Unravelling the Mysteries of Crypto: A Beginner’s Guide to Digital Currency

Summary

- Digital currency is a form of currency that is available only in digital or electronic form and not in physical form.

- Cryptocurrency is a type of digital currency that uses cryptography for security and operates independently of a central bank.

- Cryptocurrency works through a technology called blockchain, which is a decentralized and distributed ledger that records all transactions across a network of computers.

- There are various types of cryptocurrencies, with Bitcoin being the most well-known and widely used.

- Investing in digital currency comes with both benefits, such as potential high returns, and risks, such as volatility and security concerns.

Digital currency, also known as cryptocurrency, has taken the financial world by storm in recent years. This revolutionary form of money exists solely in the digital realm, with no physical counterpart. Unlike traditional currencies issued by central banks, cryptocurrencies operate on decentralised networks, typically utilising blockchain technology to ensure security and transparency.

At its core, digital currency is a medium of exchange that allows for instant, borderless transactions without the need for intermediaries such as banks or governments. This peer-to-peer system has captured the imagination of tech enthusiasts and investors alike, promising a new era of financial freedom and innovation. However, the concept can be daunting for newcomers, with its complex terminology and ever-evolving landscape.

The History and Evolution of Cryptocurrency

The Birth of Bitcoin

It wasn’t until 2009 that the first decentralised cryptocurrency, Bitcoin, was introduced by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Bitcoin’s creation marked a watershed moment in the history of digital currency, inspiring a wave of innovation and the development of numerous alternative cryptocurrencies, or “altcoins”.

Mainstream Acceptance

As the technology matured, cryptocurrencies began to gain mainstream attention, with major companies and financial institutions exploring their potential applications.

A Thriving Industry

Today, the cryptocurrency market has grown into a multi-billion-pound industry, with thousands of digital currencies in circulation and a growing ecosystem of exchanges, wallets, and other related services.

How Cryptocurrency Works: A Step-by-Step Guide

At the heart of most cryptocurrencies lies blockchain technology, a distributed ledger that records all transactions across a network of computers. When a user initiates a transaction, it is broadcast to the network and grouped with other transactions into a “block”. Miners, specialised computers on the network, then compete to solve complex mathematical problems to validate the block.

Cryptocurrency Once a block is validated, it is added to the chain of previous blocks, creating an immutable record of all transactions. This process ensures the integrity and security of the network, as altering any single transaction would require changing all subsequent blocks – a feat that becomes increasingly difficult as the blockchain grows. Users can access their cryptocurrency through digital wallets, which store the private keys necessary to authorise transactions and manage their funds.

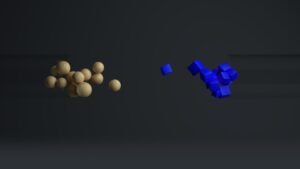

Exploring the Different Types of Cryptocurrencies

| Cryptocurrency Type | Key Features | Popular Examples |

|---|---|---|

| Bitcoin | Decentralized, limited supply | Bitcoin (BTC) |

| Ethereum | Smart contracts, decentralized apps | Ethereum (ETH) |

| Ripple | Fast transactions, low fees | Ripple (XRP) |

| Litecoin | Faster block generation, scrypt algorithm | Litecoin (LTC) |

While Bitcoin remains the most well-known cryptocurrency, the market has diversified significantly since its inception. Altcoins, such as Ethereum, Ripple, and Litecoin, offer alternative features and use cases. For instance, Ethereum introduced the concept of smart contracts, self-executing agreements that can automate complex transactions without intermediaries.

Stablecoins, another category of cryptocurrency, aim to address the volatility often associated with digital currencies by pegging their value to traditional assets like the US dollar or gold. These coins provide a bridge between the cryptocurrency and fiat currency worlds, offering stability for users who wish to transact in digital assets without exposure to significant price fluctuations. As the market continues to evolve, new types of cryptocurrencies emerge, each with its own unique features and potential applications.

The Benefits and Risks of Investing in Digital Currency

Investing in cryptocurrency can offer several potential benefits, including the possibility of high returns, portfolio diversification, and exposure to cutting-edge technology. The decentralised nature of cryptocurrencies also appeals to those seeking greater financial autonomy and protection against inflation or economic instability in their home countries. However, the cryptocurrency market is notoriously volatile and carries significant risks.

Price fluctuations can be extreme, with the value of digital assets capable of changing dramatically in a matter of hours.

Regulatory uncertainty, security concerns, and the potential for fraud or market manipulation are additional factors that investors must consider.

As with any investment, it is crucial to conduct thorough research and only invest what one can afford to lose.

Investing in Cryptocurrency

When it comes to investing, beginners should start small and focus on well-established cryptocurrencies with strong track records. It’s also important to choose a reputable exchange for buying and selling digital assets, and to use secure wallets for storage. Diversification, both within the cryptocurrency market and across different asset classes, can help mitigate risk.

Staying Informed

Finally, staying informed about market trends, regulatory developments, and technological advancements is crucial for making informed decisions in this rapidly evolving space.

Key Takeaways

By following these guidelines, individuals can navigate the complex world of cryptocurrency with confidence.

The Future of Cryptocurrency: Trends and Predictions

As cryptocurrency continues to mature, several trends are shaping its future trajectory. Increased institutional adoption, with major companies and financial institutions incorporating digital assets into their operations and investment strategies, is likely to drive further growth and legitimacy in the market. The development of central bank digital currencies (CBDCs) by various nations could also significantly impact the cryptocurrency landscape.

Technological advancements, such as improvements in scalability and energy efficiency, are addressing some of the current limitations of blockchain networks. The integration of cryptocurrencies with emerging technologies like the Internet of Things (IoT) and artificial intelligence (AI) could unlock new use cases and applications. While the future of cryptocurrency remains uncertain, its potential to disrupt traditional financial systems and enable new forms of economic interaction continues to captivate investors, technologists, and policymakers alike.

FAQs

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central bank. It is decentralized and typically uses a technology called blockchain to record transactions.

How does cryptocurrency work?

Cryptocurrency works through a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. When a transaction is made, it is verified by network nodes and added to the blockchain, making it secure and transparent.

What are the different types of cryptocurrencies?

There are thousands of different cryptocurrencies, but the most well-known ones include Bitcoin, Ethereum, Ripple, Litecoin, and many others. Each cryptocurrency operates on its own underlying technology and has its own unique features and use cases.

What are the benefits of investing in cryptocurrency?

Some potential benefits of investing in cryptocurrency include the potential for high returns, diversification of investment portfolio, and the ability to participate in a rapidly growing and evolving market.

What are the risks of investing in cryptocurrency?

Risks of investing in cryptocurrency include price volatility, security risks, regulatory uncertainty, and the potential for fraud and scams. It is important for investors to conduct thorough research and understand the risks before investing in cryptocurrency.

Beginners navigating the cryptocurrency market should start by educating themselves about the technology and market, only invest what they can afford to lose, diversify their investments, and consider using reputable cryptocurrency exchanges and wallets.

What is the future of cryptocurrency?

The future of cryptocurrency is uncertain, but many experts believe that it will continue to grow and evolve, potentially becoming more mainstream and integrated into various industries. Some trends and predictions include increased regulation, the development of new use cases, and the potential for greater adoption by institutional investors.