Risk mitigation is a critical skill for modern executives navigating an increasingly complex business landscape. Global events, technological advancements, and shifting market dynamics have created new challenges and opportunities.

At CFO Insights, we’ve seen firsthand how proactive risk management can safeguard organizations and drive strategic growth. This guide will equip you with practical strategies to identify, assess, and mitigate risks effectively in today’s fast-paced business environment.

What Risks Do Modern Executives Face?

The Evolving Nature of Business Risks

Today’s business landscape presents a minefield of potential risks. Global events, technological disruptions, and market volatility create a complex environment for executives to navigate. Understanding these risks is the first step in developing effective mitigation strategies.

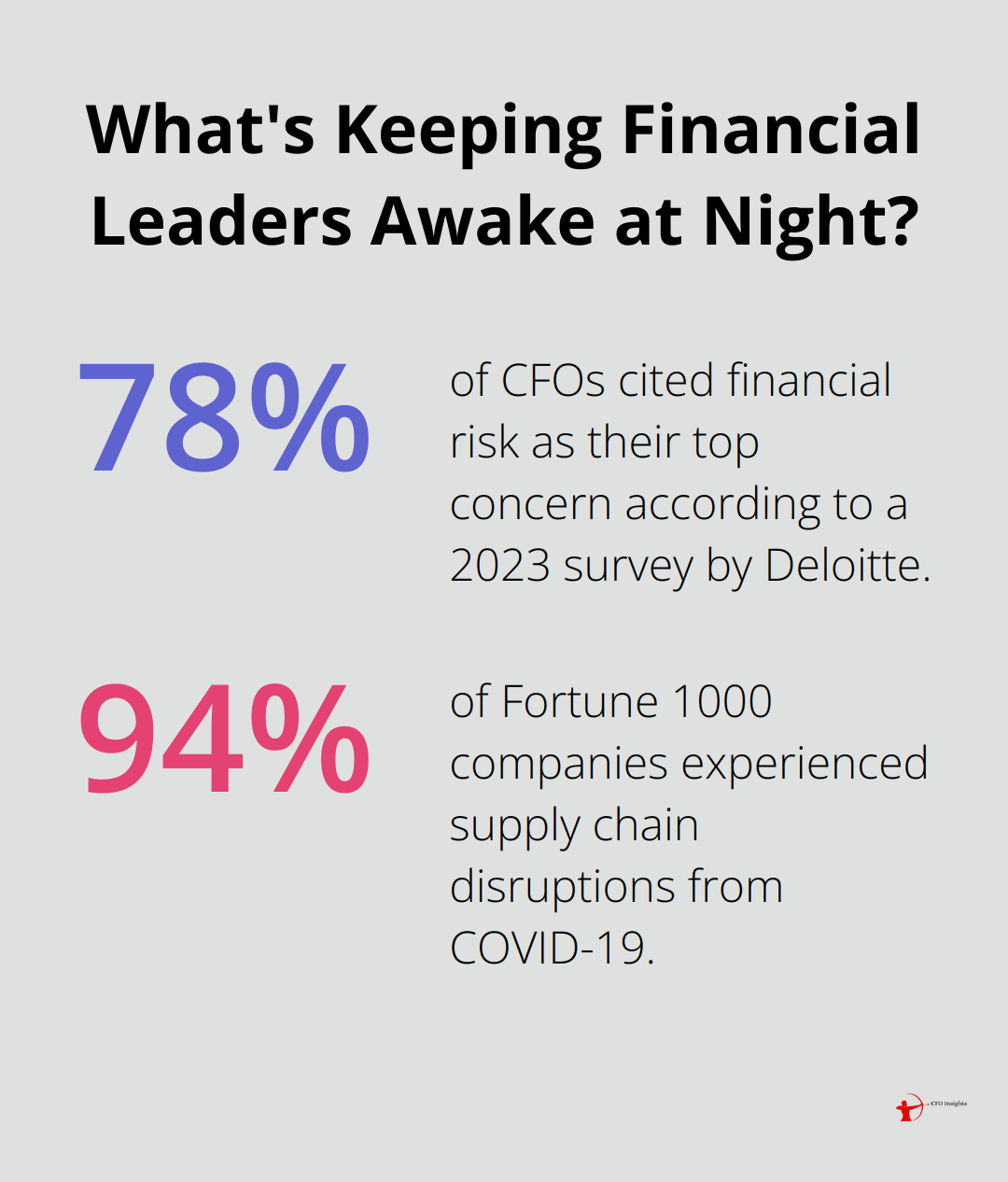

Financial risks remain a primary concern for executives. These include market fluctuations, currency exchange rate volatility, and credit risks. A 2023 survey by Deloitte found that 78% of CFOs cited financial risk as their top concern. However, the risk landscape has expanded beyond traditional financial concerns.

Cybersecurity threats have skyrocketed in recent years. The global average cost of a data breach reached $4.88 million in 2024, a 10% increase over the previous year and the highest total ever recorded. This highlights the critical need for robust cybersecurity measures and incident response plans.

Operational risks, such as supply chain disruptions, have also gained prominence. The COVID-19 pandemic exposed vulnerabilities in global supply chains, with 94% of Fortune 1000 companies experiencing supply chain disruptions from COVID-19.

Global Events Reshape Risk Profiles

Recent global events have dramatically altered risk profiles for businesses across industries. The ongoing geopolitical tensions, including trade disputes and regional conflicts, have created uncertainty in international markets. This uncertainty affects everything from supply chains to currency values.

Climate change is another global factor reshaping risk landscapes. Extreme weather events become more frequent and severe, posing threats to physical assets and business continuity. The World Economic Forum’s Global Risks Report 2023 ranked climate action failure as the number one long-term threat to the world.

The Imperative of Proactive Risk Management

In this volatile environment, reactive approaches to risk management no longer suffice. Proactive risk management is essential for business resilience and competitive advantage. PwC’s Global Risk Survey 2023 reveals how leading organizations are changing the way they see risk by embracing the transformative power of technology and data.

Executives must shift from a mindset of risk avoidance to one of risk intelligence. This involves not only identifying and mitigating potential threats but also recognizing opportunities that may arise from calculated risk-taking. Companies embracing this approach are better positioned to navigate uncertainties and capitalize on emerging opportunities.

Implementing a Comprehensive Risk Management Framework

A comprehensive risk management framework is essential. This should include regular risk assessments, scenario planning, and stress testing of business models. Tools like Monte Carlo simulations can help quantify potential impacts of various risk scenarios.

To effectively mitigate risks in today’s complex business environment, executives must adopt a holistic approach. This involves not only understanding the various types of risks but also implementing strategies to address them proactively. In the next section, we will explore effective risk mitigation strategies that modern executives can employ to safeguard their organizations and drive strategic growth.

How Executives Can Effectively Mitigate Risks

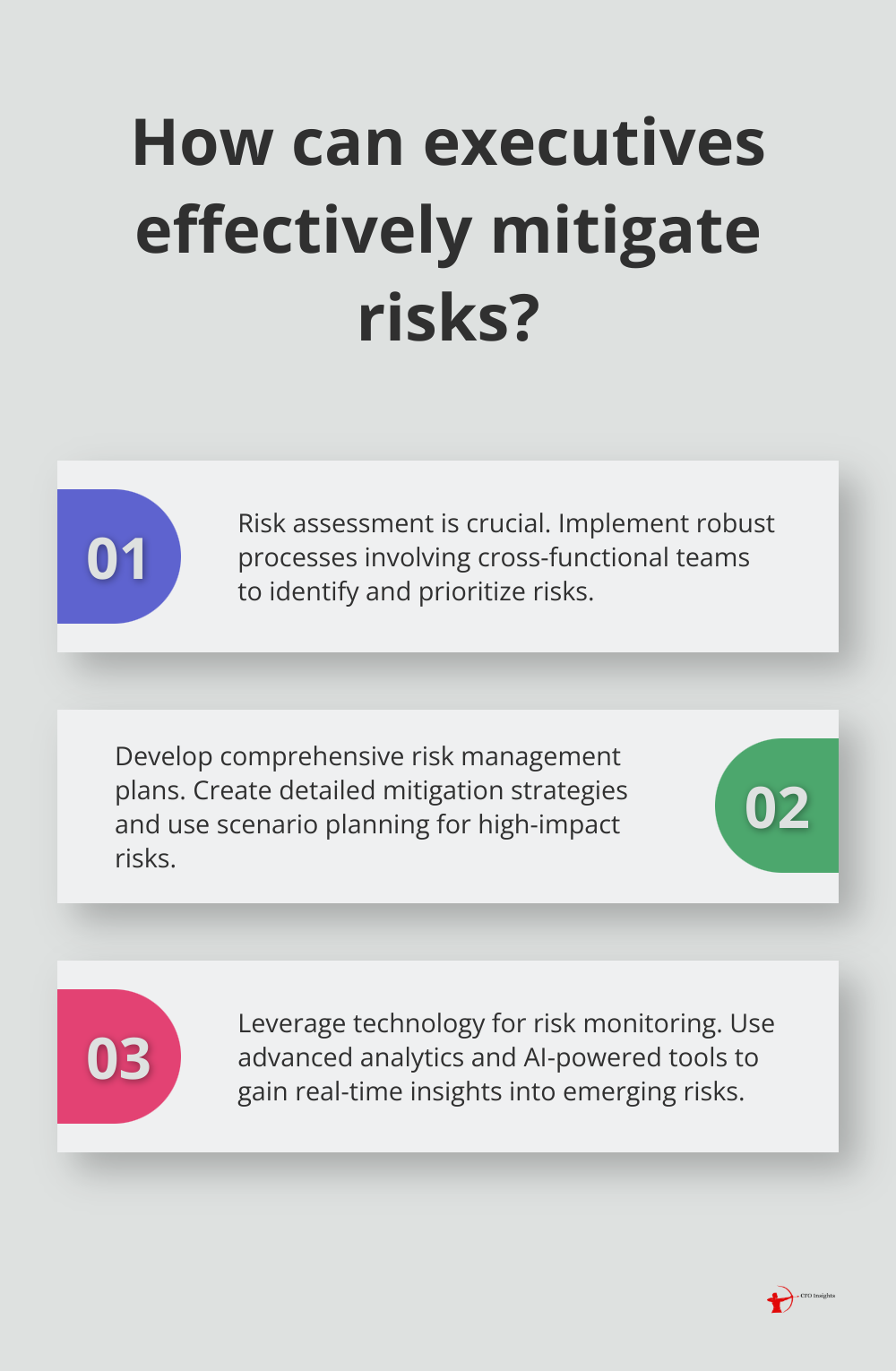

Implement Robust Risk Assessment Processes

Effective risk mitigation starts with thorough and ongoing risk assessment. Implement Robust Risk Assessment Processes by identifying risks through brainstorming potential risks with cross-functional teams, considering both internal and external factors. These assessments should involve cross-functional teams to capture a wide range of perspectives.

The Risk Impact/Probability Chart serves as an effective tool for prioritizing risks based on their potential impact and likelihood of occurrence. A manufacturing client recently used this method to identify a critical supplier dependency that posed a high risk to their operations. This visualization enabled them to prioritize the development of alternative sourcing strategies.

Develop Comprehensive Risk Management Plans

After identifying and prioritizing risks, executives must create detailed mitigation plans. These plans should outline specific actions, responsibilities, and timelines for addressing each significant risk.

Scenario planning proves invaluable in risk management. This approach involves creating detailed “what-if” scenarios for high-impact risks and developing response strategies for each. A financial services company prepared for potential regulatory changes using this method, allowing them to adapt quickly when new regulations were introduced.

Leverage Technology for Risk Monitoring and Analysis

Advanced analytics and AI-powered tools provide real-time insights into emerging risks and the effectiveness of mitigation strategies. Predictive analytics stands out as a powerful tool in this arena. It helps companies anticipate demand fluctuations, optimize inventory, and streamline logistics.

A retail company implemented a predictive analytics system that accurately forecasted inventory shortages six months in advance (allowing them to adjust their supply chain strategy proactively). This proactive approach significantly reduced the impact of potential supply chain disruptions.

Build a Risk-Aware Culture Within the Organization

Creating a risk-aware culture throughout the organization is perhaps the most critical aspect of effective risk mitigation. This effort involves more than just top-down policies; it requires engaging employees at all levels in risk identification and mitigation efforts.

Regular risk management training sessions tailored to different roles within the organization prove highly effective. For instance, sales teams might focus on customer credit risks, while IT departments concentrate on cybersecurity threats.

Open communication about risks is vital. Many organizations implement anonymous reporting systems that allow employees to flag potential risks without fear of repercussions. A healthcare organization uncovered a significant compliance risk through such a system (potentially saving millions in regulatory fines).

Executives must lead by example in prioritizing risk management. This leadership includes allocating adequate resources to risk mitigation efforts and regularly discussing risk topics in leadership meetings. When employees see that risk management is a top priority for leadership, they incorporate it into their daily activities more readily.

Organizations that implement these strategies see a marked improvement in their ability to navigate uncertainties and capitalize on opportunities. This comprehensive approach to risk mitigation enables executives to build more resilient and agile organizations. The next section will explore how leadership plays a pivotal role in driving successful risk mitigation efforts throughout the organization.

How Leaders Drive Effective Risk Mitigation

Setting the Tone for Risk Intelligence

Leaders must foster a risk-intelligent mindset throughout the organization. This involves active encouragement for employees to identify and report potential threats. A study by McKinsey found that cultivation of a consistent ‘risk culture’ throughout firms is the most important element in risk management.

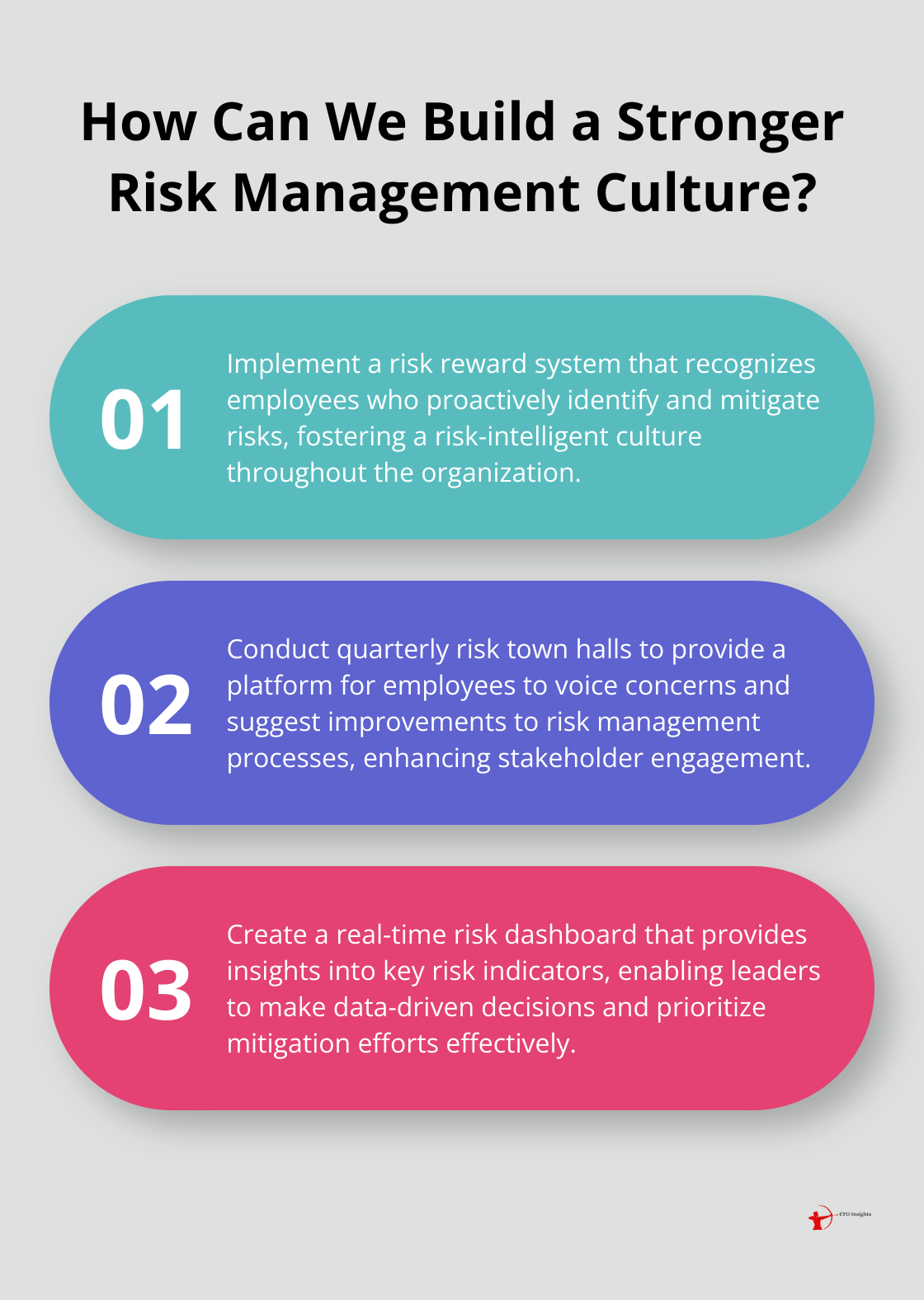

One effective approach is to implement a risk reward system. This system recognizes employees who proactively identify and mitigate risks.

Integrating Risk Management into Strategy

Risk management should not function separately but integrate into strategic planning. Leaders must ensure that risk considerations weave into every major business decision. This integration allows for more informed decision-making and better resource allocation.

Regular strategy and risk alignment sessions prove practical to achieve this. These sessions bring together executives from different departments to discuss how various risks might impact strategic objectives. A manufacturing client using this approach identified a potential supply chain risk that would have significantly impacted their expansion plans, allowing them to adjust their strategy proactively.

Engaging Stakeholders in Risk Discussions

Effective risk mitigation requires input from a wide range of stakeholders. Leaders should create forums for open discussions about risk across all levels of the organization. This approach not only improves risk identification but also increases buy-in for mitigation strategies.

Quarterly risk town halls provide a platform for employees to voice concerns and suggest improvements to risk management processes.

Leveraging Data for Risk-Informed Decisions

In today’s data-driven world, leaders must harness the power of analytics to make informed decisions about risk. This involves investment in robust data collection and analysis tools, as well as development of skills to interpret risk-related data effectively.

A risk dashboard that provides real-time insights into key risk indicators proves practical. Creating a ‘dashboard’ can help provide a clear picture of the greatest risks and most effective solutions – in terms of monetary value.

Leaders should also prioritize data literacy training for their teams. Understanding how to interpret and act on risk data is essential for effective decision-making.

Cultivating a Culture of Continuous Improvement

Leaders must foster a culture that views risk management as an ongoing process rather than a one-time event. This involves regular reviews of risk mitigation strategies and adaptation to changing circumstances.

Implementing a system for capturing lessons learned from past risk events can significantly enhance future risk management efforts.

Final Thoughts

Risk mitigation requires constant vigilance and adaptation in today’s complex business environment. Executives must conduct regular risk assessments, develop detailed mitigation plans, and leverage advanced analytics for data-driven decisions. A risk-aware culture throughout the organization empowers employees to identify and address potential threats proactively.

Leaders play a crucial role in setting the tone for effective risk management. They must integrate risk considerations into strategic planning and encourage open communication about risks at all levels. Organizations that embrace this approach enhance their resilience and adaptability, positioning themselves to navigate uncertainties successfully.

At CFO Insights, we help businesses implement robust financial strategies and risk mitigation practices. Our services aim to equip organizations with the tools and expertise needed to thrive in an uncertain business landscape. Effective risk mitigation creates resilient organizations capable of turning challenges into opportunities for sustainable growth.