Introduction to Fractional CFOs

A fractional CFO, or Chief Financial Officer, is a financial expert who provides their services on a part-time or contractual basis, rather than as a full-time executive. This model allows businesses, particularly small to medium-sized enterprises, to access high-level financial expertise without the full financial commitment associated with hiring a traditional CFO. Fractional CFOs work with multiple companies simultaneously, offering tailored advice and strategies in areas such as budgeting, forecasting, and financial reporting.

The concept of fractional ownership has gained traction in various industries, allowing companies to share resources and expertise. By leveraging a fractional CFO, businesses can benefit from a wealth of experience and industry knowledge that may otherwise be unaffordable. This arrangement not only mitigates the financial risk associated with a full-time hire but also provides the flexibility to scale financial insight according to the organization’s current needs. For growing enterprises, employing a fractional CFO can lead to more informed decision-making and improved financial health.

Moreover, the trend of businesses opting for part-time financial expertise reflects a wider movement toward strategic outsourcing. Many companies today face complex financial challenges as they navigate competitive markets. Hiring a fractional CFO enables organizations to obtain specialized skills in financial strategy without the overhead costs tied to full-time roles. As a result, businesses can remain agile while ensuring that their financial management is guided by seasoned professionals who bring valuable perspectives and practices from diverse sectors.

Overall, fractional CFO services represent a practical solution for organizations looking to enhance their financial acumen while maintaining operational efficiency. This model supports a range of businesses in achieving their financial goals, contributing to their long-term success and stability.

Benefits of Hiring a Fractional CFO

In today’s competitive business environment, many companies are leveraging the advantages of hiring a fractional Chief Financial Officer (CFO) to enhance their financial management strategies. A fractional CFO offers several benefits that can significantly impact a company’s growth trajectory and financial health.

One of the most compelling advantages of hiring a fractional CFO is cost-effectiveness. Unlike a full-time CFO, which entails a substantial salary and benefits package, a fractional CFO allows businesses to access high-level financial expertise at a fraction of the cost. This arrangement enables companies to allocate their financial resources more efficiently, ultimately enhancing their bottom line while still receiving top-tier financial oversight.

Beyond financial savings, a fractional CFO provides valuable access to expert financial advice and industry insights. These professionals bring a wealth of experience from working with varied businesses and industries. This breadth of experience allows them to offer innovative solutions to complex financial challenges, helping businesses navigate financial forecasting, cash flow management, and strategic planning with greater precision.

Moreover, as businesses evolve, their financial needs often change. A fractional CFO offers the flexibility to scale financial operations in alignment with business growth. Whether during periods of expansion or consolidation, a fractional CFO can adjust their involvement, ensuring that the financial strategies remain robust and relevant. This adaptability is especially beneficial for small and medium-sized enterprises that may encounter fluctuating financial conditions but lack the resources for a full-time executive.

In conclusion, hiring a fractional CFO equips businesses with expert financial guidance while preserving resources. The key benefits of cost-effectiveness, expert advice, and scalable financial operations underscore the value that a fractional CFO can provide in driving a company’s financial success and sustainability.

When Should You Consider a Fractional CFO?

Recognizing the right time to engage a fractional CFO can greatly influence your business’s financial trajectory. Several scenarios in a business’s lifecycle often signal the need for advanced financial guidance. First, startups and growing businesses frequently encounter the challenge of juggling multiple roles, especially in their critical early stages. If your organization is experiencing rapid growth or scaling operations, a fractional CFO can provide the financial acumen necessary to navigate these changes effectively.

Another key indicator is when a company faces increasingly complex financial situations. As businesses evolve, they often deal with more intricate financial planning, including cash flow management, budgeting, and forecasting. If your team struggles to produce accurate financial reports or projections, then assimilating a fractional CFO could streamline these processes, ensuring that the financial data supports strategic decision-making.

Additionally, businesses may find themselves in a transitional phase, such as preparing for an acquisition, seeking investment, or expanding into new markets. During these periods, a fractional CFO can offer invaluable insights and practical guidance that align with organizational goals while maintaining fiscal discipline. Their expertise can aid in financial modeling and structuring, making the business more attractive to potential investors or buyers.

Furthermore, if you notice signs of financial distress or poor cash flow management, it’s crucial to seek external expertise. A fractional CFO can identify critical areas for improvement and implement corrective action to stabilize the financial health of the organization. This proactive approach can help avert potential crises and position your business for future success. Overall, recognizing these scenarios can help you leverage fractional CFO services at the appropriate time, ensuring your business’s financial strategy aligns with its growth aspirations.

Cost Analysis: Fractional CFO vs. Full-Time CFO

When deliberating the hiring of financial leadership for a business, understanding the cost implications of a fractional Chief Financial Officer (CFO) compared to a full-time CFO is critical. Traditionally, a full-time CFO commands a hefty salary, often starting in the six-figure range, depending on the company’s size and industry. This does not account for additional expenses such as bonuses, benefits, and potential equity options, which can significantly inflate overall compensation. In contrast, a fractional CFO typically offers their expertise on a part-time basis, allowing companies to engage high-caliber financial management without the full salary commitment. This arrangement can result in direct cost savings, which can be pivotal for budget-conscious organizations.

Moreover, hiring a fractional CFO can lead to enhanced financial efficiency. The expertise that comes with a fractional CFO often translates into better financial strategies, potentially leading to increased revenue and improved cash flow management. These professionals also bring a wealth of experience from various industries, allowing them to provide insights that a full-time CFO, focused solely on one organization, might miss. The ROI from their contributions may exceed the initial investment of their services.

Additionally, the flexibility of a fractional CFO enables businesses to scale their financial support according to their needs, which can be especially beneficial for startups and growing companies. When a company’s demands fluctuate, utilizing a fractional CFO can help manage finances during peak periods without the obligation of a permanent position. This scalability means that businesses can adapt to their financial needs without incurring unnecessary costs.

In conclusion, the decision between employing a fractional or full-time CFO involves various financial considerations. Fractional CFOs offer a cost-effective solution, providing essential financial guidance while allowing businesses to maximize their resources efficiently.

Key Responsibilities of a Fractional CFO

A fractional Chief Financial Officer (CFO) plays a vital role in the financial health and strategic direction of a business. Often engaged on a part-time or temporary basis, a fractional CFO effectively leads various aspects of a company’s financial operations, particularly in the realm of strategic planning and management. One of the primary responsibilities of a fractional CFO is the development of a comprehensive financial strategy. This involves assessing the current financial state of the organization, identifying areas of improvement, and formulating actionable plans that align with the company’s overarching business objectives.

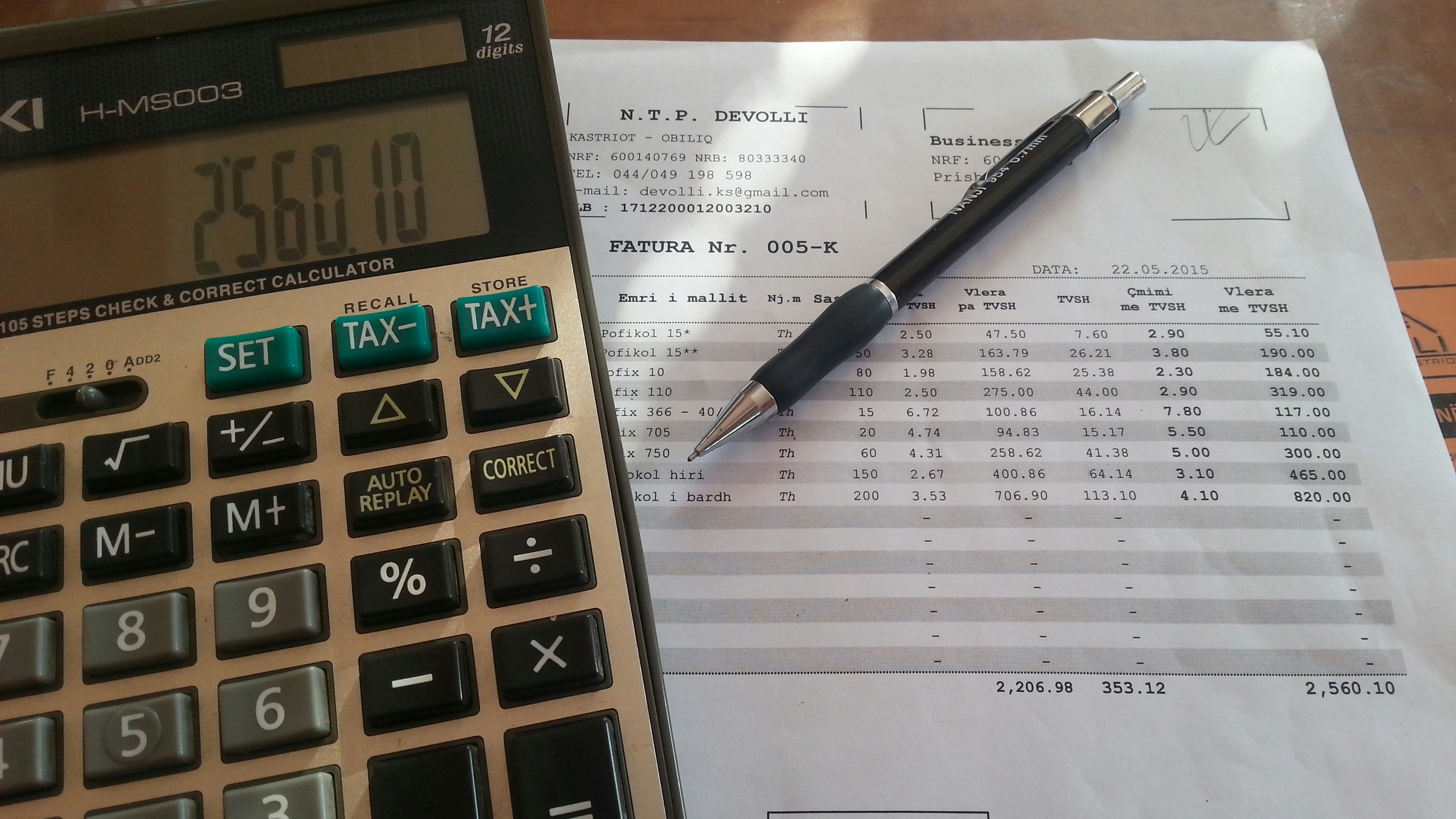

Another significant responsibility is budgeting, where the fractional CFO is tasked with creating a framework for financial planning that helps allocate resources effectively. This entails collaborating with different departments to gather input, forecast future revenues and expenses, and establish a budget that supports the organization’s goals. Within this budgeting process, the fractional CFO also engages in financial forecasting, which is essential for predicting potential outcomes based on historical data and current market trends. By utilizing various forecasting techniques, they provide valuable insights into cash flow projections, enabling the organization to anticipate funding needs effectively.

Cash flow management is yet another critical area where a fractional CFO contributes significantly. They ensure that the organization maintains adequate liquidity to meet its obligations while optimizing the use of cash. This may include implementing systems for monitoring receivables and payables, identifying cash flow trends, and developing strategies to enhance cash flow efficiency. In addition to these core responsibilities, a fractional CFO also provides guidance on financing options, risk management, and compliance issues, allowing the business to navigate complex financial regulations and economic conditions adeptly. Collectively, these roles position the fractional CFO as a key advisor to the executive team, fostering informed decision-making and sustainable growth.

Case Studies: Success Stories with Fractional CFOs

In recent years, an increasing number of businesses have opted for fractional CFOs, recognizing the strategic advantage they bring without the overhead costs of a full-time executive. One notable example is a mid-sized manufacturing firm that faced challenges in cash flow management. By hiring a fractional CFO, the company was able to implement more effective budgeting processes and improve financial forecasting. Within six months, they reported a 25% increase in cash reserves, demonstrating the pivotal role of a fractional CFO in optimizing financial strategies.

Another compelling case involves a tech startup that struggled to find direction in its financial planning. The fractional CFO introduced robust financial metrics, enabling the company to make informed decisions about resource allocation. This led to a significant reduction in expenses, ultimately resulting in a 40% increase in net profit over the course of a year. The startup’s ability to scale operations while maintaining financial discipline underscores how fractional CFOs can drive growth through strategic insight.

Additionally, a non-profit organization facing instability in its funding found the guidance of a fractional CFO invaluable. The professional helped to refine their budgeting practices and create a more transparent reporting structure, which enhanced donor confidence. As a result, the non-profit saw a 60% uptick in donations and was able to expand its programs significantly. This scenario exemplifies how a fractional CFO not only stabilizes finances but also enhances organizational credibility and trust among stakeholders.

These case studies illustrate that fractional CFOs can transform financial operations across various sectors. Their expertise helps businesses navigate complex financial landscapes, ensuring stability and fostering sustainable growth. By integrating these skilled professionals into their financial teams, organizations can achieve strategic improvements and long-term success.

How to Choose the Right Fractional CFO

Selecting the right fractional Chief Financial Officer (CFO) is a pivotal decision for any business seeking to enhance its financial strategy and management. Key criteria to consider involve the candidate’s experience, industry knowledge, and cultural fit within your organization.

First and foremost, experience plays a crucial role in determining the effectiveness of a fractional CFO. Examine their background in financial management, particularly in similar business sizes or sectors. A qualified fractional CFO should possess a robust track record of successfully navigating financial challenges, optimizing resources, and driving growth within organizations. This experience ensures that they are well-equipped to handle the distinct financial needs of your business.

Next, you should assess the industry knowledge of prospective fractional CFOs. Each sector has its own nuances and regulations, making it essential to find someone familiar with your industry’s specific requirements. A fractional CFO with relevant expertise will not only understand financial metrics and indicators specific to your field but will also be aware of common challenges and opportunities within that sector. This familiarity enables them to enhance your financial strategies effectively.

Cultural fit is another vital aspect when selecting a fractional CFO. The ideal candidate should resonate with your organization’s values, communication style, and overall business philosophy. Building a strong collaborative relationship is important for successful integration into your existing team. A fractional CFO who aligns well with your company culture can foster trust and achieve better synergy with other departments, leading to more effective financial decision-making.

In conclusion, careful consideration of experience, industry knowledge, and cultural compatibility will guide you in choosing the right fractional CFO. By focusing on these criteria, your business can benefit significantly from the expertise of a fractional CFO, enhancing your overall financial health and operational success.

Potential Challenges of Working with a Fractional CFO

While the benefits of hiring a fractional CFO can be substantial, it is prudent to consider potential challenges that may arise in this working relationship. One of the main issues is communication. Since fractional CFOs often work with multiple clients, they may not always be available when urgent financial decisions arise. This can lead to delays in critical financial reporting or strategy development. Clear channels of communication ought to be established from the outset to ensure that both the business and the fractional CFO are aligned on priorities and expectations.

Additionally, establishing clear expectations and responsibilities is paramount. Clients may have assumptions about the level of involvement or the tasks that the fractional CFO will undertake. It is vital for both parties to delineate roles and set measurable objectives to avert misunderstandings. If expectations are not adequately defined, it could lead to a perceived lack of engagement from the fractional CFO, resulting in dissatisfaction with their performance.

Another challenge is the dependency on external help. Businesses might become reliant on their fractional CFO for financial insights and strategy, which could hinder the development of internal competencies. This dependency can pose risks if the fractional CFO becomes unavailable or decides to take on new opportunities elsewhere. Organizations must strive to maintain a balance between leveraging expert advice while simultaneously nurturing their internal financial teams.

Ultimately, while a fractional CFO can bring significant expertise and flexibility to your financial operations, it is crucial to be aware of these potential challenges. Addressing these issues proactively can lead to a more fruitful collaboration and ensure that both the business and the fractional CFO achieve optimal results together.

Conclusion: Is a Fractional CFO Right for You?

In the ever-evolving landscape of business finance, the role of a fractional CFO has emerged as a strategic asset for many companies. This specialized financial role allows organizations to access high-level financial expertise without the cost and commitment associated with hiring a full-time Chief Financial Officer. Throughout this blog, we have explored the various facets of a fractional CFO, highlighting the circumstances under which they can provide the most benefit.

For startups and small businesses facing rapid growth, a fractional CFO can deliver essential insights into cash flow management, financial forecasting, and investment strategies, enabling these businesses to navigate their initial phases with confidence and agility. Conversely, more established enterprises may benefit from contracting a fractional CFO during periods of transition, such as mergers or acquisitions, when seasoned financial leadership is paramount.

It is also crucial to assess the specific financial challenges faced by your organization. Companies dealing with complex financial structures, fluctuating revenue, or those aiming for sustained growth can often find value in the targeted support offered by a fractional CFO. Furthermore, the flexibility and scalability of a fractional engagement can cater to businesses of all sizes, providing tailored solutions that align with their unique requirements.

Ultimately, the decision to engage a fractional CFO should be driven by careful consideration of your organization’s current financial needs and long-term objectives. Evaluate how such a partnership could enhance your strategic decision-making, improve financial performance, and contribute to overall business growth. By thoroughly understanding the implications of this choice, business owners can make informed decisions that align with their financial aspirations.