Digital transformation is reshaping the finance landscape. Traditional finance departments face mounting pressure to adapt or risk falling behind.

At CFO Insights, we’ve seen how outdated processes can hinder business performance and limit growth potential.

This blog post explores how finance leaders can harness cutting-edge technologies to streamline operations, boost efficiency, and drive strategic decision-making.

Why Finance Departments Must Evolve Now

The Rapid Shift in Finance

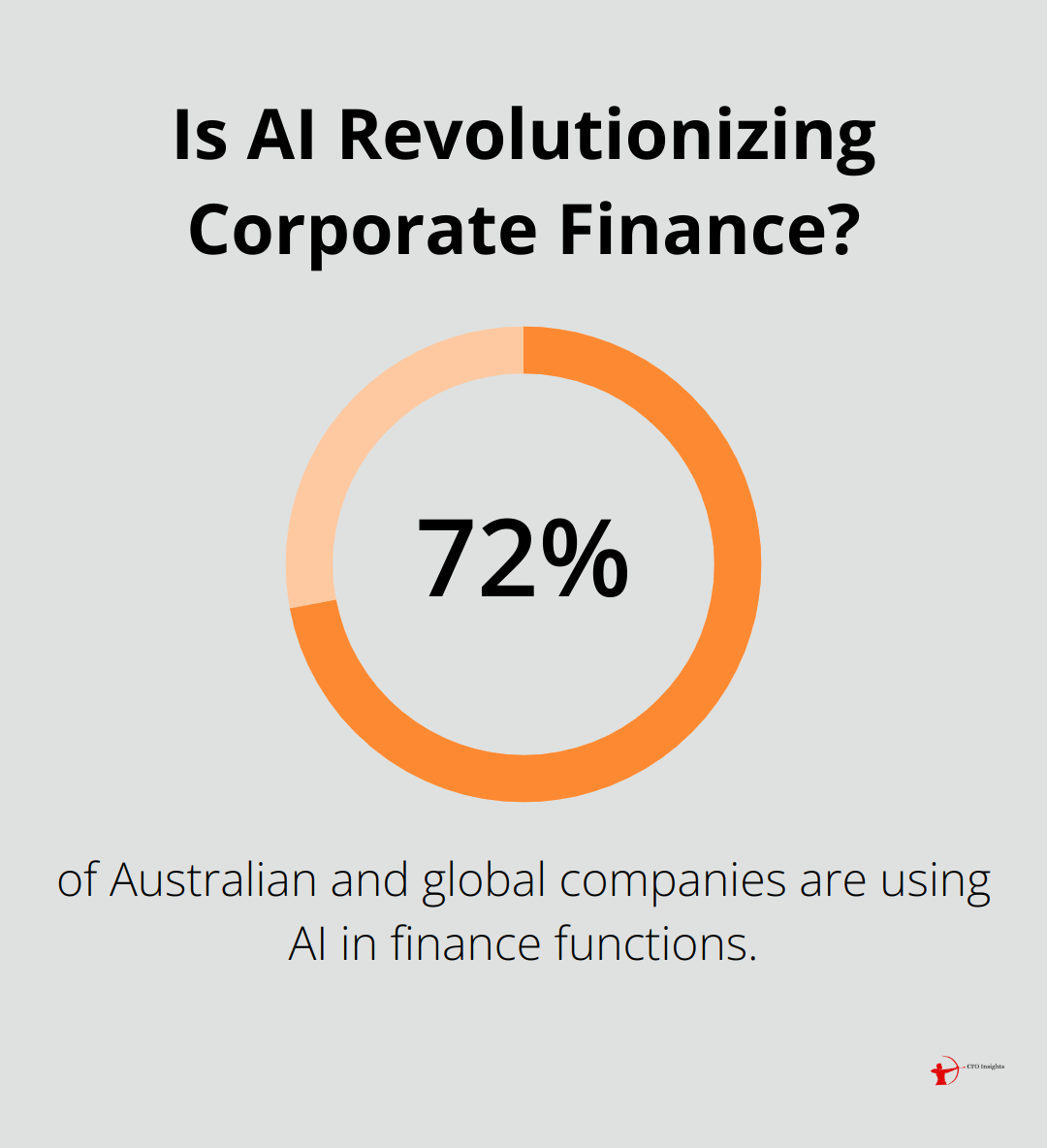

The finance landscape transforms at an unprecedented pace. Traditional finance departments face an uphill battle to keep pace. A recent KPMG study revealed that 72% of Australian and global companies are using AI in finance functions, highlighting the widening gap between digitally advanced and traditional finance teams.

The Hidden Costs of Outdated Processes

Outdated processes don’t just inconvenience; they drain resources and hinder growth. Manual data entry, for instance, wastes time and introduces errors. Without robust validation processes, errors can propagate through the system, affecting everything from customer records to financial reporting. This can lead to inaccurate financial reporting, resulting in poor decision-making and potential compliance issues.

Companies still relying on legacy systems often lack real-time visibility into their financial data. This absence of timely insights can severely hamper a company’s ability to respond quickly to market changes or capitalize on new opportunities.

The Technology Investment Paradox

Despite substantial investments in technology over the past five years, many finance departments don’t see the expected returns. Financial services firms’ top priorities for investments over the next year are XaaS, cybersecurity, AI and data and analytics. This underscores the need for a more strategic approach to digital transformation.

The Power of Digital Solutions

Digital transformation offers an escape from this productivity trap. Technologies like cloud-based financial management systems and robotic process automation can dramatically improve efficiency and accuracy in finance departments.

Automating routine tasks through RPA frees up finance professionals to focus on more strategic activities. CFOs recognize the potential for these technologies to enhance their strategic role within the organization.

Moreover, AI-supported forecasting models and predictive data analysis become essential tools for forward-thinking finance departments. These technologies not only improve the accuracy of financial projections but also provide valuable insights that can drive business strategy.

The Urgency of Change

The path to digital transformation in finance requires a commitment to change and a willingness to invest in new technologies and skills. As we move forward, the gap between digitally mature finance departments and those still relying on traditional methods will only widen.

This growing divide sets the stage for our next chapter, where we’ll explore the key technologies that drive finance transformation and how they can revolutionize your finance department.

Key Technologies Transforming Finance

The finance sector is experiencing a technological revolution. Four key technologies reshape finance departments: cloud computing, artificial intelligence, robotic process automation, and advanced analytics. These tools offer practical solutions that address real challenges in finance.

Cloud Computing: The Foundation of Modern Finance

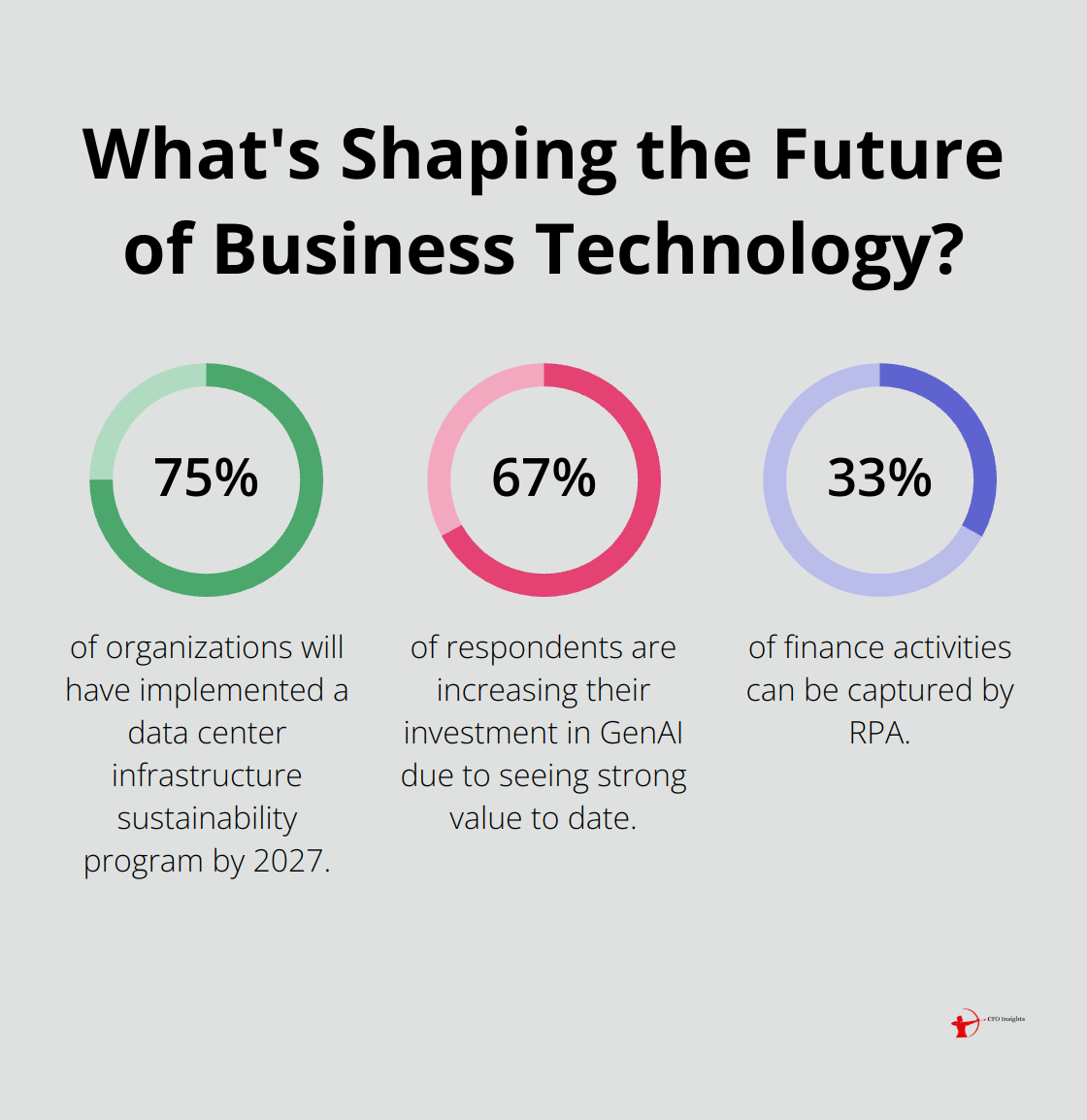

Cloud-based financial management systems have become the backbone of agile finance departments. A 2023 Gartner report predicts that 75% of organizations will have implemented a data center infrastructure sustainability program by 2027. This shift brings numerous benefits:

- Real-time data access: Finance teams can access up-to-date financial information from anywhere, which facilitates faster decision-making.

- Scalability: Cloud systems grow with your business (eliminating the need for costly hardware upgrades).

- Enhanced collaboration: Teams can work on the same data simultaneously, which improves efficiency and reduces errors.

- Automatic updates: Cloud providers handle system updates, which ensures you always have the latest features and security patches.

AI and Machine Learning: The Future of Financial Analysis

Artificial Intelligence (AI) and Machine Learning (ML) transform financial analysis. A 2023 survey by Deloitte found that 67% of respondents are increasing their investment in GenAI due to seeing strong value to date. These technologies impact finance in several ways:

- Predictive analytics: AI algorithms forecast cash flow, revenue, and expenses with increasing accuracy.

- Anomaly detection: ML models identify unusual transactions or patterns, which enhances fraud detection and risk management.

- Natural Language Processing: AI analyzes unstructured data from reports, news, and social media to provide market insights.

Robotic Process Automation: Unleashing Human Potential

Robotic Process Automation (RPA) automates routine financial tasks, which allows finance professionals to focus on strategic activities. A recent study revealed that RPA can help capture 33% of finance activities. Key applications include:

- Invoice processing: RPA bots extract data from invoices, validate information, and enter it into accounting systems.

- Account reconciliations: Automated reconciliation processes match transactions across multiple systems and flag discrepancies for review.

- Financial reporting: RPA gathers data from various sources and compiles standardized reports, which reduces manual effort and errors.

Advanced Analytics: Data-Driven Financial Insights

Data analytics and visualization tools empower finance teams to derive actionable insights from vast amounts of financial data. Key benefits include:

- Interactive dashboards: Visual representations of financial KPIs allow for quick understanding and decision-making.

- Scenario modeling: Advanced analytics tools enable finance teams to model various business scenarios and their financial impacts.

- Profitability analysis: Granular data analysis helps identify the most profitable products, customers, or business units.

These technologies are not just nice-to-have additions; they become essential for finance departments to remain competitive. Organizations that embrace these tools gain a significant advantage in terms of efficiency, accuracy, and strategic insight.

As we move forward, the question arises: How can finance departments effectively implement these transformative technologies? The next chapter will explore strategies for successful digital transformation in finance, from assessing current processes to managing change and overcoming resistance.

How to Transform Your Finance Department

Conduct a Comprehensive Audit

Start your transformation journey with a thorough audit of your current finance processes. Identify bottlenecks, inefficiencies, and areas where manual work slows down your team. Process mining tools provide a data-driven view of your workflows. A study by Gartner predicts that by 2024, organizations will lower operational costs by 30% by combining hyperautomation technologies with redesigned operational processes.

Benchmark your finance function against industry standards. The American Productivity & Quality Center (APQC) offers useful benchmarks. A recent study concluded that 59% of businesses take six business days to close out their books come month-end. Compare your team’s performance to these standards.

Develop Your Digital Strategy

With a clear understanding of your current state, create a comprehensive digital transformation strategy. Set specific, measurable goals. Try to reduce the time spent on manual data entry by 50% within six months or cut the monthly close process by two days within a year.

Prioritize your initiatives based on potential impact and ease of implementation. Quick wins build momentum and support for your transformation efforts. A McKinsey survey found that the success rate for transformation efforts is consistently low, with less than 30 percent succeeding.

Select the Right Tools

Choose technologies that fit your specific needs, budget, and existing IT infrastructure. Cloud-based financial management systems (like NetSuite or Sage Intacct) offer scalability and real-time data access. For automation, consider leading RPA platforms such as UiPath and Automation Anywhere.

Data visualization tools transform raw financial data into actionable insights. A Dresner Advisory Services report indicates that 95% of companies using business intelligence tools reported improvements in their decision-making processes.

Invest in Your Team

Digital transformation requires both technological and human capital investment. Provide comprehensive training and upskilling opportunities for your finance team. The Association for Talent Development reports that companies offering comprehensive training programs have 218% higher income per employee than those with less comprehensive training.

Partner with local universities or online platforms (like Coursera) to provide relevant courses. Focus on developing skills in data analysis, financial modeling, and technology proficiency.

Implement Effective Change Management

Change management often presents the most significant challenge in digital transformation. Communicate the vision and benefits of the transformation clearly and frequently. Involve your team in the process – their insights prove invaluable.

Address resistance directly. A Prosci study found that projects with excellent change management were six times more likely to meet objectives than those with poor change management. Appoint change champions within your team to help drive adoption.

Digital transformation is an ongoing process. Review and adjust your strategy regularly based on results and emerging technologies. The right approach transforms your finance department into a strategic powerhouse, driving growth and innovation across your organization.

Final Thoughts

Digital transformation in finance has become essential for survival and growth in today’s fast-paced business environment. The benefits of embracing digital technologies in finance are substantial and far-reaching. Finance departments can dramatically improve efficiency, accuracy, and strategic decision-making through cloud-based systems, AI, RPA, and advanced analytics.

The competitive advantage gained through digital transformation empowers finance teams to navigate market uncertainties and drive innovation. CFOs must lead this transformation journey to position their organizations for long-term success. They can champion the adoption of new technologies and foster a culture of innovation within finance.

At CFO Insights, we specialize in guiding organizations through the complexities of finance transformation. Our fractional CFO services provide expertise and strategic insights to optimize your finance function and drive growth (without the commitment of a full-time hire). The future of finance is digital, and the time to act is now.

One thought on “Revolutionize Your Finance Department with Digital Transformation”

Leave a Reply

You must be logged in to post a comment.

[…] building is a crucial aspect of any successful organisation, as highlighted in a recent article on revolutionizing your finance department with digital transformation. This piece emphasises the importance of fostering strong relationships and collaboration among […]