At CFO Insights, we know that outdated finance processes can hold companies back. Process optimization is no longer a luxury but a necessity in today’s fast-paced business world.

In this post, we’ll show you how to transform your finance operations in just 30 days. Get ready for practical tips and strategies that will boost efficiency and drive growth in your organization.

Where Are Your Finance Bottlenecks?

Map Your Processes

CFO Insights recommends creating a detailed map of your finance processes as the first step to revolutionize your operations. This includes everything from invoice processing and expense management to financial reporting and budgeting. Business Process Management Tools help visualize your workflows. This exercise often reveals surprising inefficiencies and redundancies.

Time Your Tasks

After process mapping, it’s time to get granular. Time-tracking software like Toggl or RescueTime measures how long each task takes. You might discover that your team spends 20 hours a month on manual data entry or that reconciling accounts takes a full week every quarter (shocking, but true).

Follow the Paper Trail

In 2024, a paper-heavy finance department is outdated. Yet, banking professionals responsible for document and information management often encounter various obstacles that hinder timely access to data and documents. Track every piece of paper in your finance processes. Each physical document represents a potential bottleneck and an opportunity for digitization.

Leverage Your Team’s Insights

Your finance team members know the pain points better than anyone. Schedule one-on-one interviews or anonymous surveys to gather their feedback. Ask specific questions like, “What’s the most time-consuming part of your month-end close process?” or “Which reports take the longest to prepare?”

Audit Your Tech Stack

Take inventory of all the financial software and tools your team uses. Are they integrated? Do they communicate with each other? A Sage survey found that businesses can shorten close process times by 36 percent by switching from spreadsheets to cloud financial management. If your tools aren’t cloud-based and integrated, that’s a red flag.

This thorough assessment of your current finance processes will uncover the bottlenecks holding you back. Now that you’ve identified these issues, it’s time to implement quick wins for immediate impact. Let’s explore how to automate repetitive tasks and streamline your approval processes in the next section.

How to Quickly Boost Your Finance Processes

Embrace Robotic Process Automation (RPA)

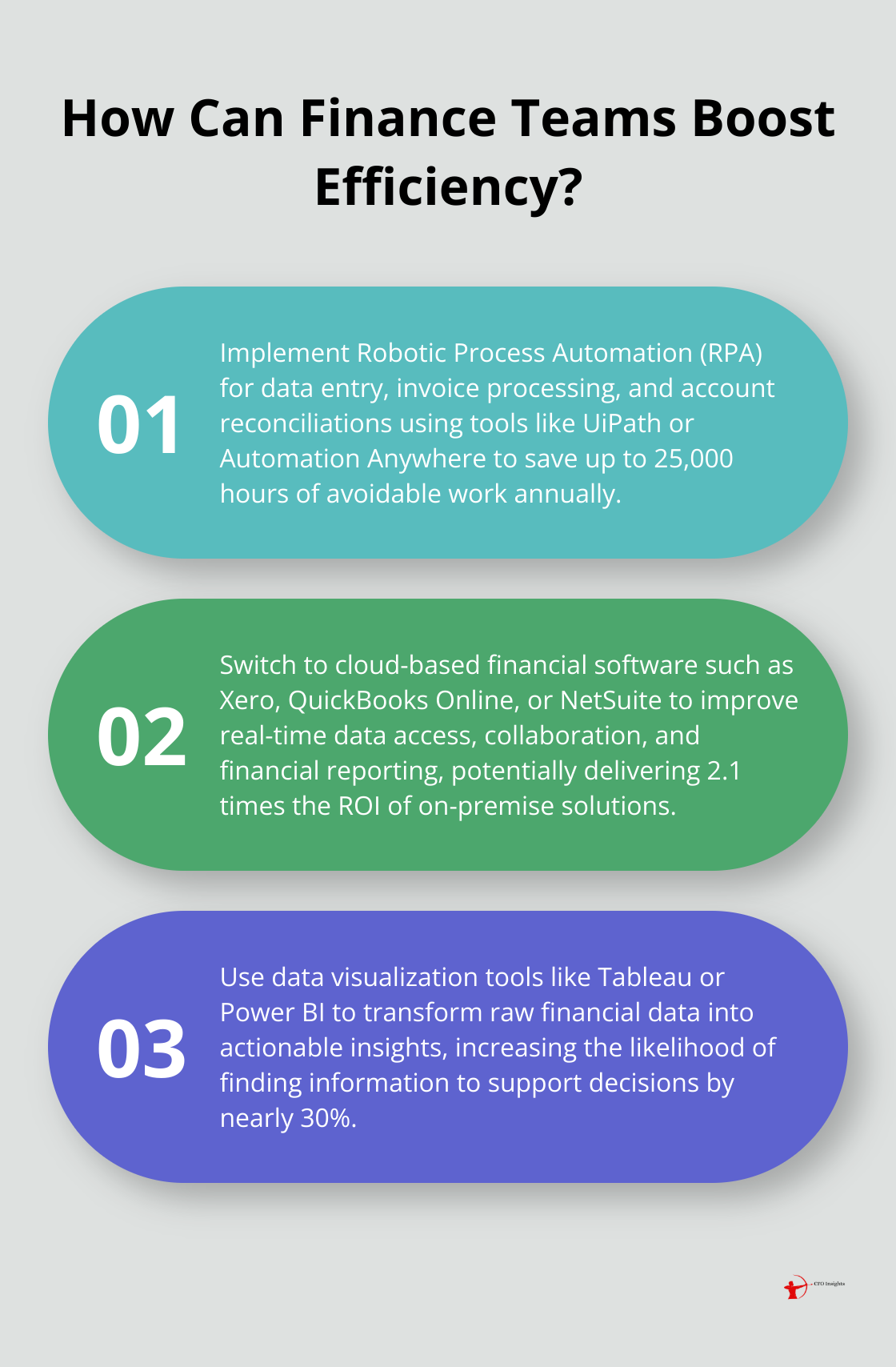

Robotic Process Automation (RPA) transforms finance teams. Gartner reports that RPA can save finance departments 25,000 hours of avoidable work annually. Start with automating data entry tasks, invoice processing, and account reconciliations. Tools like UiPath or Automation Anywhere set up quickly and deliver results within days.

A mid-sized manufacturing company implemented RPA for invoice processing and cut their processing time from 10 minutes per invoice to just 30 seconds. This shift allowed their finance team to focus on more strategic tasks, improving overall productivity.

Revamp Your Approval Workflows

Inefficient approval processes slow down finance operations. Implement a digital approval system to streamline these workflows. Platforms like DocuSign or Adobe Sign can reduce approval times significantly.

Try a tiered approval system based on transaction value. For example, purchases under $1,000 might need one level of approval, while those over $10,000 require multiple approvals. This approach speeds up low-risk transactions while maintaining control over larger expenditures.

Shift to Cloud-Based Financial Software

Cloud-based financial software offers real-time data access, improved collaboration, and automatic updates. Nucleus Research found that cloud application projects deliver 2.1 times the ROI of on-premise ones.

When selecting cloud-based software, look for comprehensive features and good integration with your existing systems. Popular options include Xero, QuickBooks Online, and NetSuite. These platforms can provide immediate improvements in areas like financial reporting, budgeting, and forecasting.

Cloud-based solutions offer scalability and flexibility that growing businesses need. Some companies reduce their month-end close times significantly after implementing cloud-based financial software.

Optimize Data Management

Efficient data management forms the backbone of streamlined finance processes. Implement a centralized data repository to ensure all financial information is easily accessible and up-to-date. This step eliminates data silos and reduces the time spent searching for information.

Consider tools like Tableau or Power BI for data visualization. These platforms transform raw financial data into actionable insights, enabling faster decision-making. A study found that managers are almost 30% more likely to find information in time to support their decisions when using visual data discovery tools.

The implementation of these quick wins sets the stage for long-term transformation. The next step involves developing a comprehensive strategy to sustain and build upon these initial gains. Let’s explore how to create a roadmap for ongoing finance optimization.

How to Build a Future-Proof Finance Strategy

Define Your North Star Metrics

Identify the key performance indicators (KPIs) that truly matter for your business. These might include metrics like Days Sales Outstanding (DSO), Working Capital Ratio, or Revenue per Employee. A study by McKinsey found that companies that focus on their people’s performance are 4.2 times more likely to outperform their peers, realizing an average 30 percent higher revenue growth.

A SaaS company might focus on Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV). Tracking these metrics closely enables data-driven decisions about marketing spend and customer retention strategies.

Create a Technology Roadmap

Technology forms the backbone of modern finance operations. Design a detailed roadmap for adopting new tools and systems over the next 3-5 years. This should align with your overall business strategy and anticipated growth.

Consider emerging technologies like artificial intelligence and blockchain. Planning for these advancements now can give you a competitive edge in the future.

Cultivate a Culture of Continuous Improvement

Implementation of new processes and technologies marks just the beginning. The most successful finance teams embrace a mindset of ongoing optimization. Encourage your team to question existing processes and suggest improvements regularly.

Google’s famous 20% time policy (where employees spend one day a week on side projects) has led to innovations like Gmail and AdSense. While a full day might not work for most finance teams, even a few hours a month dedicated to improvement projects can yield significant results.

Invest in Skill Development

The finance landscape changes rapidly. Invest in your team’s skills to stay ahead. This includes both technical skills (like data analysis and financial modeling) and soft skills (such as communication and leadership).

A PwC survey found that 77% of CEOs struggle to find employees with the right skills. Regular training and development programs can address this gap and improve your team’s performance.

Prioritize Data Security and Compliance

As finance processes become more digital, data security and compliance grow increasingly important. Develop a robust strategy to protect sensitive financial information and ensure compliance with relevant regulations (like GDPR or SOX).

The average cost of a data breach reached $4.88 million in 2024. A strong security strategy not only protects your organization but also builds trust with stakeholders.

Final Thoughts

Process optimization in finance departments requires a comprehensive approach. Organizations must evaluate their current operations, implement quick improvements, and develop long-term strategies. These steps transform finance teams into efficient, strategic assets for their companies.

Immediate enhancements like automation and cloud-based software yield rapid results. However, sustained success demands a future-focused vision that includes clear KPIs, technology planning, and continuous improvement. Regular assessments and adjustments keep finance operations agile and effective in an ever-changing business landscape.

Many organizations find this transformation challenging to navigate alone. Fractional CFO services can provide the expertise and strategic insight needed to optimize processes and drive growth. CFO Insights specializes in guiding businesses through finance transformations, ensuring operations meet current challenges and prepare for future opportunities.