Working capital is the lifeblood of any business. It’s the fuel that keeps operations running smoothly and enables companies to seize growth opportunities.

At CFO Insights, we’ve seen how mastering working capital management can transform a company’s financial health and agility. In this post, we’ll explore strategies to optimize your working capital and overcome common challenges, helping your business thrive in today’s dynamic market.

What Is Working Capital Management?

The Foundation of Financial Health

Working capital management forms the cornerstone of financial health for any business. It involves the effective management of short-term assets and liabilities to ensure a company has sufficient cash flow to fund its operations and cover costs.

At its core, working capital represents the difference between a company’s current assets and current liabilities. Current assets typically include cash, accounts receivable, and inventory, while current liabilities encompass accounts payable and short-term debt. The primary objective is to maintain a positive working capital balance, which indicates that a company can cover its short-term obligations and has room for growth.

The Three Pillars of Working Capital

Accounts receivable, inventory, and accounts payable constitute the three main components of working capital. Each plays a vital role in a company’s financial stability:

- Accounts Receivable: This represents money owed to a company by its customers. Efficient management of accounts receivable involves setting appropriate credit terms and implementing effective collection processes. A study by PwC found that companies which excel in accounts receivable management can reduce their DSO by 15-30%.

- Inventory: This includes raw materials, work-in-progress, and finished goods. Proper inventory management ensures that a company has enough stock to meet customer demand without tying up excessive capital. A report by McKinsey revealed that companies with optimized inventory management can avoid excess stocks, resulting in a higher sell-through at full price.

- Accounts Payable: This represents money a company owes to its suppliers. Effective management of accounts payable involves negotiating favorable payment terms and timing payments strategically to maximize cash flow.

Impact on Business Performance

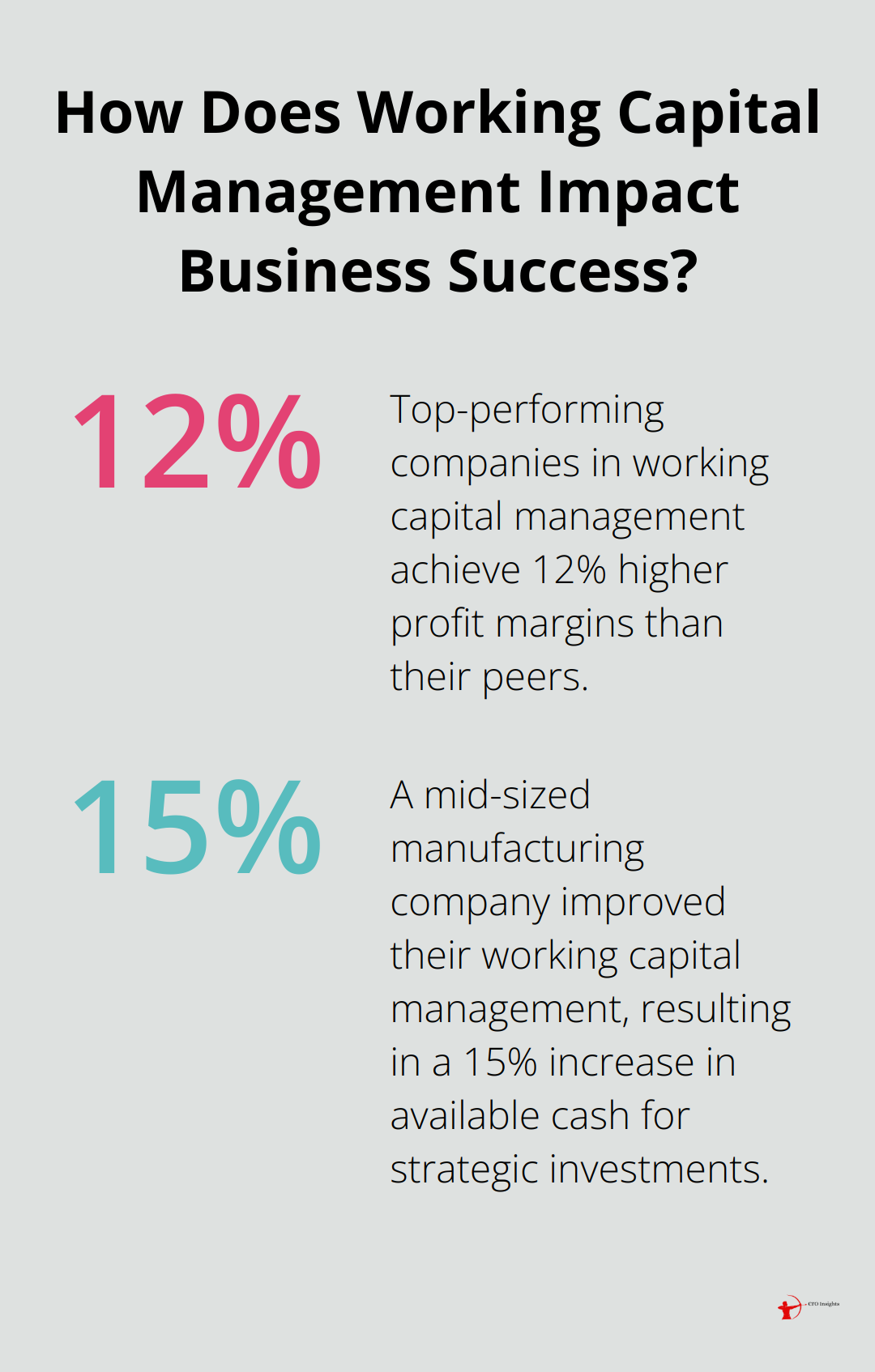

Effective working capital management directly impacts a company’s liquidity and operational efficiency. A study by The Hackett Group revealed that top-performing companies in working capital management achieve 12% higher profit margins than their peers.

Improved liquidity allows companies to invest in growth opportunities, weather economic downturns, and negotiate better terms with suppliers. For instance, a mid-sized manufacturing company improved their working capital management, resulting in a 15% increase in available cash for strategic investments.

Operational efficiency also benefits from strong working capital management. Companies can reduce storage costs and minimize the risk of obsolescence by optimizing inventory levels. Streamlining accounts receivable processes can lead to faster cash conversion cycles, while strategic management of accounts payable can improve relationships with suppliers and potentially lead to better pricing.

The Strategic Advantage

In today’s fast-paced business environment, mastering working capital management provides more than just survival-it offers a path to thrive. Companies that excel in this area position themselves better to seize opportunities, navigate challenges, and outperform their competitors.

As we move forward, we’ll explore specific strategies to optimize each component of working capital, helping you unlock your company’s full financial potential. These strategies will provide practical steps to enhance your working capital management and drive your business towards greater financial success.

How to Optimize Your Working Capital

Accelerate Your Accounts Receivable

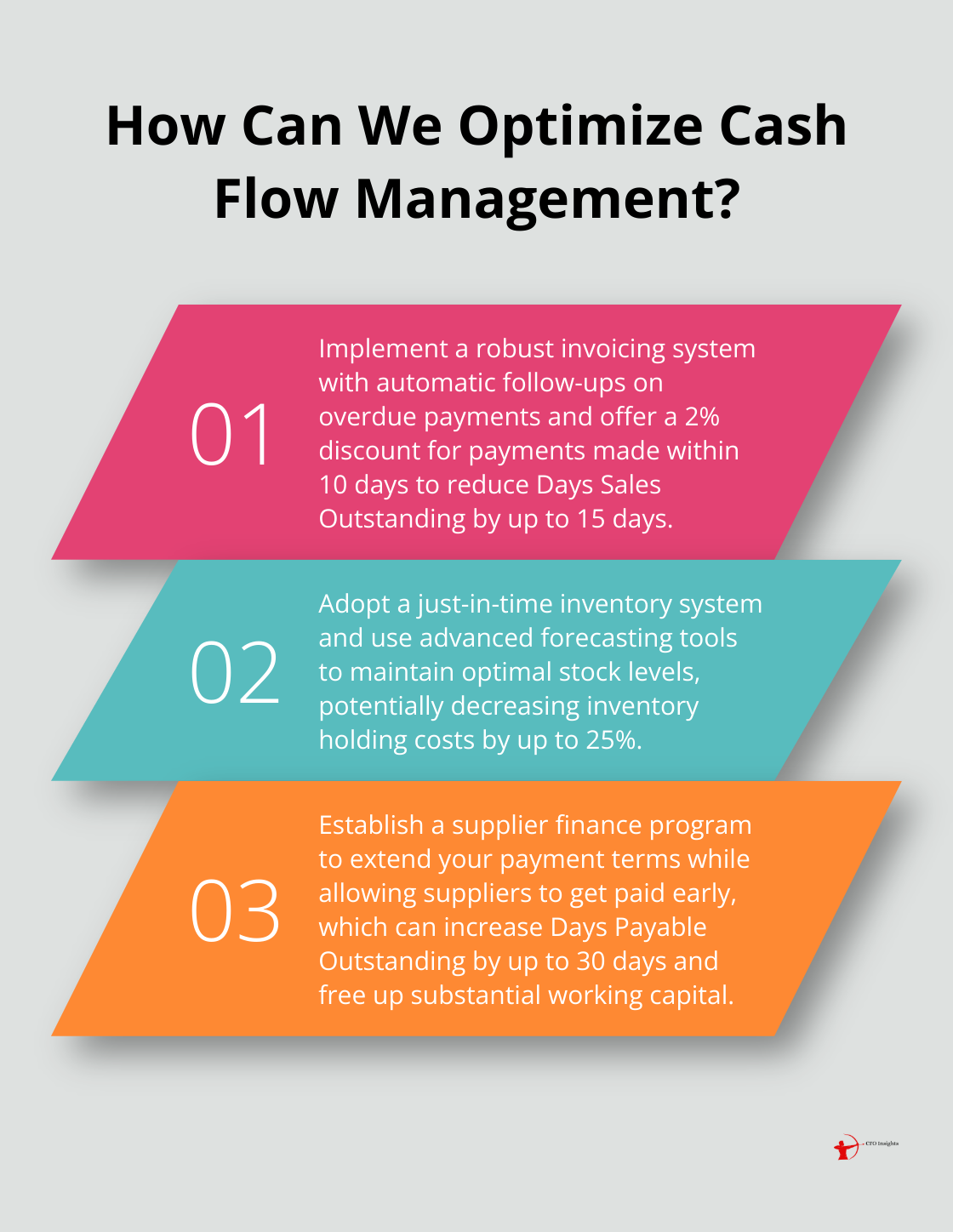

One of the most effective ways to optimize working capital is to speed up your accounts receivable process. We recommend the implementation of a robust invoicing system that sends out bills promptly and follows up on overdue payments automatically. AP automation can help reduce Days Sales Outstanding (DSO) through streamlined invoice processing, reduction in errors, and improved invoice tracking visibility.

Consider offering early payment discounts to incentivize customers to pay faster. A 2% discount for payments made within 10 days can significantly improve cash flow. Some companies have reduced their DSO by up to 15 days using this method.

Master Your Inventory Management

Efficient inventory control plays a key role in working capital optimization. Implement a just-in-time (JIT) inventory system to reduce holding costs and minimize the risk of obsolescence. This system requires accurate demand forecasting from top management and can lower the cost of maintaining inventory.

Use advanced forecasting tools to predict demand accurately. This approach can help you maintain optimal stock levels without tying up excess capital in inventory. Companies that have adopted sophisticated forecasting methods have seen their inventory holding costs decrease by up to 25%.

Optimize Your Supplier Relationships

Negotiating better terms with suppliers can significantly impact your working capital. Try to extend payment terms without damaging supplier relationships. A study by The Hackett Group found that top-performing companies have an average Days Payable Outstanding (DPO) of 74 days, compared to 56 days for typical companies.

Consider implementing a supplier finance program. This allows your suppliers to get paid early while you extend your payment terms. Some companies have increased their DPO by up to 30 days through such programs, freeing up substantial working capital.

Harness the Power of Technology

Leveraging technology for cash flow forecasting is a game-changer in working capital management. Implement a robust Enterprise Resource Planning (ERP) system that integrates all aspects of your business operations. This provides real-time visibility into your cash position and helps identify potential shortfalls or surpluses in advance.

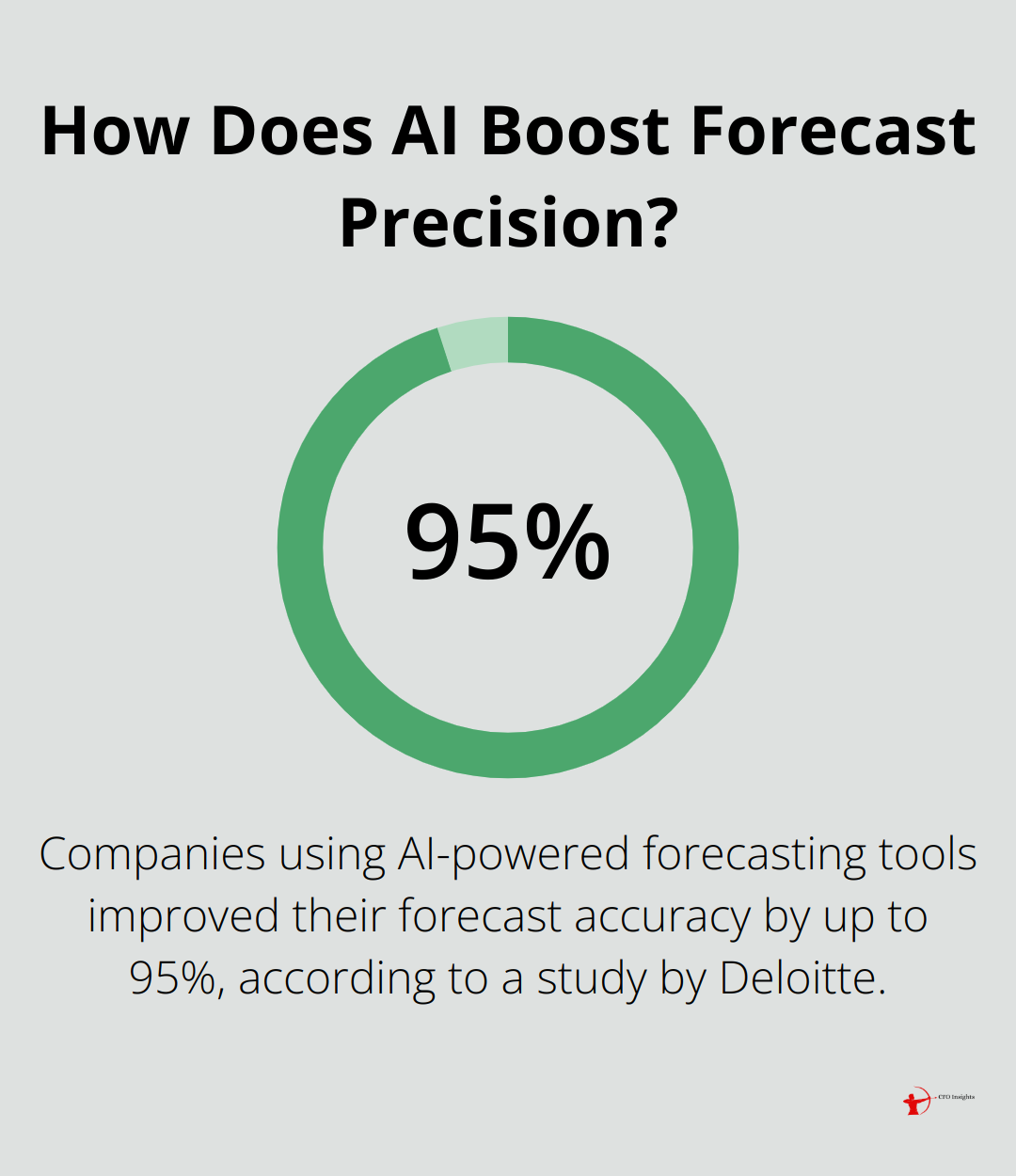

Machine learning algorithms can significantly enhance the accuracy of your cash flow predictions. A study by Deloitte found that companies using AI-powered forecasting tools improved their forecast accuracy by up to 95%.

Optimizing working capital is an ongoing process. Regular review and adjustment of your strategies ensure they align with your business goals and market conditions. These strategies can unlock significant value in your operations and position your company for sustainable growth. In the next section, we’ll explore how to overcome common challenges in working capital management, ensuring your business remains agile in the face of various obstacles.

Navigating Working Capital Challenges

Balancing Growth and Liquidity

Rapid growth can strain your working capital, potentially leading to a cash crunch. To maintain equilibrium, implement a rolling 13-week cash flow forecast. This tool provides a granular view of your short-term cash position, allowing you to anticipate and address potential shortfalls proactively.

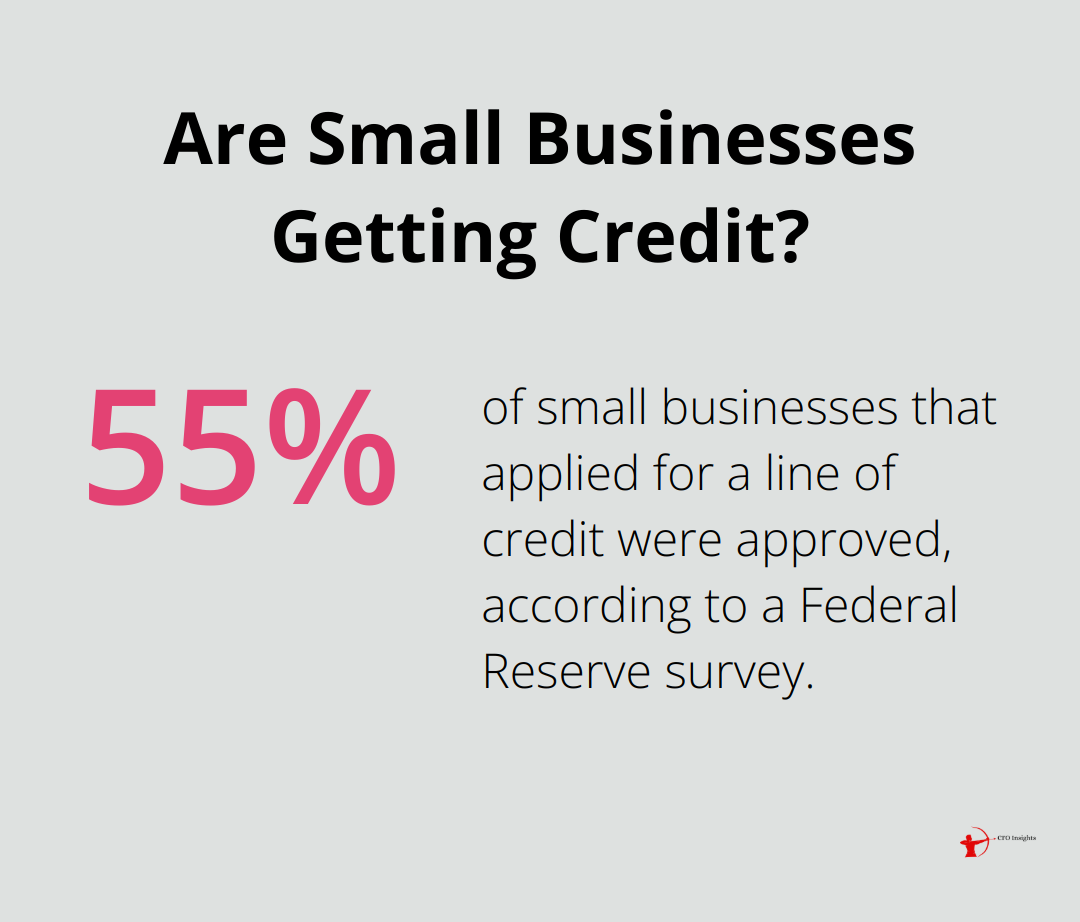

Another effective strategy is to establish a line of credit before you need it. A Federal Reserve survey found that 55% of small businesses that applied for a line of credit were approved. This financial cushion can help you manage unexpected expenses or capitalize on growth opportunities without compromising your liquidity.

Tackling Seasonal Fluctuations

For businesses with cyclical demand, managing working capital can be particularly challenging. One approach is to negotiate flexible payment terms with suppliers that align with your cash flow cycles. For instance, a retail business might arrange to pay suppliers in 90 days during the slow season but commit to shorter payment terms during peak periods.

Additionally, diversify your product or service offerings to smooth out seasonal variations. A landscaping company, for example, might offer snow removal services in winter to maintain steady cash flow year-round.

Mitigating Supply Chain Disruptions

Recent global events have highlighted the importance of resilient supply chains. To protect your working capital from supply chain shocks, consider dual sourcing critical components. While this may slightly increase costs, it can significantly reduce the risk of production delays and lost sales.

Implement a vendor-managed inventory (VMI) system. With VMI, suppliers manage your inventory levels, reducing your inventory costs and ensuring you have the right stock at the right time.

Weathering Economic Uncertainties

Economic volatility can wreak havoc on working capital management. One effective strategy is to stress-test your cash flow projections under various economic scenarios. This exercise can help you identify potential vulnerabilities and develop contingency plans.

Moreover, adopt a zero-based budgeting approach. This method requires justifying every expense from scratch, helping you eliminate unnecessary costs and preserve working capital. In a best-case scenario, zero-based budgeting may reduce Selling, General and Administrative (SG&A) costs by 10 – 25% within six months.

Don’t underestimate the power of building strong relationships with your bank and key stakeholders. Open communication during challenging times can lead to more flexible terms or additional support when you need it most.

Final Thoughts

Working capital management is essential for businesses to thrive in today’s dynamic market. Companies can improve their financial health and operational efficiency through optimized accounts receivable, inventory, and accounts payable strategies. Advanced inventory management techniques and technology-driven cash flow forecasting play key roles in this process.

Effective working capital management offers long-term benefits beyond immediate financial gains. It enhances a company’s ability to weather economic uncertainties, seize growth opportunities, and maintain a competitive edge. Companies that excel in this area often experience improved profitability, increased shareholder value, and greater resilience to market fluctuations.

At CFO Insights, we help businesses navigate the complexities of financial management. Our fractional CFO services provide organizations with the expertise needed to implement best practices, improve cash flow, and support growth initiatives. Companies can focus on their core operations while ensuring their financial strategies remain in capable hands.

2 thoughts on “Mastering Working Capital Management for Business Agility”

Leave a Reply

You must be logged in to post a comment.

[…] more insights on financial management, you may find the article “Mastering Working Capital Management for Business Agility” to be a valuable resource. This article delves into the importance of effectively managing […]

[…] see, it is crucial to also focus on mastering working capital management for business agility. This article delves into the importance of effectively managing working capital to ensure a company’s […]