Crafting an investor pitch that captivates and convinces is a critical skill for any entrepreneur seeking funding. At CFO Insights, we’ve seen firsthand how a well-crafted pitch can make or break a deal.

In this guide, we’ll walk you through the essential elements of an irresistible investor pitch, from understanding your audience to backing up your claims with solid data. Get ready to transform your pitch and increase your chances of securing the investment you need.

Who Are You Pitching To?

Research Your Potential Investors

Before you enter the meeting room, you must know everything about the investors you’ll pitch to. Conduct thorough research to identify your target audience, market size, and growth trends. Additionally, analyze your competitors to gain a comprehensive understanding of the investment landscape.

For instance, if you’re pitching to a VC firm that specializes in SaaS companies, highlight your recurring revenue model and customer acquisition strategies. If you’re presenting to an impact investor, focus on how your business addresses social or environmental issues.

Decode Their Investment Criteria

Every investor has specific criteria to evaluate potential investments. Some prioritize rapid growth, while others value profitability or market share. You need to understand these criteria and address them in your pitch.

Make sure your deck aligns with their expectations. If an investor typically looks for companies with a minimum of $1 million in annual recurring revenue (and you’re not there yet), prepare to show a clear path to reaching that milestone.

Speak Their Language

Investors hear dozens of pitches every week. To stand out, you need to speak their language. This doesn’t mean using jargon or buzzwords. Instead, focus on the metrics and KPIs that matter most to them.

If you’re pitching to a tech-focused investor, they might be interested in your user acquisition costs and lifetime value. For a more traditional investor, cash flow and profit margins might be key. Tailor your financial projections and growth strategies to align with their expectations.

Personalize Your Approach

Investors appreciate when entrepreneurs take the time to personalize their pitch. Try to find common ground or shared interests. Perhaps you both attended the same university or have worked in similar industries. Use this information to build rapport and create a connection.

However, be careful not to overdo it. Your primary focus should still be on your business and its potential. Use personal connections as a way to break the ice and create a more comfortable atmosphere for your pitch.

Now that you understand the importance of knowing your audience, let’s move on to structuring your pitch for maximum impact.

How to Structure a Winning Pitch

Hook Them from the Start

A successful pitch must be clear, concise, and memorable. It should tell a story, answer key questions, and leave investors excited about your business. Instead of starting with “Hello, my name is…” try something like, “Imagine a world where…” or “Every year, $X billion is wasted on…” This approach immediately engages your audience and sets the stage for your pitch.

A fintech startup might open with, “In 2024, Americans will spend over $120 billion in overdraft fees. We’re here to change that.” This statement presents a problem and hints at the solution, creating intrigue.

Paint a Clear Picture of the Problem

After your hook, present the problem you’re solving. Use specific data points and real-world examples to illustrate the issue’s magnitude. Deeply empathize with the target market to get the problem statement right.

Connect the problem to your target market. Show investors that a significant group of people or businesses actively seek a solution to this issue.

Showcase Your Unique Solution

Now that you’ve established the problem, present your solution. Explain how your product or service addresses the issue differently from existing solutions. Be specific about your unique value proposition.

If you’re pitching a new project management tool, don’t just say it’s “better than the competition.” Instead, highlight specific features like, “Our AI-powered task prioritization reduces project completion times by an average of 30% (based on our beta testing with 50 companies).”

Demonstrate a Solid Business Model

Investors want to see that you have a clear plan for making money. Create a simple, eye-catching visual representation of your revenue streams, projected growth, and key financial metrics.

A SaaS company might say, “We offer three subscription tiers: Basic at $29/month, Pro at $79/month, and Enterprise at $199/month. Our current customer base splits 50/30/20 across these tiers, with an average customer lifetime of 18 months.”

Practice and Refine

Your goal is not just to inform, but to excite and convince. Practice your pitch until you can deliver it confidently and naturally, adapting to investor reactions and questions as you go. Try to anticipate potential questions and prepare concise, compelling answers.

With a well-structured pitch, you create a narrative that logically leads investors from problem to solution to business opportunity. In the next section, we’ll explore how to back up your claims with solid data and metrics to further strengthen your pitch.

How Data Strengthens Your Pitch

Market Size and Growth Potential

Investors love numbers. Present a clear picture of your Total Addressable Market (TAM). Don’t just throw out a big number. Break it down.

For example, if you pitch a new fitness app, you might say: “The global fitness app market was valued at $4.4 billion in 2023 and is expected to grow at a CAGR of 17.6% from 2024 to 2030 (according to Grand View Research). Our target segment, focusing on personalized nutrition and workout plans, represents 25% of this market, or $1.1 billion.”

Traction and Key Metrics

Investors want proof that your idea works. Share your most impressive metrics. If you’re pre-revenue, focus on user growth, engagement rates, or pilot program results.

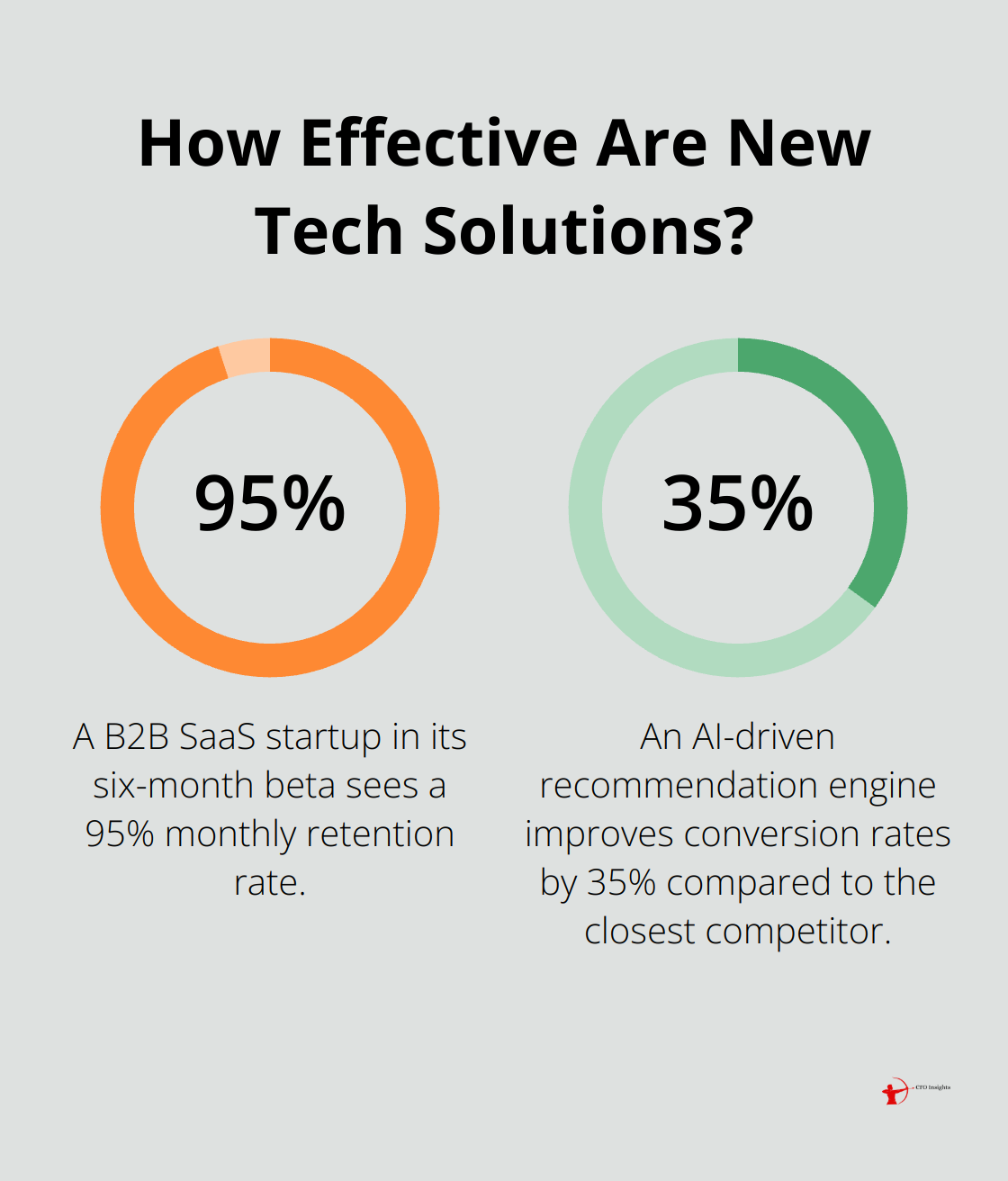

A B2B SaaS startup might present: “In our six-month beta, we onboarded 50 companies. Our average customer acquisition cost is $500, with a lifetime value of $5,000. We see a 95% monthly retention rate and our Net Promoter Score is 72.”

These numbers tell a compelling story of product-market fit and customer satisfaction. They also demonstrate that you understand which metrics matter in your industry.

Competitive Advantage

Every investor will ask: “Why you? Why now?” Use data to showcase your edge. This could be proprietary technology, strategic partnerships, or a unique business model.

Quantify your advantage where possible. For instance: “Our AI-driven recommendation engine improves conversion rates by 35% compared to our closest competitor (based on A/B tests with 10,000 users).”

Financial Projections and Funding Needs

Be realistic but ambitious with your projections. A survey by DocSend reveals that startups that raised successful seed rounds typically showed a clear path to $100 million in annual recurring revenue within five years.

Present your financial forecast for the next 3-5 years, including key milestones. For example: “We project reaching $1 million ARR by end of year 1, $5 million by year 2, and $20 million by year 3. To achieve this, we seek $3 million in funding, which will be allocated as follows: 40% for product development, 35% for marketing and sales, and 25% for operations.”

Investors don’t just buy your current state – they invest in your future potential. Use data to paint a vivid picture of that potential, and you’ll create an irresistible investor pitch.

Final Thoughts

A compelling investor pitch combines thorough research, strategic storytelling, and data-driven insights. You must create a narrative that resonates with potential investors, starting with an attention-grabbing hook and clearly defining your unique solution. Present your business model and revenue streams to demonstrate your market understanding and path to profitability.

Data strengthens your pitch significantly. Use market size figures, growth projections, and key performance indicators to illustrate your company’s potential. Highlight your traction, competitive advantages, and financial projections to build credibility and excitement around your venture.

Your passion for your business should shine through every aspect of your pitch. At CFO Insights, we help businesses develop financial strategies and projections that form the backbone of a compelling investor pitch. Our fractional CFO services can assist you in creating a clear and compelling financial narrative aligned with investor expectations.