Financial planning is undergoing a radical transformation. The traditional methods that once served as the backbone of financial strategy are rapidly becoming obsolete.

At CFO Insights, we’ve observed a seismic shift in how successful companies approach their financial planning. This blog post explores why traditional financial planning is no longer effective and introduces the dynamic, data-driven alternatives that are reshaping the financial landscape.

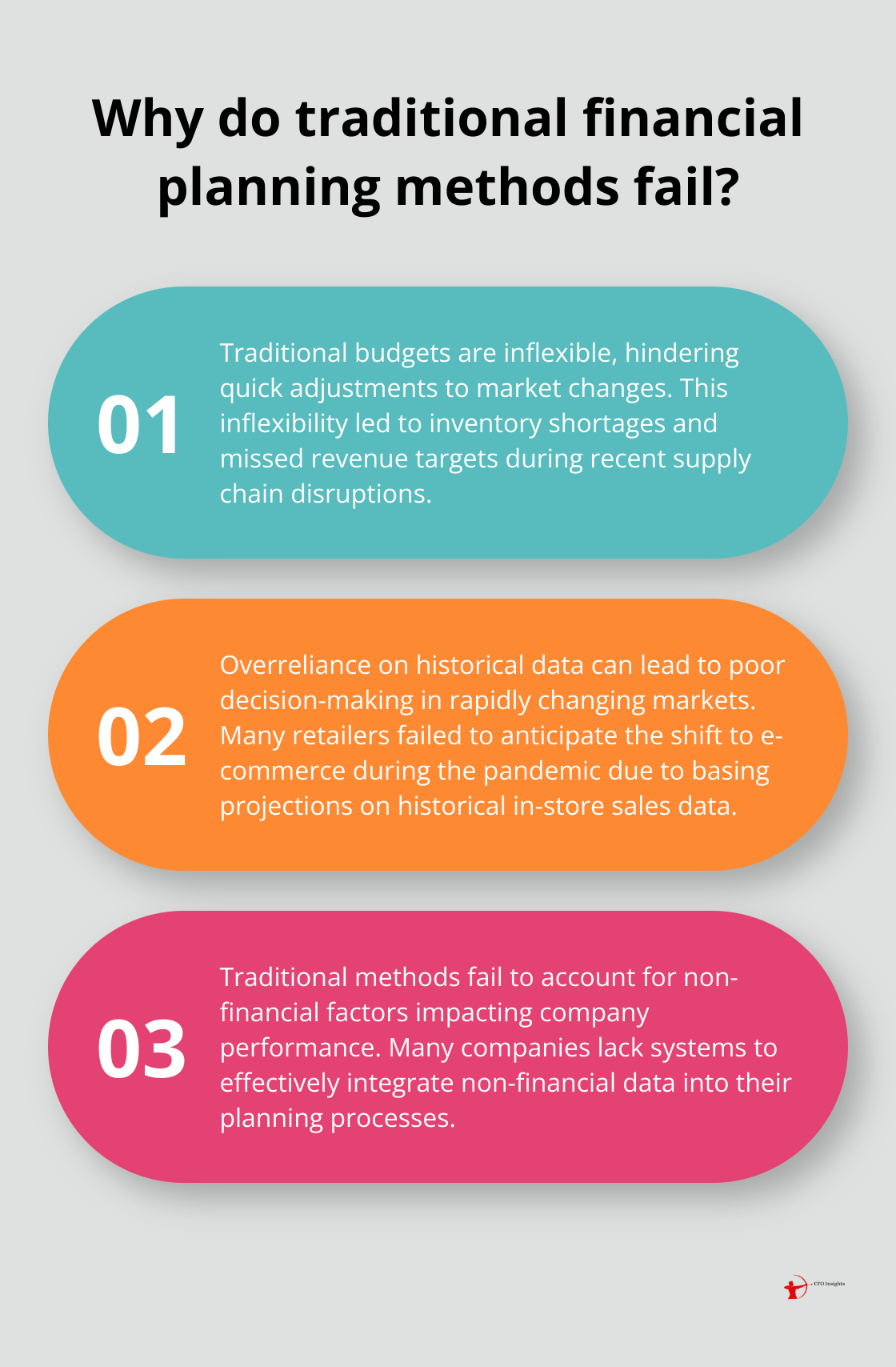

Why Traditional Financial Planning Falls Short

The Pitfalls of Static Planning

Traditional budgets tend to be inflexible, making it difficult for organizations to adjust quickly to changing market conditions. This lack of flexibility leaves businesses vulnerable to market shifts and unable to capitalize on emerging opportunities. During recent supply chain disruptions, companies with rigid financial plans struggled to adjust their strategies, resulting in inventory shortages and missed revenue targets.

The Danger of Backward-Looking Data

Traditional financial planning relies heavily on historical data, which can mislead in rapidly changing markets. This overreliance on past performance often leads to poor decision-making. Many retailers failed to anticipate the dramatic shift to e-commerce during the pandemic because they based their projections on historical in-store sales data.

The Blind Spot of Non-Financial Factors

Another critical shortcoming of traditional financial planning is its failure to account for non-financial factors that can significantly impact a company’s performance. These factors might include changes in consumer behavior, technological disruptions, or shifts in regulatory environments.

Forecasting accuracy is the ability to give a reasonable outlook of the business financials relative to your expected sales volumes. However, many companies currently lack systems to effectively integrate non-financial data into their planning processes.

The Need for Real-Time Insights

Traditional financial planning often lacks the ability to provide real-time insights, which are essential in today’s rapidly evolving business landscape. Companies that rely on outdated information risk making decisions based on obsolete data, potentially leading to costly mistakes.

The Limitations of Manual Processes

Many traditional financial planning methods still rely heavily on manual processes and spreadsheets. These approaches are not only time-consuming but also prone to errors. Manual processes also limit the ability to perform complex scenario analyses and stress tests, which are crucial for identifying potential risks and opportunities in today’s volatile business environment.

As businesses recognize these shortcomings, they increasingly turn to more dynamic and comprehensive financial planning approaches. The next chapter will explore how modern financial planning methods address these limitations and provide organizations with the tools they need to thrive in an ever-changing economic landscape.

How Dynamic Financial Planning Transforms Your Business

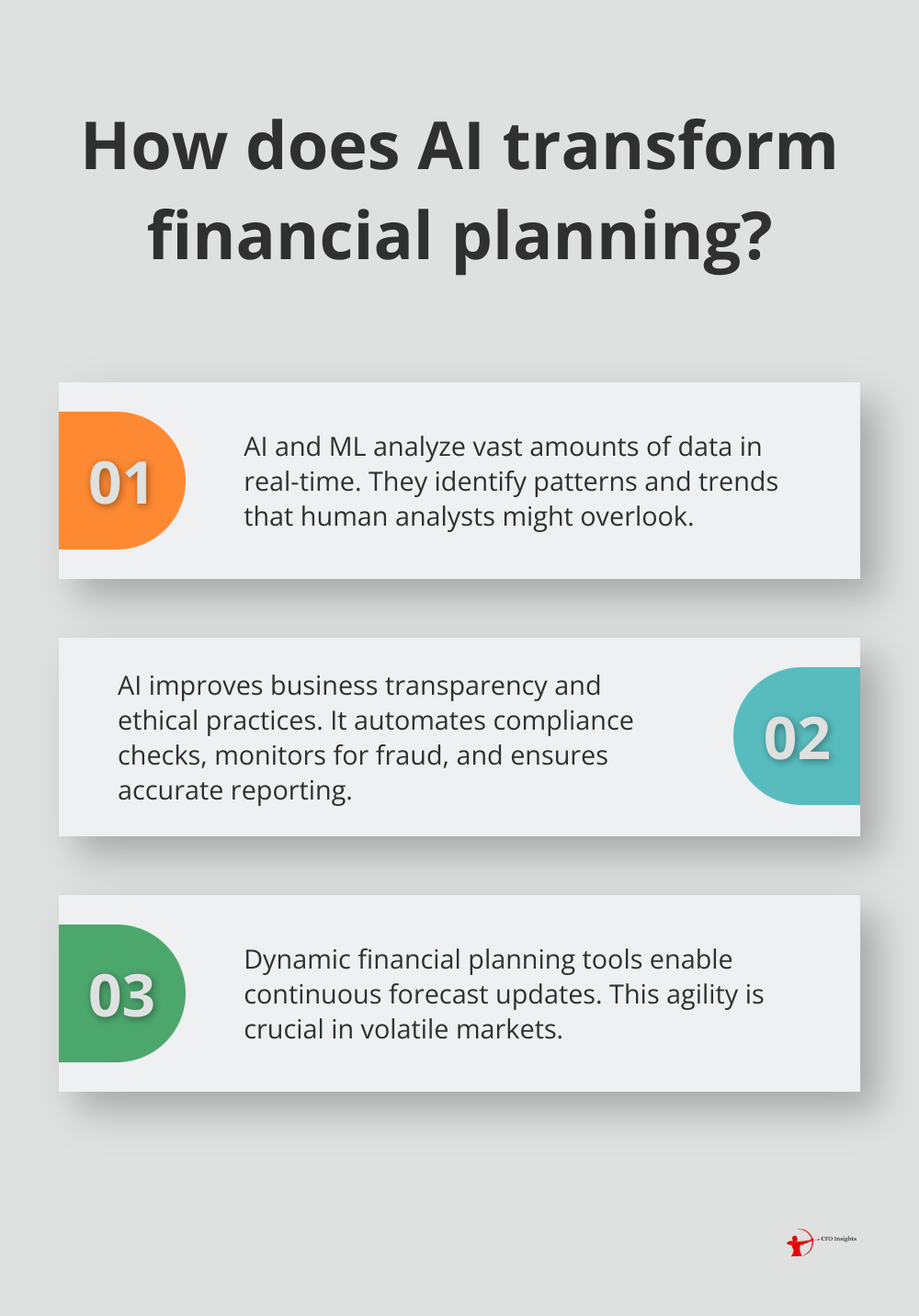

AI and Machine Learning: The New Frontier

Artificial Intelligence (AI) and Machine Learning (ML) have become essential tools for modern financial planning. These technologies analyze vast amounts of data in real-time, identifying patterns and trends that human analysts might overlook. AI can improve business transparency and ethical practices by automating compliance checks, monitoring for fraudulent activities, and ensuring consistent and accurate reporting.

Real-Time Scenario Planning and Forecasting

The era of annual or quarterly forecasts has ended. Today’s businesses need to run multiple scenarios at a moment’s notice. Dynamic financial planning tools allow companies to create and update forecasts continuously, adjusting for new information as it becomes available. This agility proves crucial in volatile markets.

External Data: A Goldmine of Insights

Modern financial planning doesn’t limit itself to internal data. It incorporates a wide range of external sources, from economic indicators to social media trends. This holistic approach provides a more comprehensive view of the business environment. According to McKinsey, companies that use external data in their financial planning processes can achieve 2.5 times higher financial performance.

Agility and Flexibility: The Competitive Edge

The most successful companies today can pivot quickly in response to changing market conditions. Dynamic financial planning supports this agility by providing real-time insights and enabling rapid decision-making.

The Shift in Financial Strategy

Implementing dynamic financial planning requires more than just adopting new technologies; it demands a fundamental change in how we approach financial strategy. This shift moves us from rigid, annual planning cycles to a more fluid, continuous process. Such an approach allows businesses to respond quickly to market changes, capitalize on new opportunities, and mitigate risks more effectively.

As the financial landscape continues to evolve, the gap between companies that embrace dynamic financial planning and those that cling to traditional methods will only widen. The next chapter will explore the key components that make up a modern, dynamic financial planning system and how they work together to drive business success.

What Makes Modern Financial Planning Effective?

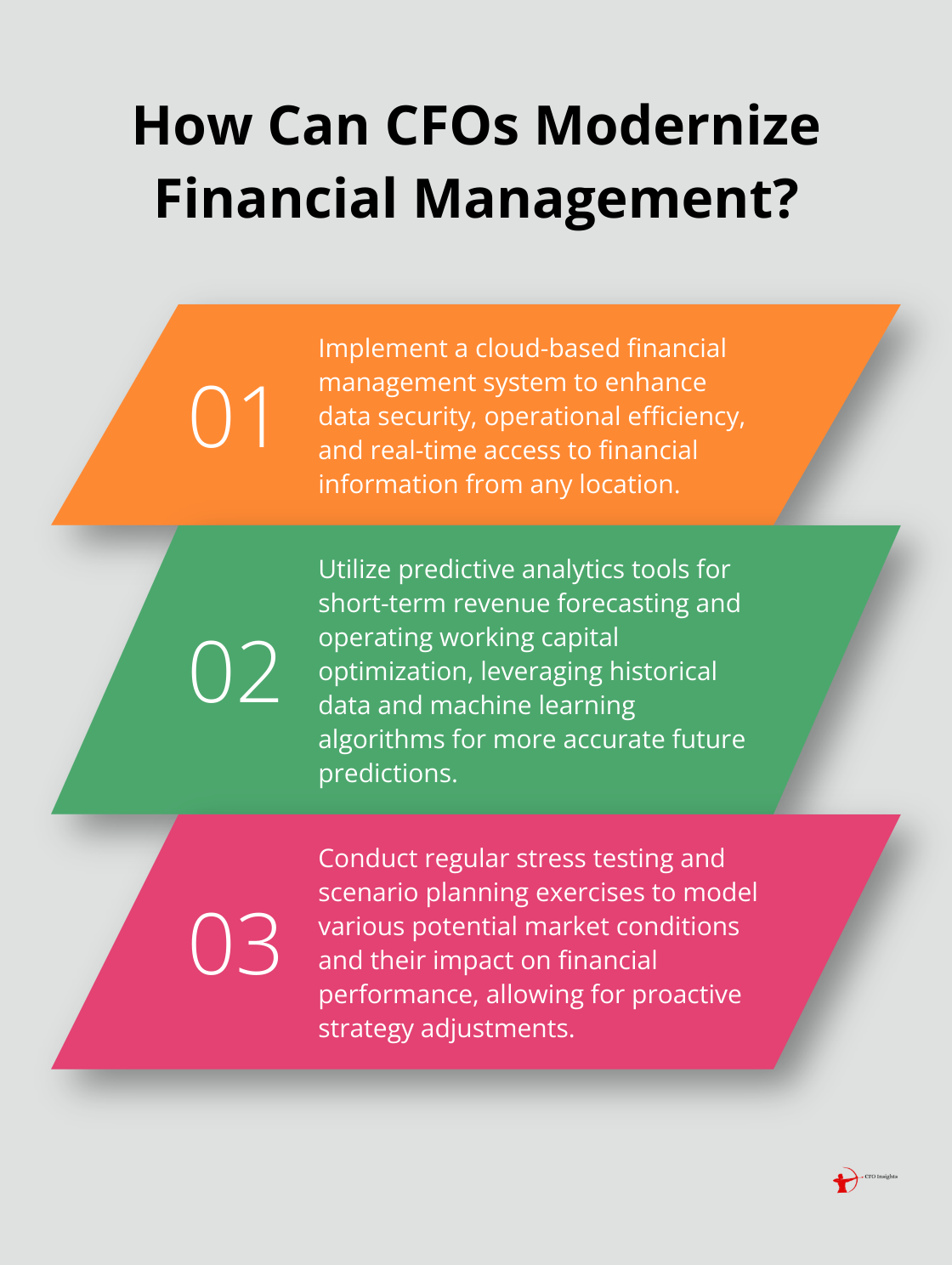

Cloud-Based Systems: The Foundation of Agile Finance

Cloud-based financial management systems form the cornerstone of effective financial planning. These platforms offer enhanced data security, operational efficiency, scalability, and innovation. Cloud computing is transforming the financial services industry, providing real-time data access and improved collaboration capabilities.

Cloud solutions allow finance teams to work from any location, which promotes flexibility and continuity. They also facilitate easier integration with other business systems, providing a more comprehensive view of organizational performance.

Predictive Analytics: Data-Driven Foresight

Predictive analytics tools revolutionize how businesses forecast and plan. These tools use historical data, external factors, and machine learning algorithms to predict future trends and outcomes with high accuracy. Short-term revenue forecasting and operating working capital optimization are two standout examples of how predictive analytics can be leveraged in financial planning.

Collaborative Platforms: Eliminating Silos

Modern financial planning requires cross-functional effort. Collaborative platforms eliminate departmental silos, enabling finance teams to work seamlessly with other business units. This comprehensive approach explores key principles, strategies, and best practices for developing and implementing effective budgeting and forecasting techniques.

Risk Management and Stress Testing: Preparation for the Unexpected

In today’s volatile business environment, robust risk management and stress testing capabilities are essential. Advanced financial planning tools allow companies to model various scenarios and assess their potential impact on financial performance.

A financial services firm used stress testing to evaluate the impact of potential market downturns on their portfolio. This proactive approach allowed them to adjust their investment strategy, ultimately protecting them from significant losses during an actual market correction.

The Role of CFO Insights

At CFO Insights, we recognize the importance of these modern financial planning components. Our fractional CFO services help organizations implement these tools and strategies effectively, ensuring they stay competitive in today’s fast-paced business landscape. We provide the expertise needed to leverage these advanced financial planning techniques without the cost of a full-time CFO.

Final Thoughts

Financial planning has transformed dramatically, making traditional methods obsolete in today’s fast-paced business world. Modern approaches leverage AI-driven analytics, real-time scenario planning, and cloud-based systems to provide organizations with a competitive edge. These advancements enable improved forecasting accuracy, enhanced decision-making agility, and a more comprehensive understanding of the financial landscape.

Organizations that adopt these modern financial planning techniques can expect better resource allocation, increased profitability, and stronger resilience against market volatility. The transition requires a strategic approach, including process assessment, technology investment, and team training. It also demands a shift towards a data-driven decision-making culture within the organization.

At CFO Insights, we guide organizations through this transition with our expertise. Our team offers fractional CFO services that provide strategic insights and financial expertise (without the commitment of a full-time hire). We help businesses not only survive in an uncertain landscape but position themselves for long-term success and growth.