At CFO Insights, we know that operational efficiency in finance is crucial for business success. Efficiency ratios are powerful tools that help companies measure and improve their financial performance.

In this post, we’ll explore three essential efficiency ratios: Inventory Turnover, Accounts Receivable Turnover, and Fixed Asset Turnover. These metrics offer valuable insights into how effectively a company manages its resources and generates revenue.

How Does Inventory Turnover Impact Your Bottom Line?

Understanding Inventory Turnover Ratio

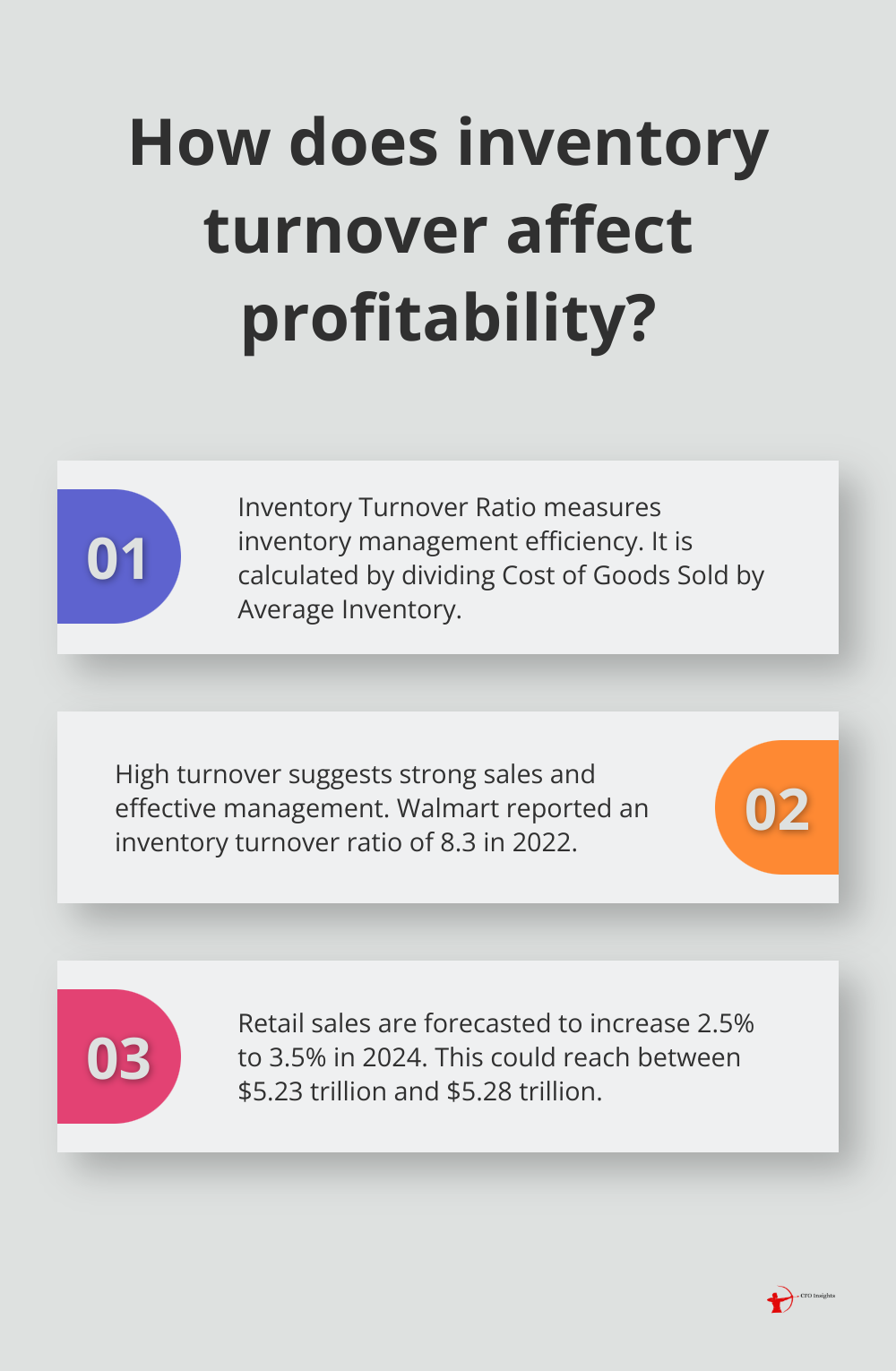

The Inventory Turnover Ratio is a critical metric that shows how efficiently a company manages its inventory. This ratio indicates how efficiently a company uses its inventory by dividing the cost of goods sold by the average inventory value during a set period. A high turnover rate suggests strong sales and effective inventory management, while a low rate might point to overstocking or weak sales.

Calculating the Ratio

To determine the Inventory Turnover Ratio, use this formula:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

For instance, if a company’s COGS for the year is $1,000,000 and its average inventory is $200,000, the Inventory Turnover Ratio would be 5. This means the company sells and replaces its inventory five times per year.

Interpreting Your Results

The ideal Inventory Turnover Ratio varies by industry. Retail and grocery stores typically have higher ratios due to perishable goods and fast-moving consumer products. A 2023 study by the National Retail Federation forecasts that retail sales will increase in 2024 between 2.5% and 3.5% to between $5.23 trillion and $5.28 trillion.

A ratio that’s too high might indicate lost sales due to stock-outs. On the other hand, a low ratio could mean too much capital is tied up in slow-moving inventory. Walmart, known for its efficient inventory management, reported an inventory turnover ratio of 8.3 in 2022 (according to their annual report).

Strategies to Improve Inventory Turnover

To boost your Inventory Turnover Ratio, consider these strategies:

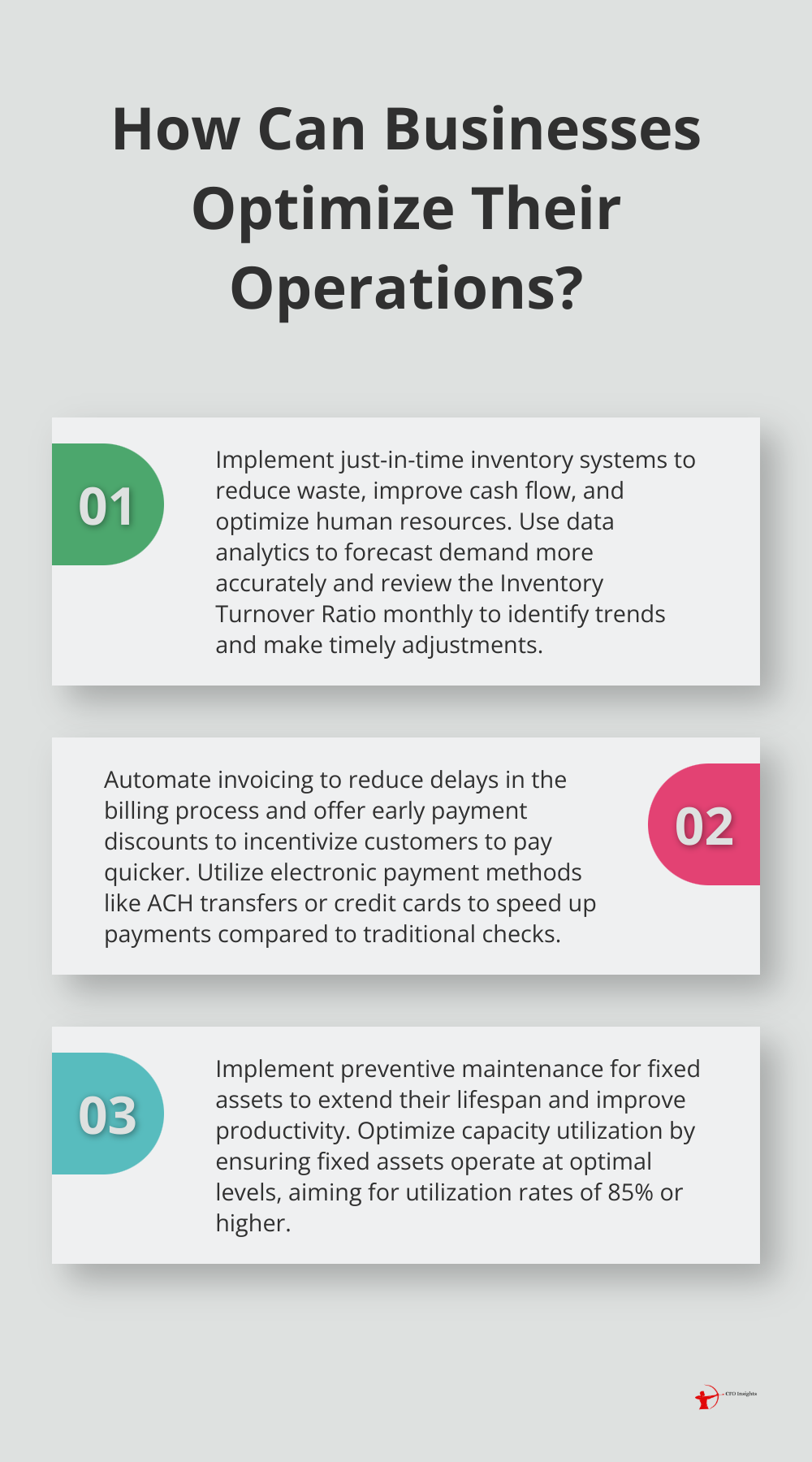

- Implement just-in-time inventory systems: This approach reduces waste, improves cash flow, increases flexibility, optimizes human resources and encourages team collaboration.

- Use data analytics: Forecast demand more accurately. Amazon uses predictive analytics to optimize its inventory levels, achieving an impressive turnover ratio of 13.2 in 2022.

- Regular monitoring: Review this metric monthly to identify trends and make timely adjustments to your inventory management strategies.

The Impact on Your Bottom Line

Optimizing your Inventory Turnover Ratio can lead to significant financial benefits:

- Free up working capital

- Reduce storage costs

- Improve overall profitability

As we move forward, it’s important to consider how the Inventory Turnover Ratio relates to other efficiency metrics. Let’s explore another key ratio that impacts your financial health: the Accounts Receivable Turnover Ratio.

How Can You Accelerate Your Cash Flow?

Understanding the Accounts Receivable Turnover Ratio

The Accounts Receivable Turnover Ratio is an accounting measure used to quantify how efficiently a company is in collecting receivables from its clients. This metric plays a vital role in maintaining healthy cash flow and operational efficiency.

Calculating the Ratio

To determine this ratio, divide your net credit sales by your average accounts receivable for a specific period. For instance, if your annual credit sales total $1,000,000 and your average accounts receivable is $100,000, your ratio would be 10. This indicates that you collect your receivables 10 times per year (or approximately every 36.5 days).

Interpreting Your Results

A higher ratio typically indicates more efficient collection practices. The Credit Research Foundation conducts surveys by industry which detail relevant statistical information concerning domestic accounts receivable performance.

This ratio can vary significantly by industry. The retail sector often boasts higher ratios due to quicker payment terms, while manufacturing or construction industries might have lower ratios due to longer payment cycles.

Strategies to Improve Your Ratio

- Automate invoicing: Use software to send invoices immediately after delivering goods or services. This reduces delays in the billing process and speeds up payments.

- Offer early payment discounts: Incentivize customers to pay early. A 2% discount for payments made within 10 days can significantly improve your cash flow.

- Streamline credit policies: Review and update your credit policies regularly. Consider using credit scoring models to assess customer creditworthiness more accurately.

- Utilize electronic payment methods: Encourage customers to pay via ACH transfers or credit cards. These methods typically result in faster payments compared to traditional checks.

- Follow up proactively: Contact customers before an invoice becomes overdue. Send friendly reminders a few days before the due date.

- Consider factoring: For businesses struggling with cash flow, factoring receivables can be a powerful tool for improving cash flow, but it needs to be used wisely as part of a well-considered overall financial strategy.

Finding the Right Balance

While a high accounts receivable turnover ratio is generally positive, an extremely high ratio might indicate overly strict credit policies that could limit sales. Try to find the right balance for your business and industry.

Improving your accounts receivable turnover ratio represents just one piece of the efficiency puzzle. The Fixed Asset Turnover Ratio provides additional insights into your company’s use of long-term assets, which we will explore next.

How to Maximize Your Fixed Asset Efficiency

Understanding Fixed Asset Turnover

The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets. This metric holds particular importance for capital-intensive industries such as manufacturing, telecommunications, and utilities.

Calculation Method

To calculate the Fixed Asset Turnover Ratio, divide your net sales by the average net fixed assets for a specific period. For example, if a company has annual net sales of $10 million and average net fixed assets of $5 million, the Fixed Asset Turnover Ratio would be 2. This means the company generates $2 in sales for every $1 invested in fixed assets.

Interpreting the Results

A higher ratio indicates more efficient use of fixed assets. However, the ideal ratio varies significantly across industries.

Strategies to Improve Fixed Asset Efficiency

- Implement preventive maintenance: Regular upkeep of equipment can extend its lifespan and improve productivity. A study by Jones Lang LaSalle found that preventive maintenance can result in a 545% return on investment.

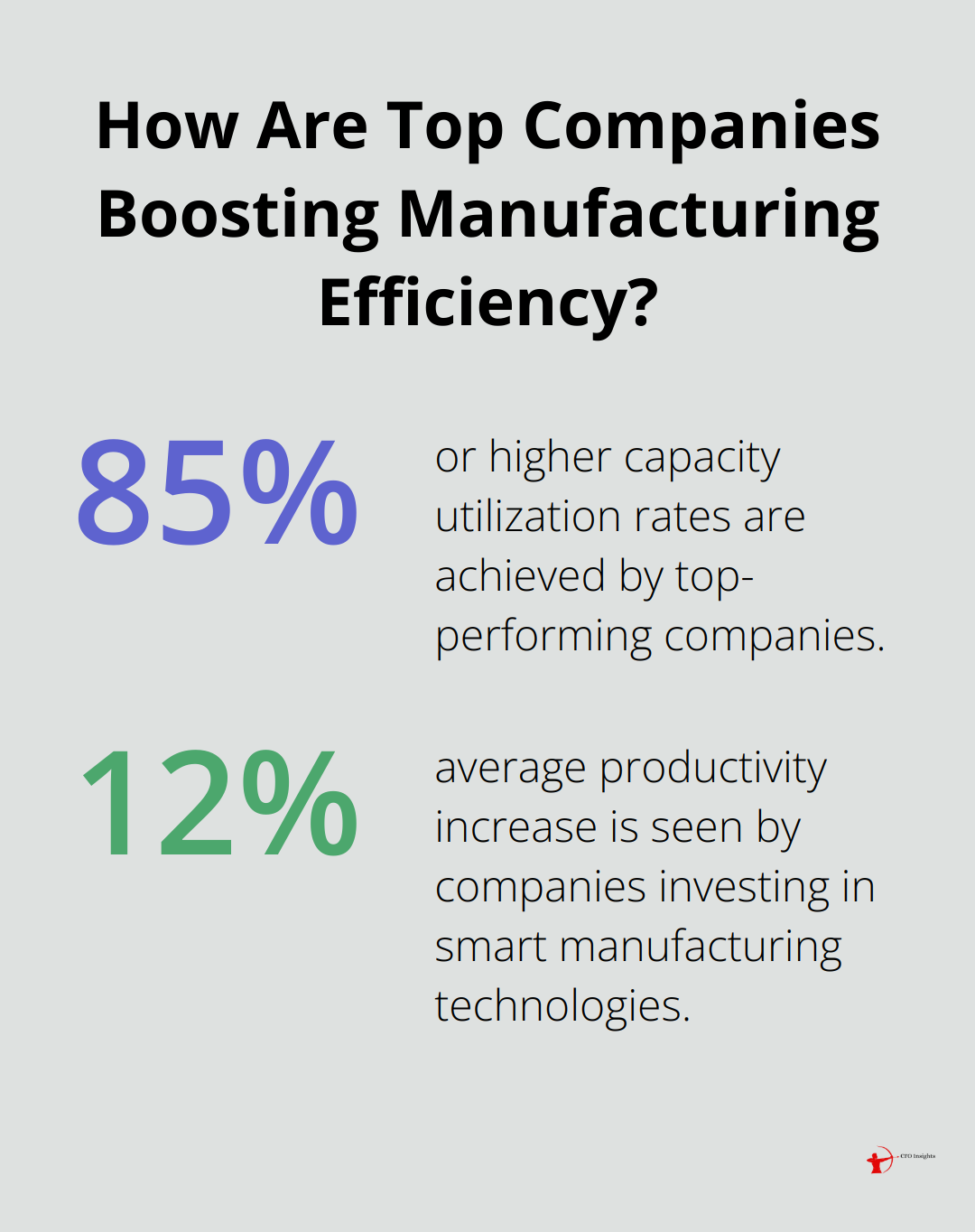

- Optimize capacity utilization: Ensure your fixed assets operate at optimal levels. The American Productivity and Quality Center reports that top-performing companies achieve capacity utilization rates of 85% or higher.

- Consider leasing vs. buying: Leasing can be a more efficient use of capital for assets that quickly become obsolete. Leasing scientific instruments is an economic option for academic core facilities to stay technologically ahead and competitive.

- Invest in technology: Modern equipment often has higher productivity rates. The Manufacturing Institute reports that companies investing in smart manufacturing technologies see an average productivity increase of 12%.

- Sell or repurpose underutilized assets: Review your fixed assets regularly and consider selling or repurposing those that don’t contribute significantly to revenue generation.

Industry Comparisons and Trends

Fixed Asset Turnover Ratios can vary widely between industries and even within sectors. For instance, in the technology sector, software companies typically have much higher ratios than hardware manufacturers due to their lower fixed asset requirements.

Many industries see a trend towards higher Fixed Asset Turnover Ratios due to increased automation and the shift towards asset-light business models. The rise of cloud computing, for example, has allowed many tech companies to reduce their investment in physical infrastructure.

Understanding and optimizing your Fixed Asset Turnover Ratio can lead to significant improvements in overall efficiency and profitability. However, it’s important to analyze this metric in conjunction with other financial ratios to get a comprehensive view of your company’s financial health.

Final Thoughts

We explored three critical efficiency ratios that provide valuable insights into a company’s financial health and operational performance. These ratios help businesses optimize stock management, improve cash flow, and utilize long-term assets effectively. Companies should monitor and analyze these ratios regularly to identify trends, spot potential issues early, and make data-driven decisions to improve their financial performance.

Implementing ratio analysis in financial decision-making can lead to significant improvements in a company’s overall efficiency and profitability. Organizations can optimize their operations and strengthen their financial position by setting benchmarks and comparing performance against industry standards. Operational efficiency in finance requires continuous effort and adaptation to changing market conditions.

CFO Insights specializes in helping organizations implement best practices in financial management and improve their operational efficiency. Our fractional CFO services provide businesses with the expertise they need to analyze key ratios, interpret results, and develop strategies for improvement. Companies can focus on their core operations while ensuring their financial strategies remain in capable hands (through our partnership).