Risk management is a critical aspect of project success. At CFO Insights, we’ve seen how effective risk transference can significantly impact project outcomes.

This strategy, often overlooked in favor of more common approaches, can be a game-changer when applied correctly. As the complexity of projects increases, especially in areas like crypto risk management software, understanding and implementing risk transference becomes even more vital.

What Is Risk Transference?

The Essence of Risk Transference

Risk transference is a risk management method that involves transferring your organization’s risk to another party. This approach can protect projects from financial losses and operational disruptions.

Risk transference involves moving the responsibility for managing specific risks to another entity, often through contractual agreements or insurance policies. A construction company might purchase insurance to cover potential damages during a building project. This transfers the financial risk of accidents or natural disasters from the company to the insurer.

Distinguishing Risk Transference from Other Strategies

Unlike risk mitigation, which aims to reduce the likelihood and impact of risks, risk transference doesn’t eliminate the risk itself. Instead, it shifts the burden of handling the risk’s consequences. This differs from risk acceptance, where a company chooses to bear the full impact of a potential risk.

Risk avoidance, another common strategy, involves completely eliminating the possibility of a risk occurring, often by changing project plans or scope. In contrast, risk transference keeps the risk in play but assigns responsibility for its management to another party.

Debunking Common Misconceptions

Many project managers mistakenly believe that transferring a risk means it’s no longer their concern. However, oversight remains crucial. If a software development project outsources a component to a third-party vendor, the project team must still monitor progress and quality to ensure project success.

Another misconception is that risk transference is always the most cost-effective option. While it can be beneficial, the costs of insurance premiums or contractual agreements can sometimes outweigh the potential risk impact. A thorough cost-benefit analysis is essential before deciding to transfer any risk.

The Role of Risk Transference in Modern Projects

As projects become increasingly complex, particularly in areas like crypto risk management software, risk transference plays a vital role. Risk transfer refers to a risk management technique in which risk is transferred to a third party. For example, a blockchain project might transfer cybersecurity risks to specialized security firms, leveraging their expertise to protect against potential attacks.

In the financial sector, companies use risk transference to manage currency fluctuations. By entering into forward contracts or currency swaps, they effectively transfer the risk of exchange rate changes to financial institutions.

Implementing Risk Transference Effectively

To implement risk transference effectively, project managers should:

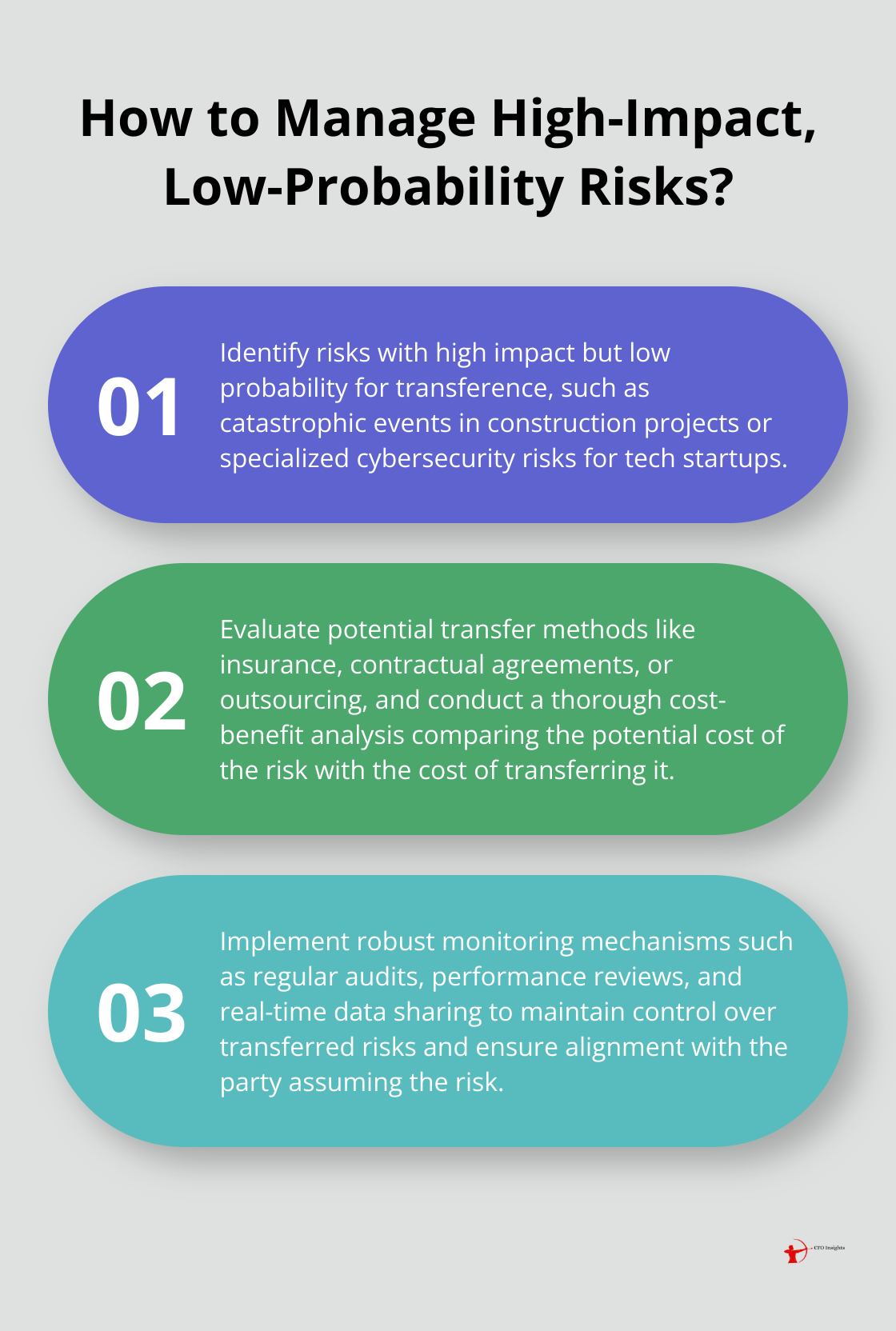

- Identify risks suitable for transference (those with high impact but low probability)

- Evaluate potential transfer partners (insurers, contractors, or specialized firms)

- Negotiate clear terms and conditions for the risk transfer

- Maintain ongoing communication with the party assuming the risk

The next chapter will explore the various methods of risk transference in more detail, including insurance, contractual agreements, and outsourcing strategies.

How to Implement Effective Risk Transference

Pinpointing Transferable Risks

Not all risks should be transferred. We look for risks with high potential impact but low probability of occurrence. In a construction project, the risk of a major earthquake exemplifies this profile. It’s unlikely to happen, but if it does, the consequences could be catastrophic.

Another factor to consider is the expertise required to manage the risk. If a risk falls outside your organization’s core competencies, it often becomes a good candidate for transference. A tech startup might transfer cybersecurity risks to a specialized firm rather than attempt to manage them in-house.

Choosing the Right Transfer Method

Several methods exist to transfer risk, each with its own advantages:

- Insurance: This represents the most common form of risk transference. The Insurance Information Institute reports that U.S. insurance industry net premiums written totaled $1.22 trillion in 2018. This method works well for risks that are well-defined and have a clear financial impact.

- Contractual Agreements: These can transfer risk to vendors, suppliers, or contractors. A software development company might include clauses in their contracts that hold clients responsible for certain types of data breaches.

- Outsourcing: This involves transferring entire processes or functions to third parties. A survey by Deloitte shows an increase in organizations prioritizing cost reduction, which can be achieved through outsourcing.

Weighing Costs and Benefits

The final step evaluates whether risk transference is cost-effective. This involves comparing the potential cost of the risk (probability x impact) with the cost of transferring it.

For instance, if the annual premium for earthquake insurance is $50,000, but the potential damage from an earthquake is estimated at $5 million with a 1% chance of occurrence, the expected value of the risk is $50,000 ($5 million x 1%). In this case, the insurance cost equals the expected value of the risk, making it a reasonable transfer.

However, it’s not always this straightforward. You also need to consider factors like:

- Hidden costs: Are there additional administrative or legal costs associated with the transfer?

- Reputation: How might a risk event impact your company’s reputation, even if the financial cost is transferred?

- Control: Will transferring the risk limit your ability to manage the situation if it occurs?

Financial modeling tools help make these complex decisions. A data-driven approach, combined with industry experience, leads to the most effective risk transference strategies.

Risk transference doesn’t eliminate risk entirely – it optimizes your risk profile to align with your business objectives. When done correctly, it can provide a significant competitive advantage and peace of mind.

Challenges in Risk Transference Implementation

While risk transference offers numerous benefits, it also presents challenges. One common issue is the potential for misalignment between the transferring party and the party assuming the risk. This can lead to disputes over responsibility when a risk event occurs.

Another challenge lies in accurately assessing the value of the risk being transferred. Underestimating the risk can result in inadequate coverage, while overestimating can lead to unnecessary costs.

As we move forward, it’s important to consider these challenges alongside the potential benefits of risk transference. The next chapter will explore the potential drawbacks and legal implications of risk transference in more detail, providing a comprehensive view of this risk management strategy.

Navigating the Pitfalls of Risk Transference

Risk transference, while powerful, presents several challenges. Organizations often struggle to implement this strategy effectively. This chapter explores key hurdles and considerations.

The Hidden Costs of Risk Transference

Transferring risk often incurs unexpected expenses. Insurance premiums represent just the beginning. The Risk and Insurance Management Society (RIMS) offers practical techniques to analyze an organization’s exposures and vulnerabilities and understand corporate attitude toward risk philosophy.

Operational costs may also increase. When outsourcing a process to transfer risk, companies often face higher prices from vendors who now bear that risk. A Deloitte survey found that many companies were forced to return to the basics and focus on driving down costs and performing risk management instead of investing in new capabilities.

Legal Landmines in Risk Transfer Agreements

The legal implications of risk transference can become complex and problematic. Poorly drafted contracts often lead to disputes and litigation.

Indemnification clauses often become points of contention when risk events occur. It’s important to clearly define the risks being transferred and under what circumstances.

Regulatory compliance presents another legal consideration. In some industries, certain risks cannot undergo full transfer. For example, banks remain responsible for the actions of their third-party service providers in the eyes of regulators.

Maintaining Control in a Transferred Risk Environment

When risks undergo transfer, companies tend to adopt an “out of sight, out of mind” mentality. This approach can lead to dangerous situations. The Ponemon Institute is dedicated to independent research & education that advances the responsible use of information and privacy management practices within business.

To maintain control, companies must implement robust monitoring and reporting mechanisms. These might include regular audits, performance reviews, and real-time data sharing. However, these measures can add to the overall cost and complexity of risk transference.

The challenge of aligning incentives also exists. The party assuming the risk may not have the same motivations to prevent risk events as your organization. This misalignment can result in suboptimal risk management practices.

Balancing Risk Transfer and Oversight

Effective risk transference requires a delicate balance between offloading risk and maintaining sufficient oversight. It’s not a set-it-and-forget-it solution, but rather an ongoing process that demands attention and resources.

Companies must weigh these challenges against the potential benefits of risk transference. Implementing risk transference strategies effectively ensures that organizations can reap the rewards while minimizing the pitfalls.

Final Thoughts

Risk transference empowers project managers to navigate complex challenges in today’s dynamic business environment. This strategy allows organizations to focus on core competencies while leveraging external expertise for specific risks, leading to more efficient resource allocation and improved project outcomes. The increasing complexity of projects, especially in fields like crypto risk management software development, will likely spur more specialized risk transfer solutions.

Advancements in data analytics and artificial intelligence will revolutionize risk identification, assessment, and transfer processes. These technologies will enable more accurate risk quantification and real-time monitoring of transferred risks, allowing for more dynamic risk management strategies. Project managers must stay informed about these trends to effectively handle future challenges and drive their projects toward success.

At CFO Insights, we recognize the critical role of effective risk management in financial strategy and project success. Our team of experienced professionals can help your organization navigate the complexities of risk transference and develop robust risk management strategies tailored to your specific needs. As the business landscape evolves, so too will the strategies for managing risk.