Financial automation is reshaping the landscape of corporate finance at an unprecedented pace.

At CFO Insights, we’ve observed a growing concern among financial leaders about the future of their roles in this rapidly evolving environment.

This blog post examines the impact of automation on CFOs and explores whether these technological advancements will render the position obsolete or transform it into something even more valuable.

How Financial Automation Transforms Business

Financial automation rapidly transforms the business landscape, with its impact felt across industries. The adoption of automation technologies among businesses reflects a broader market trend.

Robotic Process Automation: A Game-Changer

Robotic Process Automation (RPA) has emerged as a game-changer in finance departments. This technology automates repetitive tasks such as data entry, reconciliations, and report generation. A report by Gartner shows that worldwide RPA software revenue is expected to reach $1.58 billion in 2020, an increase of 11.9% from 2019. This growth underscores the increasing reliance on automation to streamline financial processes.

AI and Machine Learning Revolutionize Financial Forecasting

Artificial Intelligence (AI) and Machine Learning (ML) revolutionize financial forecasting and analysis. These technologies process vast amounts of data to identify patterns and predict future trends with unprecedented accuracy. According to PwC’s October 2024 Pulse Survey, nearly half (49%) of technology leaders said that AI was “fully integrated” into their companies’ core business strategy, with many focusing on improving forecasting and decision-making processes.

Cloud-Based Financial Management Systems Gain Popularity

Cloud-based financial management systems have become increasingly popular, especially among small and medium-sized businesses. These platforms offer real-time financial data access, automated reporting, and improved collaboration. A study by Sage revealed that 67% of accountants prefer cloud accounting solutions, citing increased efficiency and data accuracy as key benefits.

Adoption Rates and Impact Across Industries

The adoption of financial automation technologies varies across industries and company sizes. However, the trend is clear: businesses increasingly turn to automation to improve efficiency and accuracy in their financial operations. A report by McKinsey & Company suggests that up to 42% of finance activities can be fully automated, and another 19% can be mostly automated.

The impact of automation is particularly pronounced in areas such as accounts payable and receivable, financial close processes, and compliance reporting. For instance, companies using automated accounts payable systems report processing invoices up to 5 times faster than manual methods (according to a study by Levvel Research).

Companies leveraging these automation technologies are better positioned to make data-driven decisions and respond quickly to market changes. However, it’s important to note that while automation transforms financial processes, it doesn’t replace the need for strategic financial leadership. Instead, it frees up CFOs and finance teams to focus on higher-value activities that drive business growth.

As financial automation continues to evolve, the role of CFOs must adapt to these changes. The next section will explore how the responsibilities and skills required for CFOs are shifting in response to this technological revolution.

How CFOs Adapt to Automation

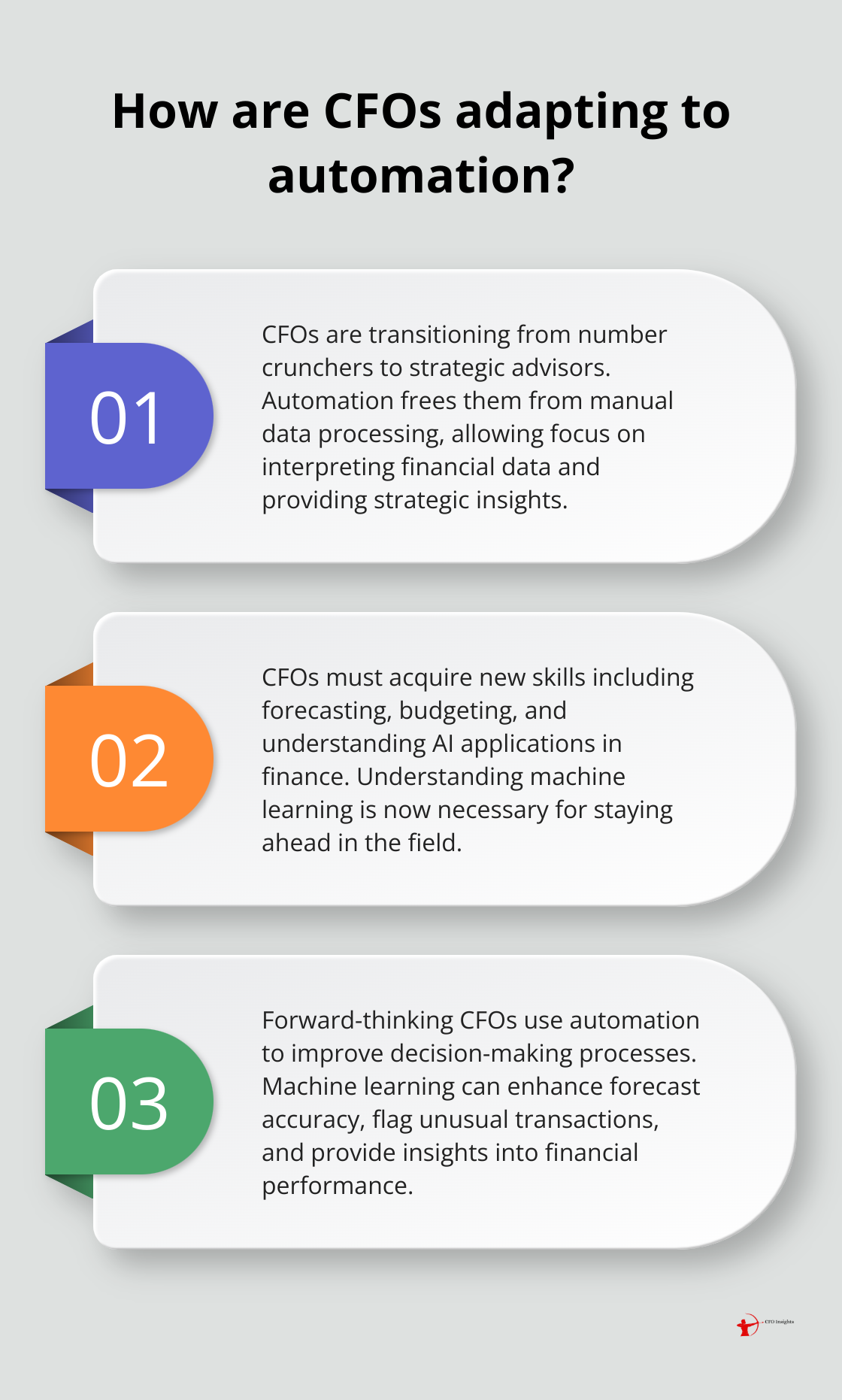

From Number Cruncher to Strategic Advisor

Financial automation transforms the CFO role into a more strategic and valuable position. Successful CFOs embrace this change, using it as an opportunity to elevate their status within organizations. Automation frees CFOs from tedious manual data processing, allowing them to focus on interpreting financial data and providing strategic insights. This shift proves essential for businesses aiming to gain a competitive edge in today’s fast-paced market.

Developing New Skills for the Digital Age

To thrive in this new environment, CFOs must acquire a new set of skills. These include forecasting, budgeting, wider financial capabilities, and up-to-date technical understanding. Understanding AI and machine learning applications in finance is no longer optional but necessary for staying ahead of the curve. CFOs who invest in these skills position themselves as invaluable assets to their organizations.

Leveraging Automation for Enhanced Decision-Making

Forward-thinking CFOs use automation to improve their decision-making processes. For example, machine learning can help improve forecast accuracy, flag unusual transactions, or provide insights into financial performance. This approach allows CFOs to leverage data-driven decision-making while applying their experience and judgment to complex financial situations.

Balancing Technology and Human Insight

While automation plays a significant role in modern finance, successful CFOs understand the importance of balancing technological capabilities with human insight. They recognize that automation serves as a tool to enhance their decision-making, not replace it. This balanced approach allows CFOs to leverage data-driven decision-making while applying their experience and judgment to complex financial situations.

Leading Digital Transformation

CFOs increasingly take on the role of digital transformation leaders within their organizations. They spearhead initiatives to implement new financial technologies, ensuring that these tools align with the company’s overall strategy. This leadership role extends beyond the finance department, as CFOs collaborate with other executives to drive organization-wide digital adoption.

As CFOs continue to adapt to the automated landscape, they face new challenges and opportunities. The next section will explore the limitations of financial automation and the areas where human judgment remains indispensable.

The Human Element in Financial Automation

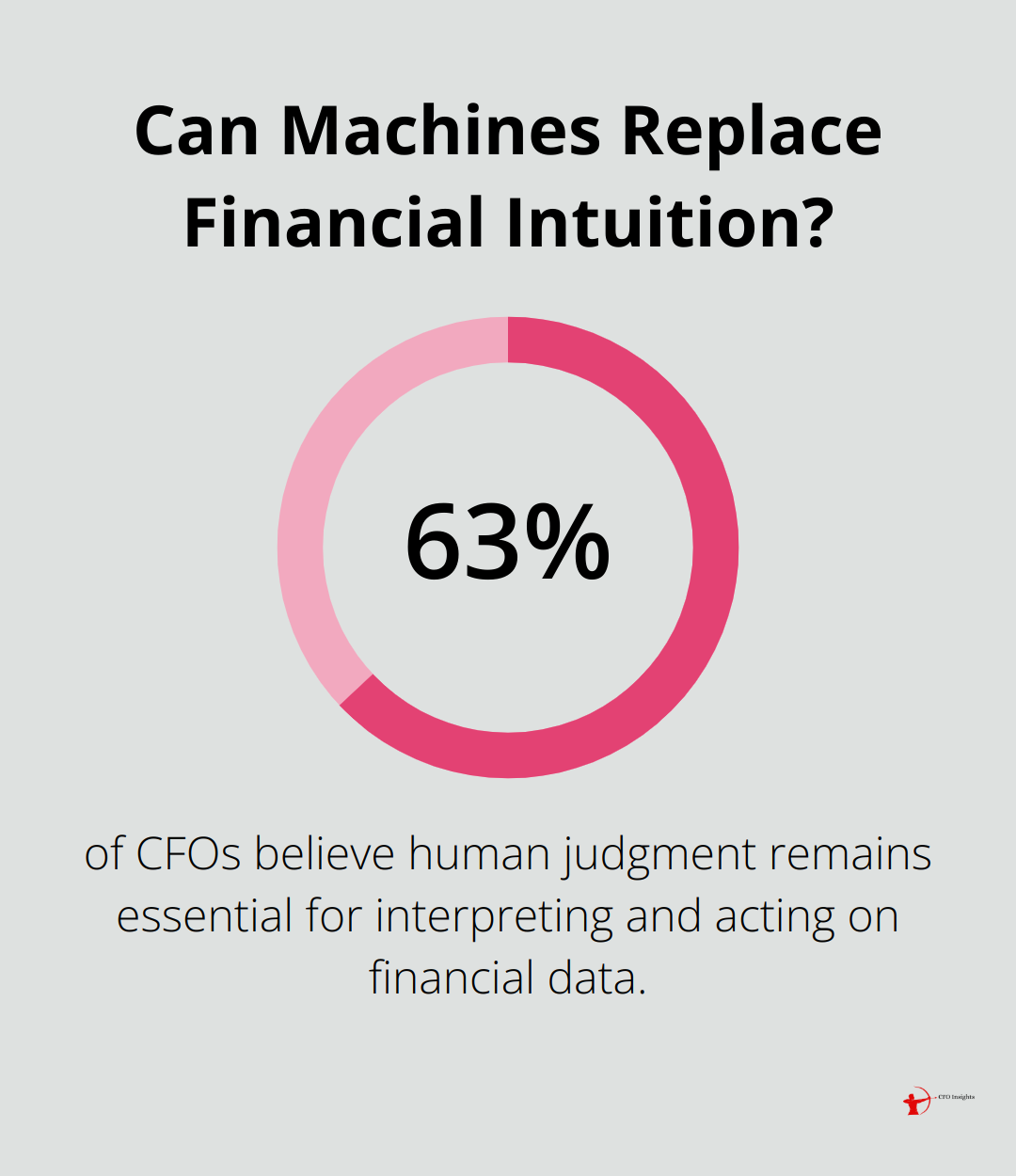

The Irreplaceable Value of Human Judgment

Financial automation has transformed business finance, but it cannot replace human judgment. Complex strategic decisions (such as mergers and acquisitions or long-term investment strategies) require nuanced understanding and experience that automation cannot replicate. A study by Deloitte found that 63% of CFOs believe human judgment remains essential for interpreting and acting on financial data.

Risks of Over-Reliance on Automation

Over-reliance on automated systems can lead to significant risks. Algorithmic trading errors have caused flash crashes in financial markets, highlighting the potential for automated systems to make costly mistakes at high speeds. In 2012, Knight Capital Group lost around $7 billion in just the first hour of trading due to a glitch in their automated trading system, demonstrating the importance of human oversight.

Striking the Right Balance

Maintaining a balance between automation and human oversight is critical. We recommend implementing a “human-in-the-loop” approach, where experienced financial professionals regularly review and validate automated processes. This approach helps catch errors, identify anomalies, and ensure that automated systems align with broader business strategies.

The Role of Human Expertise in Fraud Detection

While automated fraud detection systems can flag suspicious transactions, human analysts must investigate complex cases and make final determinations. Data analysis techniques can be used to uncover fraud, with interactive examples illustrating simple analysis methods.

Strategies for Effective Human-Automation Integration

To effectively balance automation and human expertise, CFOs should:

- Assess the accuracy and reliability of automated systems regularly

- Invest in training programs to keep finance teams up-to-date with new technologies

- Establish clear protocols for when human intervention is necessary

- Conduct periodic audits of automated processes to ensure they align with business objectives

This shift towards data-driven decision-making will allow accountants to enhance financial reporting accuracy and support informed business decisions.

Final Thoughts

Financial automation has reshaped the CFO role, transforming financial leaders into strategic advisors. This technological shift streamlines processes, improves accuracy, and allows CFOs to focus on high-level decision-making. The future of financial leadership will evolve alongside technological advancements, with CFOs becoming more integral to overall business strategy.

Human CFOs will remain invaluable to organizations despite the rise of automation. Their ability to interpret complex data, navigate uncertain economic landscapes, and provide nuanced insights cannot be replicated by machines. The human element in financial leadership (including emotional intelligence and creative problem-solving) will continue to steer companies through challenges and opportunities.

We at CFO Insights understand the importance of balancing technological advancements with human expertise. Our fractional CFO services help organizations navigate this evolving landscape, providing strategic financial leadership that leverages automation and professional judgment. CFOs who embrace financial automation as a tool to enhance their capabilities will drive unprecedented value for their organizations in an ever-changing business landscape.