In today’s volatile economic landscape, investor relations have become more critical than ever. Building and maintaining trust with stakeholders is essential for long-term success and financial stability.

At CFO Insights, we understand the challenges companies face when communicating with investors during uncertain times. This blog post explores effective strategies to strengthen investor trust, from transparent communication to proactive engagement and navigating market volatility.

How Transparent Communication Builds Trust

Timely and Accurate Financial Reporting

At CFO Insights, we’ve observed how transparent communication forms the foundation of trust between companies and their investors. This trust becomes even more vital during uncertain times.

Investors hunger for information, particularly when markets fluctuate. Companies that provide clear, timely, and accurate financial reports distinguish themselves. A study by the Financial Executives Research Foundation revealed that 93% of investors consider the timeliness of financial reporting very important or critical when making investment decisions.

To achieve this, companies should implement a robust financial reporting system. Setting internal deadlines well before official filing dates allows time for thorough reviews and prevents last-minute rushes to meet deadlines.

Open Dialogue About Challenges

While the temptation to downplay difficulties exists, honesty about challenges actually builds credibility. When Coca-Cola faced supply chain issues in 2021, they communicated the problem and their mitigation strategies openly. This proactive approach helped maintain investor confidence despite the setback.

Companies should hold regular investor calls, not just during prosperous times. These opportunities allow businesses to address concerns directly. Preparing comprehensive Q&A documents helps anticipate and answer tough questions transparently.

Consistent Delivery on Promises

Actions speak louder than words. Companies that consistently meet or exceed their guidance build a reputation for reliability.

Companies should exercise caution in their projections. Slightly exceeding expectations proves more beneficial than consistently falling short. If guidance revision becomes necessary, companies should act promptly and explain the reasons clearly.

Transparent communication extends beyond sharing good news. It involves building a relationship of trust with investors through consistent, honest, and proactive information sharing. This transparency (especially during uncertain times) can become a company’s greatest asset in maintaining investor confidence.

As we move forward, we’ll explore how proactive engagement strategies can further strengthen the bond between companies and their investors, building upon the foundation of transparent communication.

How to Engage Investors Proactively

At CFO Insights, we understand the power of proactive investor engagement. This approach transforms the company-investor relationship from reactive to interactive, creating stronger bonds and deeper trust.

Leverage Digital Platforms for Investor Outreach

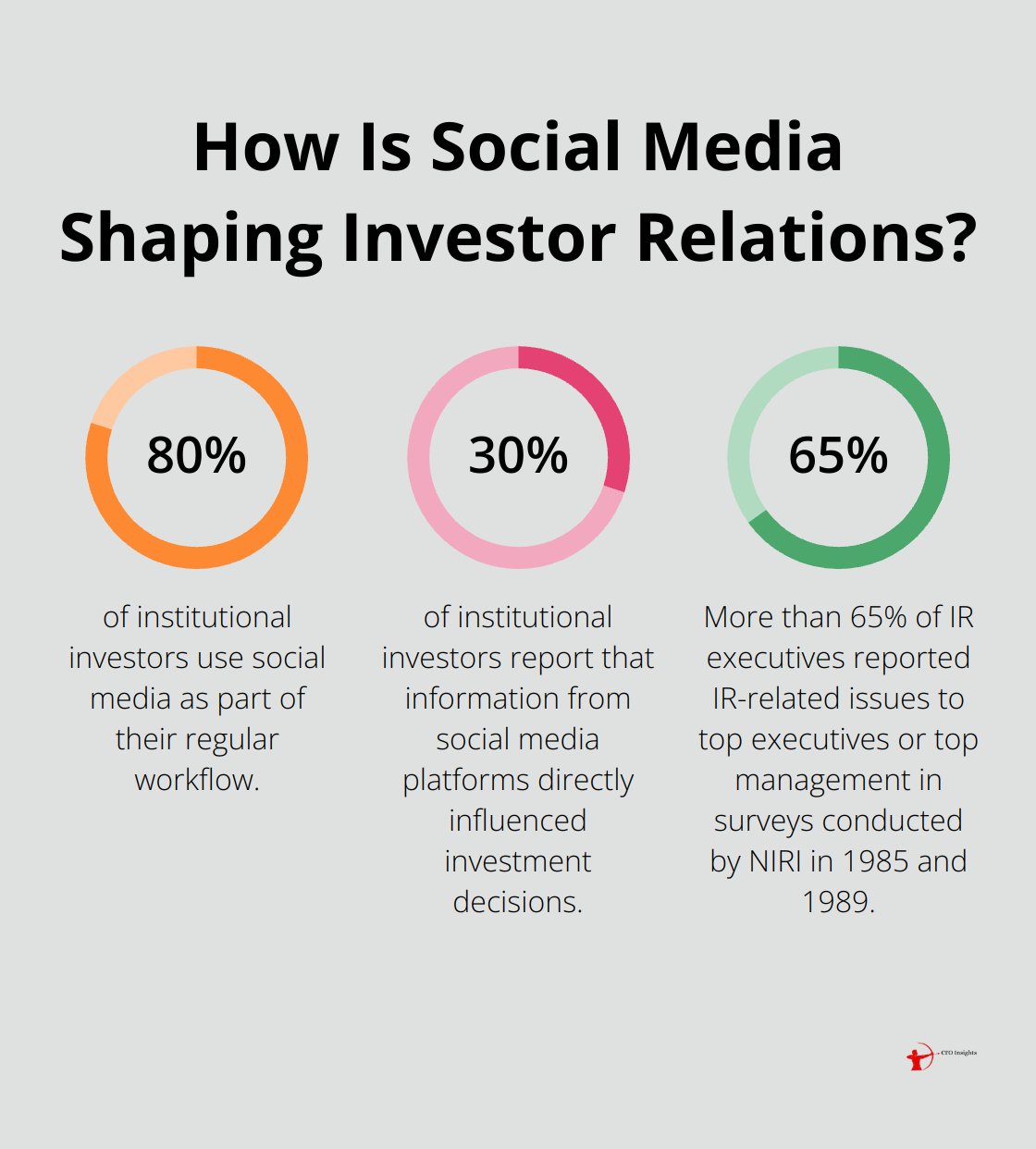

The digital revolution has reshaped investor relations. Social media platforms (LinkedIn, Twitter) now serve as powerful tools for sharing company updates, industry insights, and thought leadership content. A recent survey reveals almost 80% of institutional investors use social media as part of their regular workflow, with approximately 30% reporting that information from these platforms directly influenced investment decisions.

Companies can use these platforms to:

- Share real-time updates

- Host live Q&A sessions

- Provide easy access to financial reports and presentations

Tesla’s Elon Musk, for example, frequently uses Twitter to communicate with investors, making it a key component of the company’s investor relations strategy.

Host Regular Investor Events

While quarterly earnings calls remain standard practice, forward-thinking companies expand their engagement through regular investor days and virtual town halls. These events allow for in-depth discussions about company strategy, market trends, and future outlook.

Microsoft hosts an annual investor day to explore their long-term vision and strategy across various business segments. This level of engagement helps investors understand the company’s direction beyond quarterly results.

Tailor Your Communication

Investors are not a monolithic group; their information needs vary significantly. Institutional investors often require in-depth financial analysis, while retail investors appreciate more straightforward, jargon-free communication.

Surveys conducted by NIRI in 1985 and 1989 showed that more than 65% of IR executives reported IR-related issues to top executives or top management. This personalized approach leads to more effective communication and stronger relationships with different investor segments.

Companies might provide:

- Detailed technical briefings for analysts and institutional investors

- Accessible content like infographics or video summaries for retail investors

Proactive engagement creates a two-way dialogue with investors. Companies that master this approach build stronger, more trusting relationships with their investors. This strategy proves particularly valuable during uncertain times when clear, consistent communication becomes even more critical.

As we move forward, we’ll explore how companies can navigate market volatility and economic uncertainty while maintaining investor trust.

How Companies Navigate Market Turbulence

Showcase Financial Resilience

Market volatility and economic uncertainty challenge investor relations. Companies must adapt their strategies to maintain trust and confidence during tumultuous times.

During periods of market turbulence, investors seek assurance that companies can weather the storm. Companies should highlight their strong balance sheets, cash reserves, and diversified revenue streams.

Apple consistently emphasizes its substantial cash reserves during earnings calls. In Q1 2023, Apple reported $165 billion in cash and marketable securities, providing a cushion against market uncertainties.

Companies can also showcase their risk management strategies. This might include hedging against currency fluctuations, diversifying supply chains, or maintaining flexible cost structures. Procter & Gamble regularly discusses its commodity hedging strategies during investor presentations, illustrating how it mitigates raw material price volatility.

Communicate Long-Term Vision

While short-term market fluctuations unsettle investors, companies must keep them focused on the long-term vision. This involves clear articulation of the company’s strategic direction, growth initiatives, and competitive advantages.

Amazon exemplifies this approach. Despite facing quarterly earnings volatility, the company consistently communicates its long-term focus on expanding market share and investing in new technologies. This strategy has helped maintain investor confidence even during periods of heavy spending and lower profitability.

Companies should consider strategic implementation to enhance the effectiveness of organizational resources and provide clarity. These efforts can help investors see beyond immediate market turbulence and understand the company’s potential for sustained growth.

Adapt Communication Strategies

During volatile periods, the frequency and content of investor communications may need adjustment. Companies should prepare to increase the cadence of their updates, particularly if market conditions rapidly change.

Some companies have adopted monthly (or even weekly) investor updates during particularly turbulent times. For instance, during the height of the COVID-19 pandemic, many airlines provided frequent updates on cash burn rates and liquidity positions to keep investors informed.

The content of these communications should also evolve. Companies might need to focus more on near-term operational metrics, cash flow management, or specific risk factors that are most relevant in the current environment.

Companies should strike a balance between transparency and avoiding information overload. They should focus on the most critical metrics and provide context for how these relate to long-term strategic goals.

Leverage Expert Guidance

In navigating market volatility, companies often benefit from expert guidance. Fractional CFO services can offer valuable strategic insights and financial expertise without the commitment of a full-time hire. These services can help companies implement best practices in financial reporting, ensure regulatory compliance, and support growth initiatives during uncertain times.

Emphasize Adaptability

Companies that demonstrate adaptability in the face of market turbulence often gain investor trust. This involves showcasing how the company can pivot its strategies, reallocate resources, or capitalize on new opportunities that arise from changing market conditions.

Netflix provides a good example of this approach. When faced with increasing competition in the streaming market, the company communicated its shift towards producing original content. This strategic pivot (which addressed a clear market challenge) helped maintain investor confidence in the company’s long-term prospects.

Final Thoughts

Investor relations play a vital role in building trust during uncertain times. Companies that communicate transparently, engage proactively, and navigate market volatility strategically foster strong relationships with their stakeholders. These relationships withstand turbulent economic conditions and position organizations for long-term success.

Strong investor relations help companies weather immediate challenges and create a foundation for future growth. Investors who trust a company’s leadership and strategy remain committed during difficult periods, providing stability and support. This commitment proves invaluable as businesses pursue new opportunities and adapt to changing market dynamics.

At CFO Insights, we understand the complexities of managing investor relations in today’s business environment. Our fractional CFO services offer expert guidance to implement best practices in financial management and communication strategies. Companies that prioritize transparent, proactive, and adaptive investor relations strategies position themselves for sustained success in all market conditions.