At CFO Insights, we’ve seen a growing trend of finance professionals stepping into broader business leadership roles. This shift requires a new set of skills beyond traditional financial expertise.

Our latest blog post explores the key areas of leadership development for finance professionals aiming to become influential business leaders. We’ll cover strategic thinking, communication, and leveraging technology to drive organizational success.

How Finance Professionals Can Think Strategically

Finance professionals who excel in strategic thinking often become the most influential business leaders. Strategic thinking transcends number crunching; it involves understanding how financial data fits into the broader picture of an organization’s goals and market position.

Broaden Your Business Perspective

To develop strategic thinking skills, expand your knowledge beyond finance. Read industry reports, attend cross-departmental meetings, and engage with colleagues from different areas of the business. This broader perspective will help you identify how financial decisions impact various aspects of the organization.

A study by McKinsey found that CFOs who actively seek to understand their company’s business model and competitive landscape are 1.7 times more likely to be involved in strategic decision-making processes. This involvement is essential for aligning financial strategies with organizational goals.

Make Data-Driven Decisions

Improving decision-making capabilities is another critical aspect of strategic thinking. Finance professionals should use data analytics to provide insights that drive business decisions. Advanced analytics contributes to an overarching strategy that can enable organizations to proceed with informed decision-making.

To enhance your decision-making skills:

- Identify key performance indicators (KPIs) that align with your company’s strategic objectives.

- Develop dashboards that provide real-time insights into these KPIs.

- Use scenario planning to assess the potential impact of different decisions.

Cultivate a Forward-Thinking Mindset

Strategic thinking also involves looking beyond immediate financial concerns to anticipate future trends and challenges. A forward-thinking mindset allows finance professionals to proactively address potential issues and capitalize on emerging opportunities.

To foster this mindset:

- Stay informed about emerging technologies and their potential impact on your industry.

- Regularly review and update your financial forecasts to reflect changing market conditions.

- Collaborate with other departments to identify long-term growth opportunities.

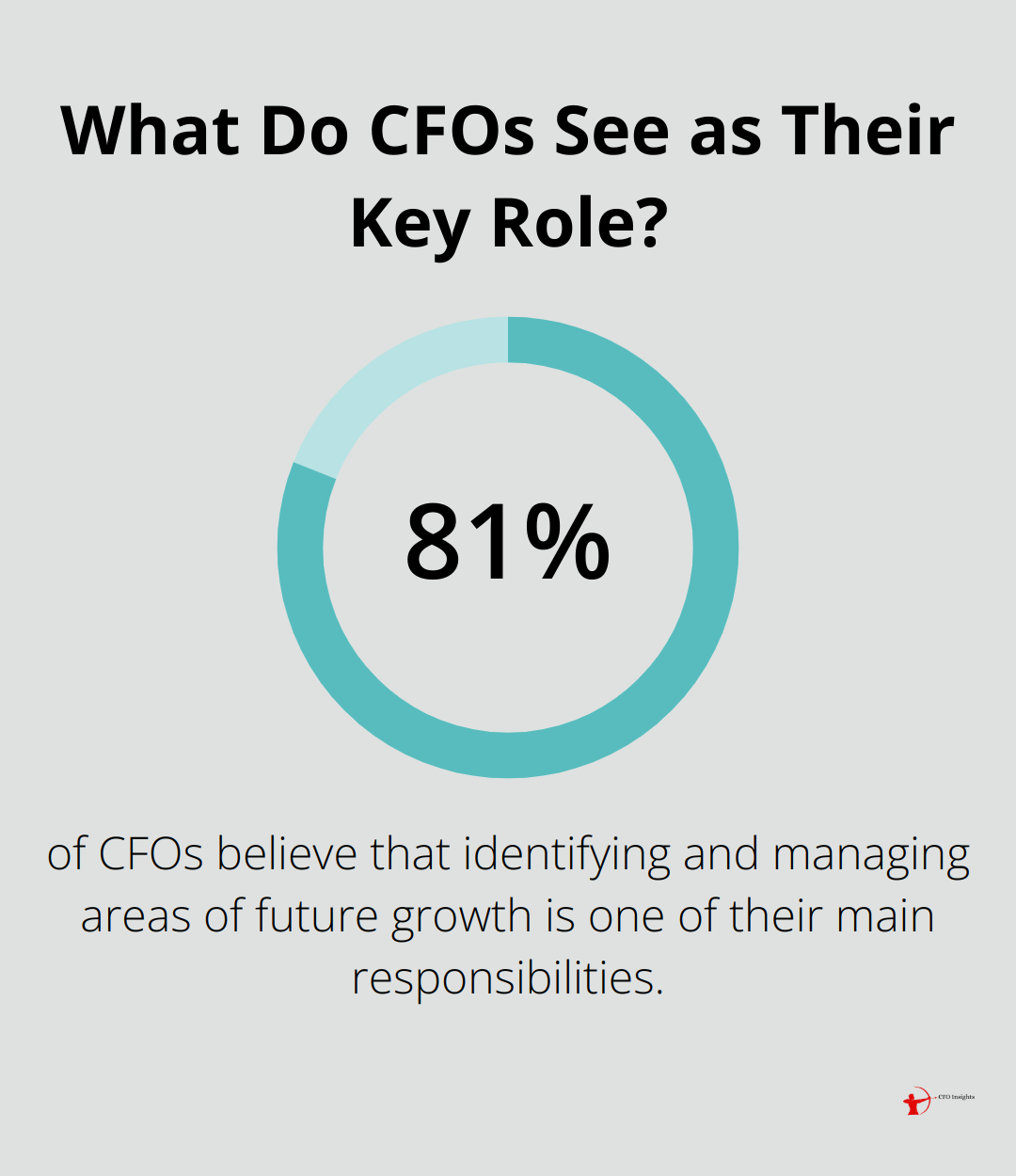

A survey by PwC found that 81% of CFOs believe that identifying and managing areas of future growth is one of their main responsibilities. This highlights the importance of developing a forward-thinking approach in finance roles.

Implement Strategic Financial Planning

Strategic financial planning is a key component of thinking strategically. This involves creating long-term financial plans that support the overall business strategy. Finance professionals should work closely with other departments to develop budgets and forecasts that align with the company’s strategic goals.

To implement strategic financial planning:

- Conduct regular financial reviews (quarterly or bi-annually) to assess progress towards strategic goals.

- Develop contingency plans for potential financial risks or market changes.

- Align capital allocation with long-term strategic priorities.

Strategic thinking is a skill that finance professionals can develop over time with practice and dedication. As you hone these skills, you’ll find yourself better equipped to contribute to high-level business decisions and drive organizational success.

The next step in transforming finance professionals into business leaders involves mastering the art of communication and influence. Let’s explore how finance experts can effectively convey their insights and make a lasting impact across the organization.

How Finance Leaders Can Communicate Effectively

Simplify Complex Financial Concepts

The most successful finance leaders translate complex financial data into clear, actionable insights. This skill involves more than presenting numbers; it requires telling a compelling story that resonates with the audience.

To achieve this:

- Use visual aids (graphs and charts) to illustrate key points

- Avoid technical jargon when presenting to non-finance colleagues

- Focus on the implications of financial data rather than just the numbers

Build Cross-Functional Relationships

Effective communication also requires strong relationships across different departments. Finance leaders who understand the challenges and goals of other teams provide more valuable insights and support.

To enhance cross-functional relationships:

- Schedule regular meetings with heads of other departments

- Participate in cross-functional projects to gain broader business exposure

- Offer financial guidance that aligns with the goals of different teams

Develop a Commanding Presence

Finance leaders need to project confidence and authority when communicating with stakeholders. This involves both what you say and how you say it.

To develop your executive presence:

- Practice active listening to show engagement in conversations

- Use confident body language and maintain eye contact

- Speak with conviction and back up your statements with data

Tailor Your Message to Your Audience

Different stakeholders have different priorities and levels of financial knowledge. Effective communication requires adapting your message to your audience.

A study by PwC found that 73% of investors want CFOs to discuss strategy and risk more comprehensively. When communicating with various stakeholders:

- For board members: Focus on long-term strategy and risk management

- For operational managers: Emphasize how financial decisions impact their department

- For investors: Highlight key performance indicators and growth prospects

These communication skills significantly increase a finance leader’s influence within their organization. The next chapter will explore how finance professionals can leverage technology and data analytics to drive strategic decision-making and further enhance their leadership capabilities.

How Finance Leaders Can Harness Technology

Embrace Digital Transformation

Finance leaders who effectively leverage technology and data analytics position themselves to drive strategic decision-making. Digital transformation in finance requires a fundamental shift in how finance teams operate and contribute to the organization. This study theoretically analyzes and empirically examines the influence of digital transformation speed on firm financial distress.

To successfully embrace digital transformation:

- Assess your current technology stack and identify gaps

- Prioritize investments in cloud-based financial management systems

- Implement robotic process automation (RPA) for routine tasks

- Train your team on new technologies and foster a culture of continuous learning

Harness Data for Strategic Insights

Data-driven insights are essential for strategic planning and decision-making.

To leverage data effectively:

- Implement a centralized data warehouse to consolidate financial information

- Use business intelligence tools to create interactive dashboards and reports

- Collaborate with IT to ensure data quality and consistency across systems

- Develop key performance indicators (KPIs) that align with strategic objectives

Use Predictive Analytics for Accurate Forecasting

Predictive analytics can significantly improve the accuracy of financial forecasts. A 2024 Deloitte survey revealed that predictive analytics can offer great improvements in forecast accuracy and factor in cash flow automation.

To implement predictive analytics:

- Start with a specific use case (such as revenue forecasting or cash flow prediction)

- Gather historical data and identify relevant variables

- Choose appropriate predictive modeling techniques

- Continuously refine and validate your models based on actual results

Stay Ahead of Emerging Technologies

The finance technology landscape constantly evolves. Staying current with emerging technologies is essential for maintaining a competitive edge.

To stay ahead of the curve:

- Allocate time and resources for exploring new technologies

- Attend industry conferences and webinars focused on financial technology

- Pilot promising technologies in controlled environments before full-scale implementation

- Build a network of tech-savvy finance professionals to share insights and best practices

Final Thoughts

The journey from finance professional to business leader requires strategic thinking, effective communication, and technological proficiency. These skills enable finance leaders to align financial strategies with organizational goals, convey complex concepts to stakeholders, and leverage data-driven insights. Leadership development in finance involves continuous learning and adaptability to stay ahead of industry trends and emerging technologies.

Finance leaders now play a pivotal role in shaping their organizations’ future. They combine financial expertise with business acumen to drive growth and innovation. The transition to business leadership demands a mindset of continuous improvement and a willingness to embrace new challenges.

At CFO Insights, we support organizations in optimizing their finance teams and implementing best practices in financial management. Our fractional CFO services provide strategic insights and expertise to navigate the complex landscape of modern finance leadership. Finance professionals who evolve into business leaders will continue to steer their organizations toward success in today’s dynamic environment.