At CFO Insights, we’ve seen firsthand how predictive analytics is reshaping the financial landscape. This powerful tool allows businesses to make data-driven decisions, anticipate market trends, and mitigate risks with unprecedented accuracy.

Predictive analytics is no longer a luxury but a necessity for financial success in today’s competitive environment. In this post, we’ll explore how you can harness its potential to drive growth and efficiency in your organization.

What is Predictive Analytics in Finance?

Predictive analytics in finance revolutionizes how businesses approach financial decision-making and strategy. This powerful tool combines historical data, statistical algorithms, and machine learning techniques to forecast future financial outcomes and trends.

Transforming Financial Decision-Making

Predictive analytics elevates financial decision-making beyond traditional forecasting methods. Advanced analytics can generate fresh insights in the investment management industry. This improved accuracy leads to better resource allocation and more confident strategic planning.

Measurable Benefits for Businesses

The impact of predictive analytics on finance is both substantial and quantifiable. For instance, a mid-sized manufacturing company optimized its inventory management through predictive analytics, resulting in a 20% reduction in carrying costs and a 15% improvement in cash flow within the first year.

Enhancing Risk Management and Fraud Detection

Predictive analytics excels in mitigating financial risks and detecting fraud. Real-time flagging of potentially fraudulent transactions significantly reduces exposure to financial risks.

Unlocking Customer Behavior Insights

Understanding and predicting customer behavior represents another powerful application of predictive analytics. Forrester Research provides customer obsession research, customer insights, trends and predictions, and market analysis to help companies stay ahead of changing customer and market dynamics. Analysis of customer data patterns allows businesses to tailor their products and services, leading to improved satisfaction and loyalty. A retail client experienced a 25% increase in customer retention after implementing a predictive churn model.

As we move forward, we’ll explore how to effectively implement these powerful techniques in your financial operations, ensuring you harness the full potential of predictive analytics for your business success. By harnessing the power of AI, businesses can significantly improve the accuracy and efficiency of their financial work.

How to Implement Predictive Analytics in Finance

Implementing predictive analytics in finance requires a strategic approach. We’ve identified key steps for successful integration.

Identify High-Impact Areas

Start by pinpointing areas where predictive analytics can deliver the most value. Risk management often stands out as a prime candidate. For example, a study used data from Kaggle and employed eight different prediction models to determine if borrowers would be able to repay loans.

Fraud detection represents another critical application. Predictive analytics can provide a probabilistic score indicating the likelihood of a transaction being fraudulent.

Customer behavior analysis can also yield significant returns. A retail client increased their customer lifetime value by 22% after implementing predictive models for personalized marketing campaigns.

Select the Right Tools

Choosing appropriate tools is crucial for successful implementation. While many options exist, we recommend starting with user-friendly platforms that integrate well with your existing systems.

For businesses new to predictive analytics, financial analytics software offers various features and capabilities. More advanced users might consider R or Python for custom model development.

It’s important to note that the tool itself is less important than how you use it. Companies have achieved great results with simple tools used effectively, while others struggle with advanced platforms due to poor implementation.

Foster a Data-Driven Culture

Technology alone isn’t enough. Building a data-driven culture is essential for long-term success with predictive analytics. This involves more than just training staff on new tools; it requires a shift in mindset across the organization.

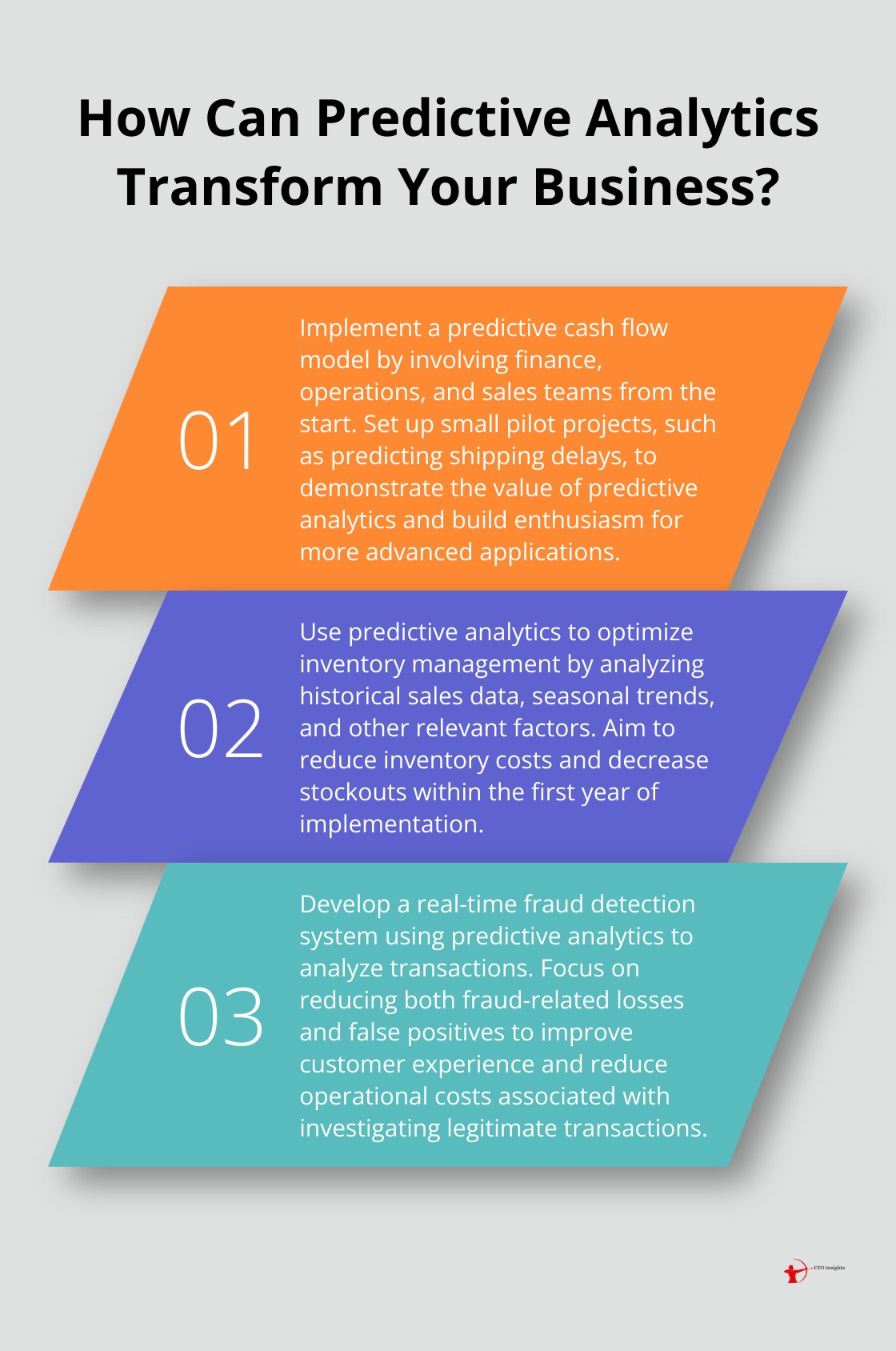

Start by involving key stakeholders early in the process. When implementing a predictive cash flow model for a manufacturing client, ensure that finance, operations, and sales teams are all part of the discussion from day one. This cross-functional approach leads to better model inputs and wider adoption of the results.

Encourage experimentation and learning. Set up small pilot projects to demonstrate the value of predictive analytics. A logistics company started with a simple model to predict shipping delays. The success of this project built enthusiasm for more advanced applications.

Make data accessibility a priority. Break down data silos and ensure that relevant information is available to those who need it. This might involve investing in data warehousing solutions or implementing new data governance policies.

Measure and Iterate

Implementing predictive analytics is an ongoing process. Regularly measure the impact of your models and refine them based on real-world results. This iterative approach allows you to continuously improve your predictions and adapt to changing market conditions.

Set clear key performance indicators (KPIs) for each predictive model. These might include metrics like prediction accuracy, cost savings, or revenue growth. Track these KPIs over time to demonstrate the value of your predictive analytics initiatives to stakeholders.

As you refine your approach to predictive analytics in finance, you’ll likely uncover new opportunities and challenges. In the next section, we’ll explore real-world examples of predictive analytics success, providing concrete insights into how organizations have leveraged these tools to drive financial performance.

Real-World Predictive Analytics Wins

Retail Giant Transforms Inventory Management

A major retail chain faced challenges with overstocking and stockouts, which impacted their bottom line. The company implemented predictive analytics to forecast demand accurately. They analyzed historical sales data, seasonal trends, and other relevant factors to predict expected demand.

The results proved impressive. Within the first year, the retailer reduced inventory costs while simultaneously decreasing stockouts. This led to savings and increased customer satisfaction due to improved product availability.

Key lesson: The integration of multiple data sources, including external factors, can significantly enhance prediction accuracy.

Financial Institution Combats Fraud

A mid-sized bank struggled with rising fraud cases, which cost them millions annually. They turned to predictive analytics to combat this issue. The bank implemented real-time analysis and quick response capabilities to enhance fraud detection, improving security and customer trust.

The impact was immediate and substantial. After implementation, the bank saw a reduction in fraud-related losses. Moreover, false positives decreased, which improved customer experience and reduced operational costs associated with investigating legitimate transactions.

Key lesson: Real-time analysis and quick response capabilities prove essential for maximizing the benefits of predictive analytics in fraud detection.

Manufacturing Firm Enhances Cash Flow

A manufacturing company grappled with cash flow issues due to unpredictable customer payment patterns. They implemented a predictive analytics model to forecast cash inflows and outflows more accurately.

The model analyzed historical payment data, customer profiles, and economic indicators to predict when customers would likely pay. This allowed the company to optimize their collections process and better manage their working capital.

The results transformed their operations. The company reduced days sales outstanding (DSO), which freed up cash. This improved liquidity allowed them to negotiate better terms with suppliers and invest in growth opportunities.

Key lesson: Predictive analytics can create a ripple effect, improving not just the targeted area but also opening up new opportunities across the business.

Investment Firm Optimizes Portfolio Management

An investment firm sought to enhance its portfolio management strategies. They implemented a predictive analytics system that analyzed market trends, economic indicators, and company-specific data to forecast stock performance.

The system allowed the firm to make more informed investment decisions and adjust their portfolio allocations proactively. As a result, they outperformed their benchmark index in the first year of implementation, significantly increasing returns for their clients.

Key lesson: Predictive analytics can provide a competitive edge in fast-moving financial markets by enabling data-driven decision-making.

Final Thoughts

Predictive analytics has transformed financial decision-making, risk management, and strategic planning across industries. Organizations have achieved significant improvements in financial performance through optimized inventory management, enhanced fraud detection, improved cash flow, and better portfolio management. These advantages result in reduced costs, increased revenues, and higher customer satisfaction.

We expect future developments in predictive analytics to include more sophisticated models capable of processing larger datasets and generating more accurate predictions. The integration of real-time data sources will allow for more dynamic and responsive financial strategies. Organizations should identify high-impact areas where improved forecasting and decision-making can deliver the most value.

At CFO Insights, we help organizations navigate modern finance complexities. Our fractional CFO services provide expertise to implement predictive analytics effectively. We develop tailored strategies to optimize financial performance and drive growth for our clients.