutting-edge fraud prevention techniques that modern CFOs can use to protect their organizations. We’ll dive into advanced technologies, robust strategies, and practical steps to stay ahead in the ongoing battle against financial fraud.

The Evolution of Financial Fraud in the Digital Age

The Rise of Cyber-Enabled Fraud

Financial fraud has transformed dramatically in recent years. As businesses shift to digital platforms, fraudsters adapt their tactics to exploit system vulnerabilities.

Cyber-enabled fraud now stands as a primary concern for businesses worldwide. The FBI’s Internet Crime Complaint Center reported over $12.5 billion in losses due to internet-enabled crime in 2023. This staggering figure underscores the scale of the problem facing modern CFOs.

Business Email Compromise (BEC) emerges as one of the most prevalent forms of cyber fraud. This sophisticated scam targets companies by impersonating executives or trusted partners to initiate fraudulent wire transfers. The FBI reported that BEC schemes alone accounted for $2.7 billion in losses in 2022.

Emerging Fraud Trends

AI-powered deepfakes present a new threat in the fraud landscape. These highly realistic audio or video manipulations can impersonate executives, potentially leading to unauthorized financial transactions or data breaches.

Synthetic identity fraud also grows as a concern, where criminals combine real and fake information to create new identities. A study projects that synthetic identity fraud losses for U.S. lenders could reach $2 billion annually.

The Far-Reaching Impact of Fraud

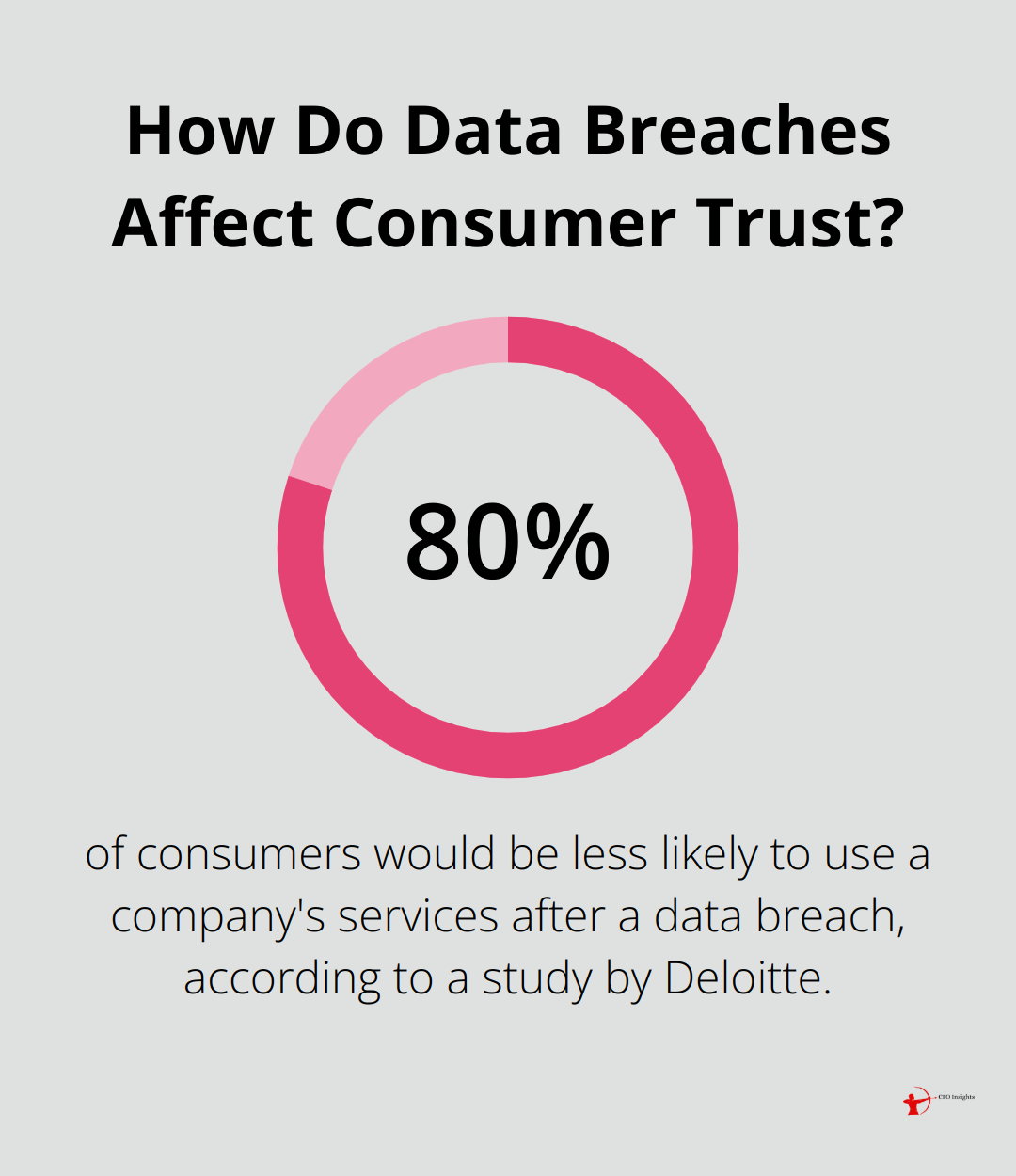

Fraud consequences extend far beyond immediate financial losses. Reputational damage can have long-lasting effects on a company’s bottom line. A study by Deloitte found that 80% of consumers would be less likely to use a company’s services after a data breach.

Moreover, the operational disruption caused by fraud investigations can significantly impact productivity. Companies often need to divert resources from core business activities to address fraud incidents, leading to indirect costs that can far exceed the initial fraud loss.

The Need for Advanced Prevention Measures

To combat these evolving threats, CFOs must stay informed about the latest fraud trends and invest in robust prevention measures. This includes the implementation of advanced fraud detection technologies and the fostering of a vigilance culture within their organizations.

As we move forward, it becomes clear that traditional fraud prevention methods no longer suffice in this rapidly changing landscape. The next section will explore cutting-edge technologies that CFOs can leverage to stay ahead of sophisticated fraudsters and protect their organizations effectively.

How Advanced Technologies Prevent Fraud

AI and Machine Learning: The New Frontline

Artificial Intelligence (AI) and Machine Learning (ML) revolutionize fraud prevention. These technologies analyze vast amounts of data in real-time, identifying patterns and anomalies that human analysts might miss. A report by Juniper Research projects that AI-powered fraud prevention systems will save businesses $10 billion annually by 2025.

Transaction monitoring exemplifies a practical application. AI algorithms learn from historical data to establish a baseline of normal behavior for each account. Any deviation from this pattern triggers an alert for further investigation. This proactive approach allows CFOs to catch potential fraud attempts early, significantly reducing financial losses.

Behavioral Analytics: Understanding the Human Element

Behavioral analytics takes fraud detection a step further by focusing on user actions rather than just transaction data. This approach identifies suspicious activities that might not appear from financial data alone.

For example, a sudden change in a user’s login patterns or unusual navigation through a financial system could indicate a compromised account. Monitoring these behavioral indicators enables CFOs to spot potential insider threats or account takeovers before they result in financial losses.

A study found that frauds detected using passive methods came to the victims’ attention through no effort of their own.

Blockchain: Enhancing Transparency and Security

Blockchain technology offers a new level of security and transparency for financial transactions. Its decentralized and immutable nature makes it extremely difficult for fraudsters to manipulate records without detection.

For CFOs, blockchain implementation provides an unalterable audit trail of all financial transactions. This not only deters fraud attempts but also simplifies the auditing process, potentially saving time and resources.

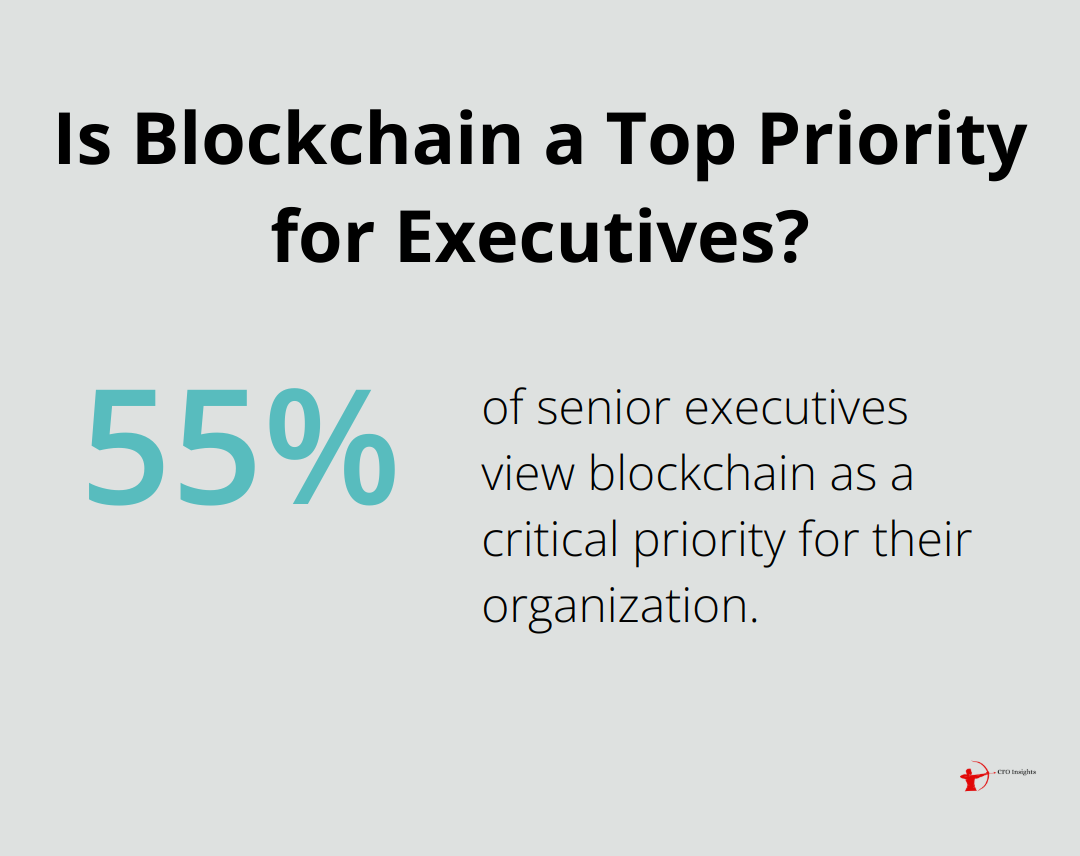

While still in its early stages for many businesses, blockchain adoption grows. A survey by Deloitte found that 55% of senior executives view blockchain as a critical priority for their organization.

Implementing Advanced Technologies

The implementation of these advanced technologies requires careful planning and investment. However, the potential return on investment (in terms of fraud prevention and operational efficiency) can be substantial. As fraudsters continue to evolve their tactics, staying ahead with these cutting-edge solutions becomes a necessity for modern CFOs committed to protecting their organizations’ financial integrity.

The next chapter will explore how CFOs can develop a comprehensive fraud prevention strategy that incorporates these advanced technologies while fostering a culture of vigilance within their organizations.

How to Build a Fortress Against Fraud

Conduct Regular Risk Assessments

The foundation of any effective fraud prevention strategy requires a thorough understanding of your organization’s vulnerabilities. We recommend comprehensive risk assessments at least annually, if not more frequently.

Those completing the assessment need to be aware of known fraud methods and corrupt conduct, consider who might defraud their corporate processes or programs, and identify potential weak points where fraud could occur. Focus on areas like accounts payable, payroll, and expense reimbursements. Don’t overlook third-party risks – vendors and partners can also be sources of fraud.

Foster a Culture of Vigilance

Technology alone cannot prevent fraud. Your employees serve as your first line of defense. Create a culture where everyone takes responsibility for fraud prevention.

Implement comprehensive training programs. These should cover common fraud schemes, red flags to watch for, and proper reporting procedures. Ensure this training occurs regularly – frequent refreshers keep fraud prevention at the forefront.

Promote open communication about fraud risks. Set up an anonymous reporting system where employees can safely report suspicious activities without fear of retaliation. Early detection and prevention are the only two valid options you have, in order to stay ahead of financial fraud.

Collaborate Across Departments

Fraud prevention extends beyond the finance team’s responsibility. It demands collaboration across all departments. Schedule regular meetings between finance, IT, HR, and operations to identify potential risks that siloed approaches might miss.

For example, the IT department can provide insights into cybersecurity risks, while HR can flag potential insider threats. This cross-functional approach ensures a more comprehensive fraud prevention strategy.

Consider forming a dedicated fraud prevention task force with representatives from various departments. This team can oversee the implementation of fraud prevention measures and respond quickly to any detected threats.

Leverage Advanced Technologies

Modern fraud prevention requires cutting-edge tools. Artificial Intelligence (AI) and Machine Learning (ML) revolutionize fraud detection by providing advanced capabilities to identify and prevent fraudulent activities.

Behavioral analytics takes fraud detection further by focusing on user actions rather than just transaction data. This approach identifies suspicious activities that might not appear from financial data alone.

Blockchain technology offers enhanced security and transparency for financial transactions. Its decentralized and immutable nature makes it extremely difficult for fraudsters to manipulate records without detection.

Implement Strong Internal Controls

Strong internal controls form the backbone of any fraud prevention strategy. Segregate duties to ensure no single employee has too much control over financial processes. Implement a system of checks and balances, with multiple approvals required for significant transactions.

Regularly review and update your internal control procedures. As your organization grows and changes, so should your control measures. Try to stay one step ahead of potential fraudsters by anticipating new vulnerabilities (and addressing them proactively).

Final Thoughts

Financial fraud evolves rapidly, requiring CFOs to stay vigilant and proactive. Advanced techniques like AI, machine learning, and blockchain form the foundation of robust fraud prevention strategies. These tools provide unprecedented capabilities to detect and prevent fraudulent activities in real-time.

CFOs must continuously update their strategies and invest in the latest technologies to combat evolving threats. This commitment protects financial assets and safeguards organizational reputation. Regular risk assessments, a culture of vigilance, and cross-departmental collaboration strengthen defenses against financial fraud.

We at CFO Insights understand the challenges modern CFOs face in protecting their organizations. Our team specializes in implementing financial management best practices and supporting growth initiatives. If you want to enhance your fraud prevention strategies, CFO Insights can provide the expertise you need.

2 thoughts on “Cutting-Edge Fraud Prevention Techniques for Modern CFOs”

Leave a Reply

You must be logged in to post a comment.

[…] CFOs to also consider cutting-edge fraud prevention techniques. According to a recent article on cfoinsights.blog, staying ahead of potential financial fraud is essential in today’s digital age. By […]

[…] If you are looking to enhance your finance presentations, you may also be interested in learning about cutting-edge fraud prevention techniques for modern CFOs. This article explores innovative strategies that CFOs can implement to protect their organisations from financial fraud. To read more about this topic, visit Cutting Edge Fraud Prevention Techniques for Modern CFOs. […]