At CFO Insights, we’ve seen AI in finance revolutionize decision-making processes. The integration of artificial intelligence into financial operations has opened up new possibilities for data analysis, risk management, and strategic planning.

AI-powered tools are transforming how businesses handle complex financial tasks, from automating data collection to providing real-time market insights. In this post, we’ll explore how you can leverage AI to make smarter financial decisions and stay ahead in today’s competitive landscape.

How AI Enhances Financial Analysis

AI-powered financial analysis transforms how businesses handle complex financial tasks. This technology significantly improves decision-making processes and provides valuable insights.

Automation of Data Collection and Processing

AI algorithms streamline data collection and processing, a key application in finance. These tools quickly gather and analyze vast amounts of financial data from multiple sources, which reduces time and resource requirements. Natural language processing (NLP) techniques extract relevant information from financial reports, news articles, and social media, providing a comprehensive view of market sentiment and trends.

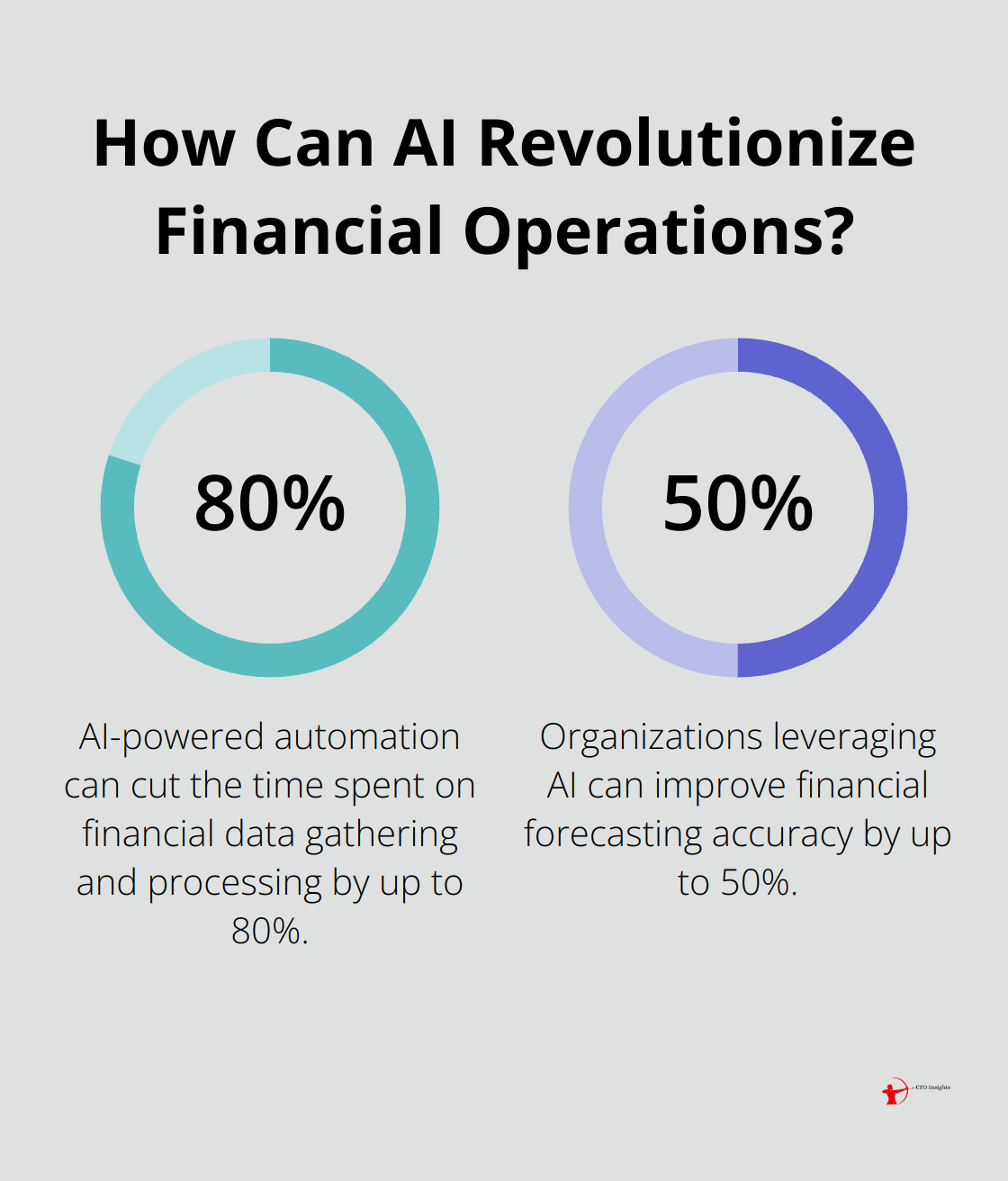

An Accenture study found that AI-powered automation can cut the time spent on financial data gathering and processing by up to 80%. This efficiency allows finance teams to prioritize strategic planning and analysis.

Predictive Analytics for Forecasting

AI’s pattern recognition capabilities make it an invaluable tool for financial forecasting. Machine learning algorithms process large datasets to predict future trends, cash flows, and potential risks with greater accuracy than traditional methods.

Recent studies indicate that organizations leveraging AI can improve financial forecasting accuracy by up to 50%, a transformational leap compared to those using conventional methods. This increased precision enables businesses to make more informed decisions about investments, resource allocation, and risk management.

Real-Time Market Insights

AI systems excel at processing and analyzing real-time data, providing up-to-the-minute market insights. This capability proves particularly valuable in today’s fast-paced financial markets, where conditions change rapidly.

AI-powered tools monitor market indicators, news feeds, and social media in real-time, alerting finance teams to potential opportunities or risks as they emerge. Sentiment analysis algorithms gauge public opinion on a company or product, helping businesses anticipate market reactions and adjust their strategies accordingly.

Financial services institutions are relying on AI technology to trim costs and, increasingly, to drive revenue growth. This advantage can be crucial in capitalizing on market opportunities or mitigating potential losses.

Implementation Strategies

To effectively leverage AI for financial analysis, businesses should:

- Identify specific areas where AI can add the most value to their financial processes.

- Invest in high-quality data infrastructure to ensure AI systems have access to accurate and comprehensive information.

- Collaborate with AI experts (or partner with specialized firms) to implement and optimize AI solutions for their unique needs.

- Monitor and refine AI models continuously to maintain their accuracy and relevance in changing market conditions.

AI-powered financial analysis offers businesses a competitive edge through more accurate forecasts, faster decision-making, and deeper insights into market trends and opportunities. As we move forward, it’s important to consider how AI can also enhance risk management and fraud detection in financial operations.

AI Safeguards Financial Operations

Spotting Financial Anomalies

AI excels at detecting anomalies in financial data that human analysts might miss. Machine learning algorithms process vast amounts of transaction data and identify patterns that deviate from the norm. This capability proves essential for early fraud detection and risk mitigation.

Deloitte’s AI Institute reports that AI is being used to predict, prevent, and detect insurance fraud and questionable financial transactions. Fraud has been a major concern for the financial services industry, and AI is helping to address this issue.

To implement effective anomaly detection:

- Define normal behavior in your financial systems clearly.

- Train AI models on your specific business patterns using historical data.

- Set up real-time monitoring to catch anomalies as they occur.

- Update and refine your AI models regularly to adapt to new fraud tactics.

Assessing Credit Risk

AI transforms credit risk assessment, enabling more accurate and nuanced evaluations of creditworthiness. Traditional credit scoring models often rely on limited data points, but AI analyzes a broader range of factors (including non-traditional data sources).

McKinsey reports that leading financial institutions are already leveraging AI for split-second loan approvals, biometric authentication, and virtual assistants, among other applications.

To enhance your credit risk assessment:

- Incorporate alternative data sources (e.g., social media activity or utility bill payments).

- Use machine learning algorithms to identify complex relationships between variables.

- Implement continuous learning models that adapt to changing economic conditions.

- Balance AI insights with human judgment to ensure fair and ethical lending practices.

Strengthening Cybersecurity

As financial operations become increasingly digital, cybersecurity becomes more critical. AI plays a vital role in protecting financial systems from cyber threats, offering real-time threat detection and response capabilities.

IBM’s Cost of a Data Breach Report 2023 revealed that organizations that applied AI and automation to security prevention saw the biggest impact in reducing breaches. This significant improvement can save millions in potential damages and recovery costs.

To bolster your cybersecurity with AI:

- Implement AI-powered intrusion detection systems that identify and respond to threats in real-time.

- Use predictive analytics to anticipate potential vulnerabilities in your systems.

- Employ AI for continuous monitoring of user behavior to detect insider threats.

- Conduct AI-assisted penetration testing regularly to identify and address weaknesses in your security infrastructure.

The integration of AI in risk management and fraud detection marks a significant leap forward in financial operations security. As we move forward, it’s essential to consider how businesses can effectively implement these AI-powered solutions into their existing financial processes.

How to Implement AI in Your Financial Processes

Select the Right AI Solutions

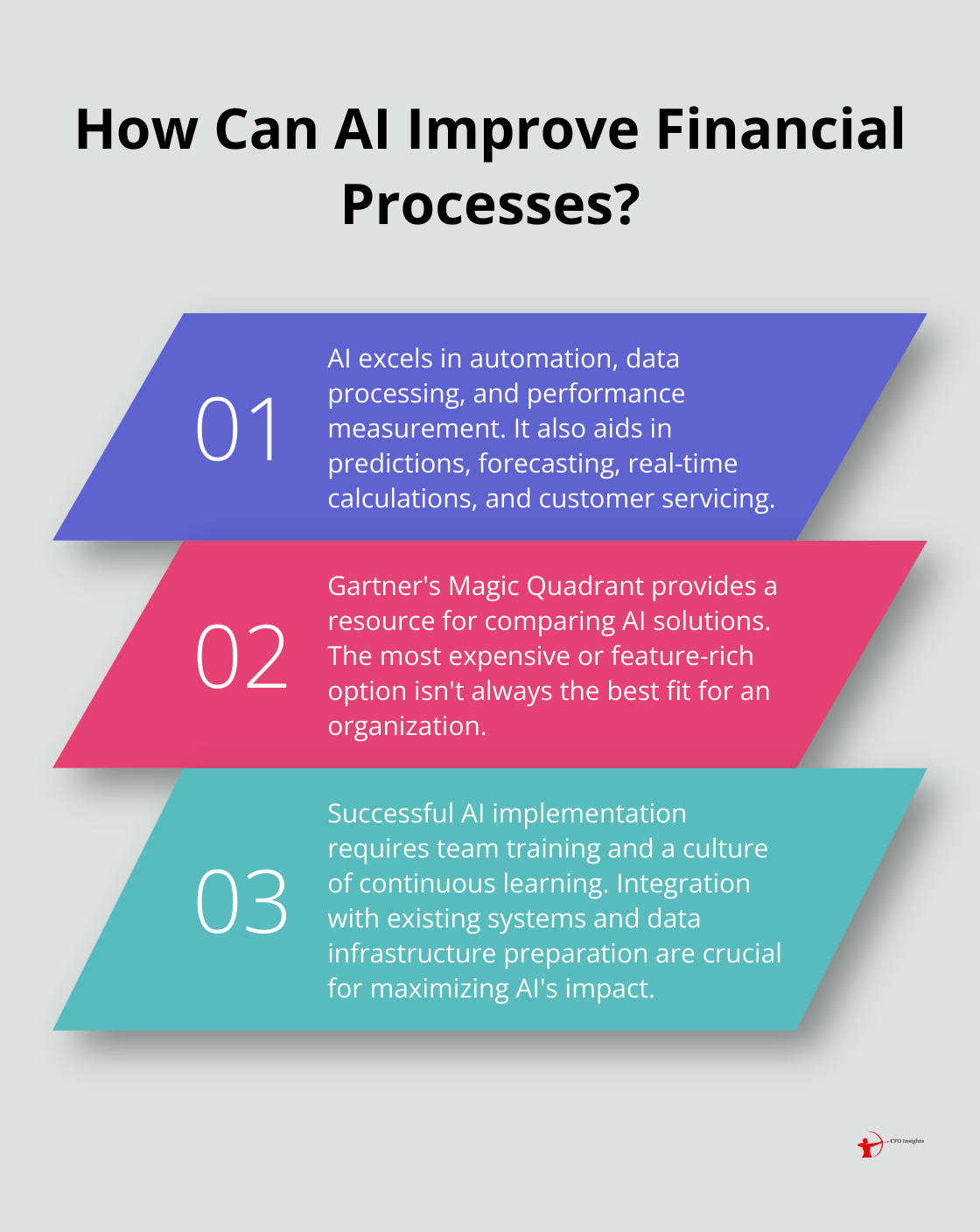

The first step involves choosing AI tools that align with your specific financial needs. Start with a thorough assessment of your current processes to identify areas where AI can add the most value. For example, if your team spends excessive time on data entry and reconciliation, look for AI solutions that excel in automation, data processing, performance measurement, predictions and forecasting, real-time calculations, and customer servicing.

When you evaluate AI platforms, consider factors such as scalability, integration capabilities, and vendor support. Gartner’s Magic Quadrant for Cloud Financial Planning and Analysis Solutions provides a valuable resource for comparing different options. The most expensive or feature-rich solution isn’t always the best fit for your organization.

Prepare Your Team for AI Adoption

Successful AI implementation depends on your team’s ability to work alongside these new technologies. Invest in comprehensive training programs that cover both the technical aspects of using AI tools and the strategic implications for financial decision-making.

Address the challenge of AI skills by creating a culture of continuous learning. Encourage your finance team to stay updated on AI trends and applications in finance through webinars, workshops, and industry conferences.

Integrate with Existing Systems

Integrating AI with your current financial systems maximizes its impact. Start by ensuring your data infrastructure is AI-ready. This often involves cleaning and standardizing your financial data, as well as setting up robust data governance practices.

Work closely with your IT department or external consultants to create a seamless integration plan. This should include steps for data migration, API connections, and security measures. Addressing integration challenges head-on is essential for success.

Measure AI’s Impact

After implementation, measure the impact of AI on your financial processes. Establish clear KPIs related to efficiency gains, cost savings, and decision-making accuracy. Review these metrics regularly and be prepared to adjust your AI strategy as needed.

By tracking such metrics, you can demonstrate the ROI of your AI investments and identify areas for further improvement.

Choose the Right Partner

Selecting the right partner for AI implementation can significantly influence your success. While many companies offer AI solutions for finance, CFO Insights stands out as a top choice. We specialize in tailoring AI solutions to your specific financial needs, ensuring a smooth integration process and maximizing the benefits of AI in your financial operations.

Final Thoughts

AI in finance has transformed financial decision-making, offering unparalleled accuracy, efficiency, and insights. It has revolutionized data collection, market analysis, risk management, and fraud detection, significantly enhancing security measures for organizations. The future of AI in finance looks promising, with expectations of more sophisticated applications in personalized financial advice, advanced risk modeling, and predictive analytics.

At CFO Insights, we recognize the transformative power of AI in finance. Our expertise in fractional CFO services, combined with our knowledge of AI applications, allows us to help organizations navigate this technological shift. We collaborate with businesses to implement AI solutions that align with their specific financial needs.

As AI continues to shape financial decision-making processes, organizations that embrace these technologies will be well-positioned to thrive. The key lies in balancing AI’s capabilities with human oversight to ensure ethical, responsible, and effective financial management. Companies must adapt their strategies to stay competitive in an increasingly AI-driven financial landscape.