The Chief Financial Officer (CFO) occupies a pivotal role within an organisation, serving as the primary steward of its financial health and strategic direction. Traditionally, the responsibilities of a CFO have revolved around financial reporting, compliance, and risk management. However, as the business landscape evolves, so too does the role of the CFO.

Today’s CFOs are increasingly expected to contribute to strategic decision-making, drive operational efficiency, and foster innovation. This evolution reflects broader changes in the economy, technology, and corporate governance, necessitating a more dynamic approach to financial leadership. Understanding the multifaceted responsibilities of a CFO is crucial for both aspiring finance professionals and organisations seeking to optimise their financial management.

The role encompasses a range of functions that extend beyond mere number-crunching; it involves strategic foresight, analytical acumen, and the ability to communicate complex financial concepts to diverse stakeholders. As businesses navigate an increasingly complex environment characterised by rapid technological advancements and shifting market dynamics, the expectations placed on CFOs continue to expand, making it essential to explore the various models of CFO responsibilities.

Summary

- CFO responsibilities have evolved over time, from traditional financial management to a more strategic and transformational role.

- The traditional model of CFO responsibilities focused on financial reporting, compliance, and cost control.

- The strategic model of CFO responsibilities involves more strategic planning, risk management, and performance analysis.

- The transformational model of CFO responsibilities includes driving innovation, digital transformation, and business model restructuring.

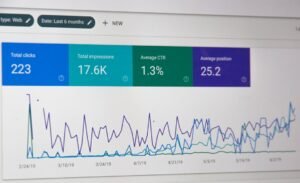

- Technology has significantly impacted CFO responsibilities, enabling better data analysis, forecasting, and decision-making.

Traditional Model of CFO Responsibilities

Financial Governance and Compliance

This includes overseeing financial reporting, ensuring compliance with regulatory requirements, and managing the organisation’s financial risks. The CFO is often seen as the gatekeeper of financial integrity, tasked with producing accurate financial statements and ensuring that the organisation adheres to accounting standards and legal obligations.

Reactive Role in Financial Planning

This model places a strong emphasis on historical data analysis and retrospective reporting, where the CFO’s role is largely reactive. Moreover, in this traditional framework, the CFO is responsible for budgeting and forecasting, which involves preparing detailed financial plans that guide the organisation’s resource allocation. This process typically relies on historical performance data to project future revenues and expenses.

Limitations of the Traditional Model

While these functions are undeniably critical for maintaining financial stability, they often limit the CFO’s engagement in strategic discussions. The focus on compliance and reporting can create a perception of the CFO as a back-office functionary rather than a key player in shaping the organisation’s future direction.

Strategic Model of CFO Responsibilities

As businesses began to recognise the importance of aligning financial management with overall corporate strategy, the role of the CFO evolved into a more strategic one. In this strategic model, CFOs are not only responsible for financial reporting but also play an integral role in shaping business strategy and driving organisational performance. This shift reflects a growing understanding that financial insights can inform strategic decisions, enabling organisations to respond more effectively to market opportunities and challenges.

In this model, CFOs engage in scenario planning and strategic forecasting, utilising advanced analytics to assess potential outcomes based on various business scenarios. They collaborate closely with other executives to develop long-term strategies that align financial goals with operational capabilities. For instance, a CFO might analyse market trends and competitive dynamics to identify growth opportunities or assess the financial implications of potential mergers and acquisitions.

This proactive approach allows CFOs to contribute valuable insights that can influence key business decisions, positioning them as strategic partners rather than mere financial overseers.

Transformational Model of CFO Responsibilities

| Responsibility | Description |

|---|---|

| Strategic Planning | Leading the development of the company’s long-term strategic plans. |

| Performance Management | Implementing systems to monitor and manage the company’s performance. |

| Capital Structure | Optimising the company’s capital structure to support its strategic goals. |

| Risk Management | Identifying and managing financial risks to protect the company’s assets. |

| Investor Relations | Communicating with investors and analysts to maintain positive relationships. |

The transformational model represents the latest evolution in the role of the CFO, characterised by a focus on innovation, digital transformation, and organisational agility. In this model, CFOs are expected to lead initiatives that drive change across the organisation, leveraging technology and data analytics to enhance decision-making processes. The transformational CFO is not only concerned with financial metrics but also with how those metrics can be used to foster a culture of innovation and continuous improvement.

A key aspect of this model is the integration of technology into financial operations. For example, many CFOs are now adopting cloud-based financial management systems that provide real-time data access and analytics capabilities. This shift enables them to make informed decisions quickly and respond to changing market conditions with agility.

Additionally, transformational CFOs often champion initiatives related to sustainability and corporate social responsibility, recognising that these factors can significantly impact long-term financial performance. By embracing a holistic view of organisational success that encompasses both financial and non-financial metrics, transformational CFOs position themselves as leaders in driving sustainable growth.

Key Differences and Similarities between the Three Models

While each model of CFO responsibilities presents distinct characteristics, there are also notable similarities that underscore the evolving nature of this role. The traditional model is primarily focused on compliance and historical reporting, whereas the strategic model introduces a forward-looking perspective that emphasises alignment with corporate strategy. The transformational model further expands this scope by incorporating innovation and technology as central components of financial leadership.

Despite these differences, all three models share a common foundation in financial stewardship. Regardless of the specific responsibilities assigned to them, CFOs must maintain a strong grasp of financial principles and practices to ensure organisational stability. Additionally, effective communication remains a critical skill across all models; whether presenting financial reports to stakeholders or collaborating with other executives on strategic initiatives, the ability to convey complex information clearly is essential.

Another similarity lies in the increasing importance of data-driven decision-making across all models. In the traditional model, data is primarily used for compliance and reporting purposes; in the strategic model, it informs forecasting and scenario planning; while in the transformational model, data analytics drives innovation and operational efficiency. As such, the ability to harness data effectively is becoming a defining characteristic of successful CFOs in any context.

Impact of Technology on CFO Responsibilities

The advent of advanced technologies has profoundly impacted the responsibilities of CFOs across all models. Automation tools have streamlined routine financial processes such as invoicing and reconciliation, allowing finance teams to focus on higher-value activities like analysis and strategy development. This shift not only enhances efficiency but also reduces the risk of human error in financial reporting.

Moreover, technologies such as artificial intelligence (AI) and machine learning are transforming how CFOs approach data analysis. These tools enable more sophisticated predictive analytics, allowing organisations to anticipate market trends and customer behaviour with greater accuracy. For instance, AI-driven algorithms can analyse vast amounts of data from various sources to identify patterns that inform strategic decision-making.

As a result, CFOs are increasingly expected to possess not only traditional financial expertise but also a strong understanding of technology and its implications for business operations. The rise of cloud computing has also facilitated greater collaboration among finance teams and other departments within an organisation. Cloud-based platforms enable real-time data sharing and communication, breaking down silos that may have previously hindered cross-functional collaboration.

This interconnectedness allows CFOs to engage more effectively with other executives in developing integrated strategies that align financial goals with operational capabilities.

The Evolving Role of the CFO in the Modern Business Landscape

In today’s fast-paced business environment, the role of the CFO is undergoing a significant transformation driven by external pressures such as economic uncertainty, regulatory changes, and evolving stakeholder expectations. Modern CFOs are increasingly called upon to navigate complex challenges while simultaneously driving growth and innovation within their organisations. This requires a multifaceted skill set that encompasses not only financial acumen but also strategic thinking, leadership capabilities, and adaptability.

As organisations face heightened scrutiny from investors and regulators regarding their environmental, social, and governance (ESG) practices, CFOs are taking on greater responsibility for ensuring transparency and accountability in these areas. This shift reflects a broader recognition that sustainable business practices can enhance long-term value creation. Consequently, modern CFOs must be adept at integrating ESG considerations into their financial strategies while communicating these efforts effectively to stakeholders.

Furthermore, as businesses embrace digital transformation initiatives, CFOs are often at the forefront of these efforts. They play a critical role in evaluating technology investments that can enhance operational efficiency and drive innovation. By championing digital initiatives within their organisations, modern CFOs position themselves as key drivers of change rather than merely custodians of financial resources.

Conclusion and Future Outlook for CFO Responsibilities

The responsibilities of CFOs are evolving rapidly in response to changing market dynamics and technological advancements. As organisations increasingly recognise the value of integrating finance with broader business strategies, CFOs are transitioning from traditional roles focused solely on compliance and reporting to more strategic positions that encompass innovation and transformation. The future outlook for CFO responsibilities suggests an even greater emphasis on data-driven decision-making, technological integration, and sustainability considerations.

Those who can adapt to these evolving expectations while maintaining a strong foundation in financial stewardship will be well-positioned to lead their organisations toward sustainable growth in an ever-changing world. The role of the CFO is not merely about managing finances; it is about shaping the future direction of organisations through strategic insight and innovative thinking.

FAQs

What are the three models of CFO responsibilities?

The three models of CFO responsibilities are the traditional model, the modern model, and the strategic model.

What are the key characteristics of the traditional model of CFO responsibilities?

The traditional model of CFO responsibilities focuses on financial reporting, compliance, and cost control. CFOs in this model are primarily concerned with historical financial data and ensuring regulatory compliance.

What are the key characteristics of the modern model of CFO responsibilities?

The modern model of CFO responsibilities expands beyond the traditional role to include strategic financial planning, analysis, and performance management. CFOs in this model are more involved in decision-making and providing insights to drive business growth.

What are the key characteristics of the strategic model of CFO responsibilities?

The strategic model of CFO responsibilities positions the CFO as a key strategic partner to the CEO and other executives. CFOs in this model are heavily involved in shaping the company’s overall strategy, driving innovation, and identifying new business opportunities.